Department store chain Dillard’s (NYSE:DDS) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, but sales fell 3.5% year on year to $1.45 billion. Its GAAP profit of $7.73 per share was 21% above analysts’ consensus estimates.

Is now the time to buy Dillard's? Find out by accessing our full research report, it’s free.

Dillard's (DDS) Q3 CY2024 Highlights:

- Revenue: $1.45 billion vs analyst estimates of $1.43 billion (1.2% beat)

- Adjusted EPS: $7.73 vs analyst estimates of $8.68 (21% beat)

- Adjusted EBITDA: $257.1 million vs analyst estimates of $184.8 million (39.2% beat)

- Gross Margin (GAAP): 43.5%, in line with the same quarter last year

- Operating Margin: 14.7%, up from 13.2% in the same quarter last year

- EBITDA Margin: 17.7%, up from 16.2% in the same quarter last year

- Free Cash Flow Margin: 10%, up from 0.6% in the same quarter last year

- Locations: 273 at quarter end, in line with the same quarter last year

- Same-Store Sales fell 4% year on year (-6% in the same quarter last year)

- Market Capitalization: $6.29 billion

Dillard’s Chief Executive Officer William T. Dillard, II stated, “While retail sales declined 4%, we focused on gross margin, reporting a respectable 44.5% of sales, while working on expense control. We reported cash and short-term investments of over $1.1 billion after repurchasing $107 million in stock. We are looking forward to welcoming our customers and serving them this holiday season.”

Company Overview

With stores located largely in the Southern and Western US, Dillard’s (NYSE:DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Department Store

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

Sales Growth

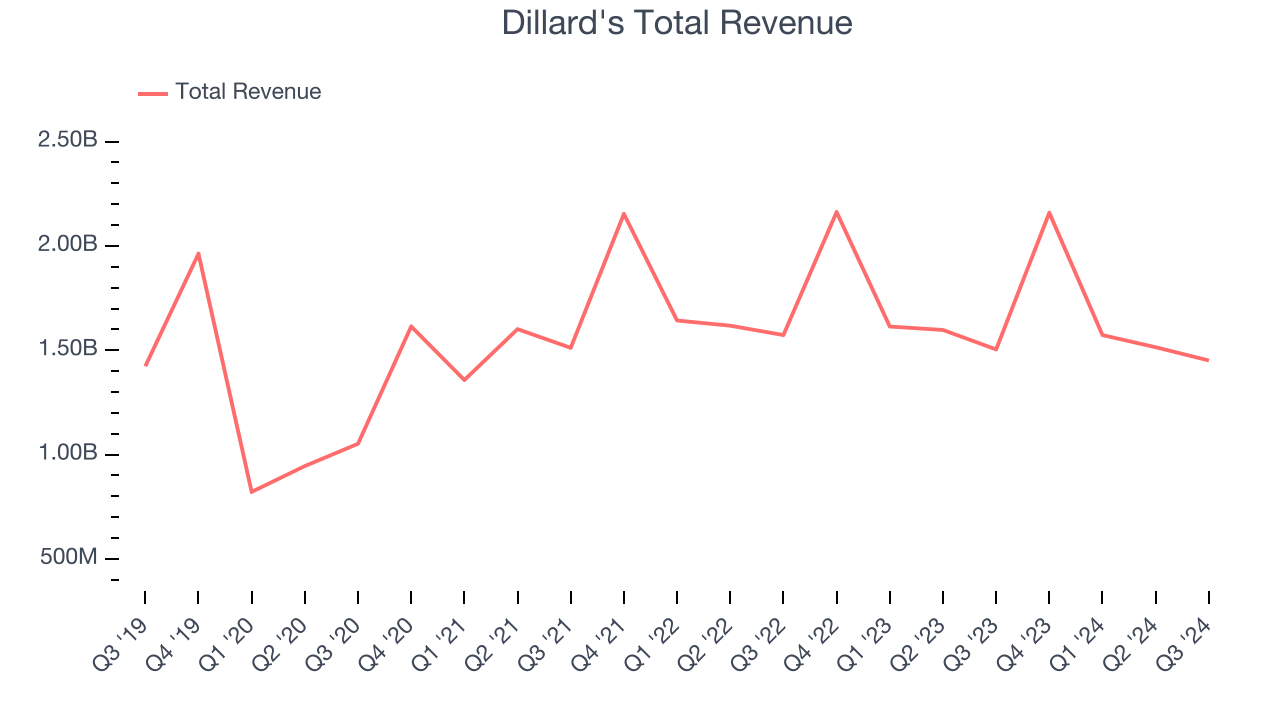

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years.

Dillard's is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Dillard’s sales were flat over the last five years (we compare to 2019 to normalize for COVID-19 impacts) because it closed stores and observed lower sales at existing, established locations.

This quarter, Dillard’s revenue fell 3.5% year on year to $1.45 billion but beat Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to decline 6.4% over the next 12 months, a deceleration versus the last five years. This projection is underwhelming and suggests its products will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

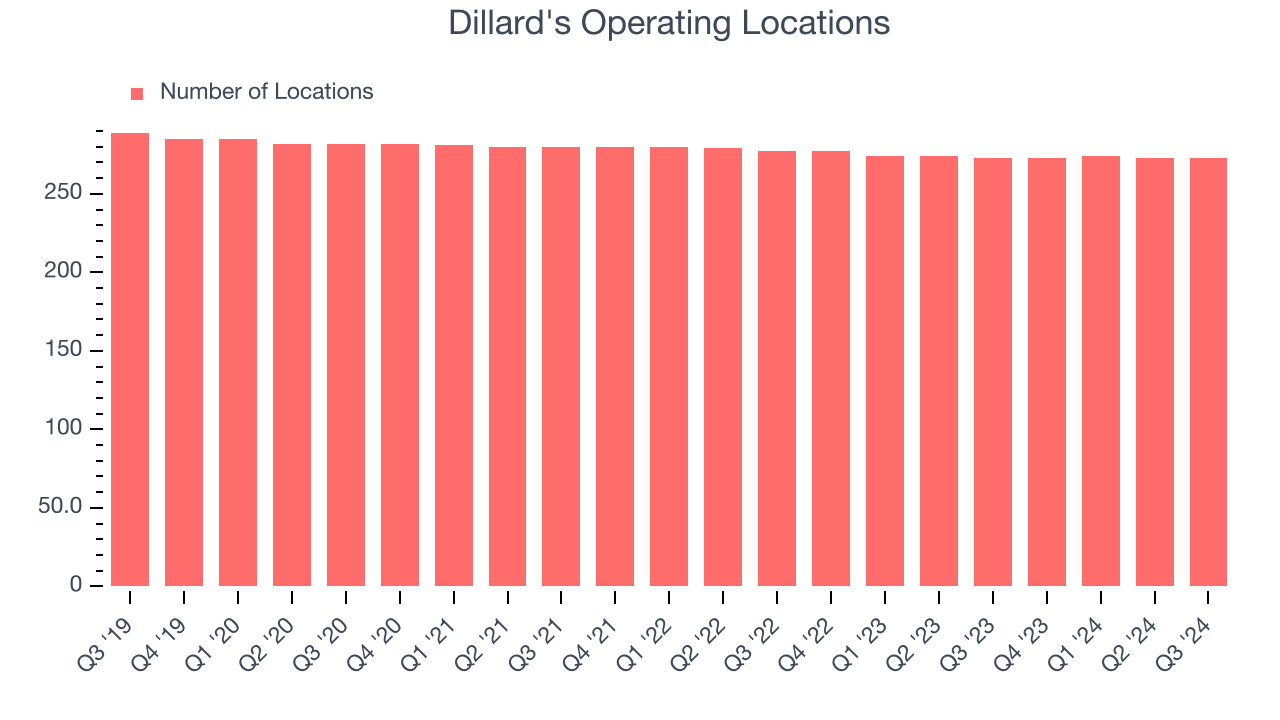

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Dillard's listed 273 locations in the latest quarter and has generally closed its stores over the last two years, averaging 1% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

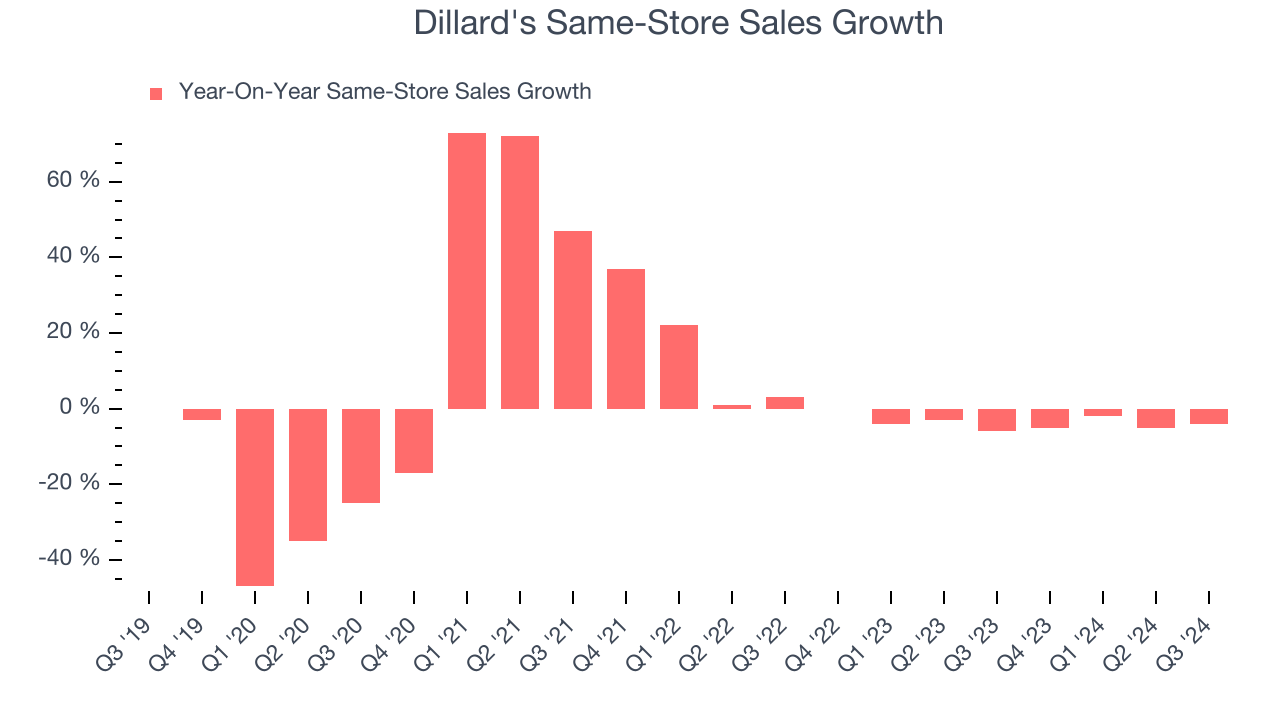

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Dillard’s demand has been shrinking over the last two years as its same-store sales have averaged 3.6% annual declines. This performance isn’t ideal, and Dillard's is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Dillard’s same-store sales fell by 4% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Dillard’s Q3 Results

We were impressed by how significantly Dillard's blew past analysts' gross margin expectations this quarter. We were also excited its EPS outperformed Wall Street's estimates. However, same-stores sales still fell, which is never good for a retailer. Zooming out, we think this was still a decent quarter. The stock is flat after reporting and currently trades at $434.45 per share.

So should you invest in Dillard's right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.