Dave & Buster’s stock price has taken a beating over the past six months, shedding 32.1% of its value and falling to $35.40. This may have investors wondering how to approach the situation.

Is now the time to buy Dave & Buster's, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Even with the cheaper entry price, we're swiping left on Dave & Buster's for now. Here are three reasons why PLAY doesn't excite us and one stock we'd rather own today.

Why Do We Think Dave & Buster's Will Underperform?

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ:PLAY) operates a chain of arcades providing immersive entertainment experiences.

1. Same-Store Sales Falling Behind Peers

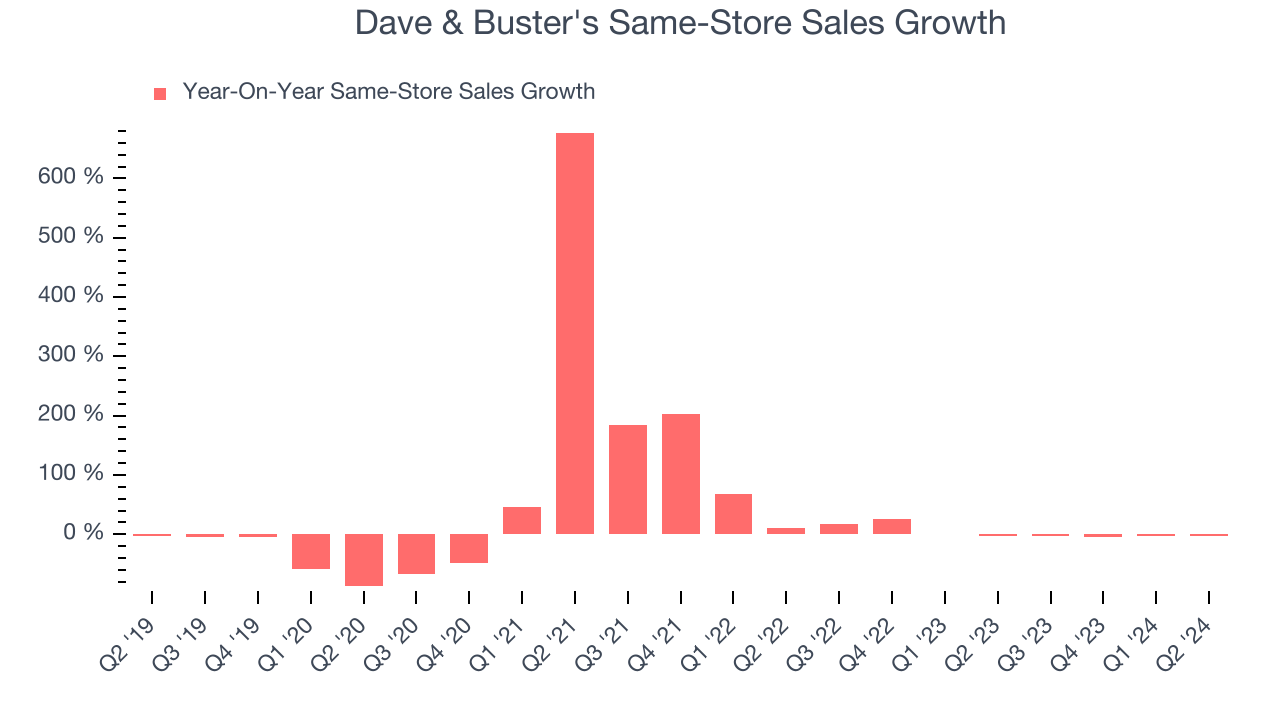

Investors interested in Leisure Facilities companies should track same-store sales in addition to reported revenue. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Dave & Buster’s underlying demand characteristics.

Over the last two years, Dave & Buster’s same-store sales averaged 3.2% year-on-year growth. This performance was underwhelming and suggests it might have to change its strategy or pricing, which can disrupt operations.

2. EPS Trending Down

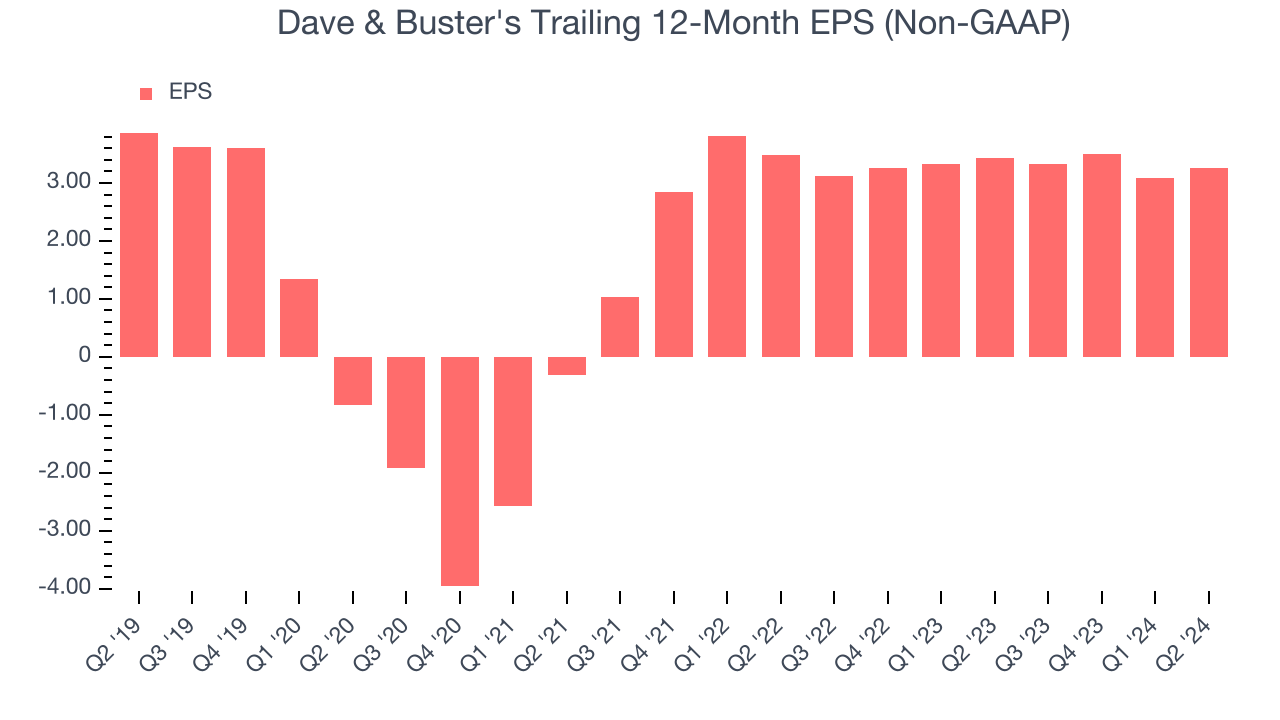

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Dave & Buster's, its EPS declined by 3.3% annually over the last five years while its revenue grew by 10.8%. This tells us the company became less profitable on a per-share basis as it expanded.

3. High Debt Levels Increase Risk

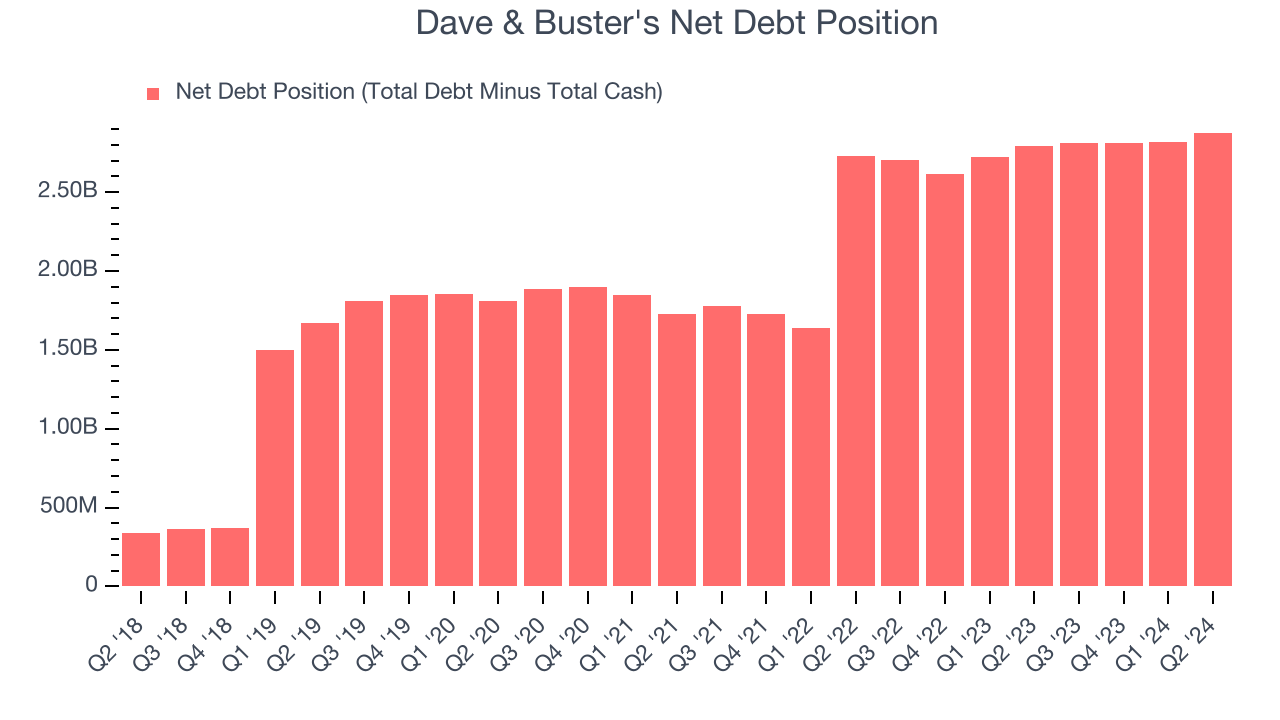

As long-term investors, the risk we care most about is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Dave & Buster’s $2.89 billion of debt exceeds the $13.1 million of cash on its balance sheet. Furthermore, its 5x net-debt-to-EBITDA ratio (based on its EBITDA of $544.1 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Dave & Buster's could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Dave & Buster's can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Dave & Buster's, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 10.7x forward price-to-earnings (or $35.40 per share). This valuation could be reasonable, but the company’s shaky fundamentals present too much downside risk. There are superior stocks to buy right now. Let us point you toward Nextracker, the market leader in utility-scale solar trackers and foundations.

Stocks We Like More Than Dave & Buster's

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.