Multi-industry consumer and professional products manufacturer Griffon Corporation (NYSE:GFF) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 2.9% year on year to $659.7 million. On the other hand, the company’s full-year revenue guidance of $2.6 billion at the midpoint came in 2.3% below analysts’ estimates. Its non-GAAP profit of $1.47 per share was 24.8% above analysts’ consensus estimates.

Is now the time to buy Griffon? Find out by accessing our full research report, it’s free.

Griffon (GFF) Q3 CY2024 Highlights:

- Revenue: $659.7 million vs analyst estimates of $641.2 million (2.9% beat)

- Adjusted EPS: $1.47 vs analyst estimates of $1.18 (24.8% beat)

- Adjusted EBITDA: $137.5 million vs analyst estimates of $120.2 million (14.4% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $2.6 billion at the midpoint, missing analyst estimates by 2.3% and implying -0.9% growth (vs -2.2% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $587.5 million at the midpoint, above analyst estimates of $538.1 million

- Gross Margin (GAAP): 39.9%, in line with the same quarter last year

- Operating Margin: 16.9%, up from 15.4% in the same quarter last year

- EBITDA Margin: 20.8%

- Free Cash Flow Margin: 7.8%, down from 12.3% in the same quarter last year

- Market Capitalization: $3.35 billion

“We are very pleased with Griffon’s results for the fourth quarter and fiscal year. The consistent strong performance from the Home and Building Products (“HBP”) segment and improved profitability from the Consumer and Professional Products (“CPP”) segment positions us for further growth in the years ahead,” said Ronald J. Kramer, Chairman and Chief Executive Officer.

Company Overview

Initially in the defense industry, Griffon (NYSE:GFF) is a now diversified company specializing in home improvement, professional equipment, and building products.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Sales Growth

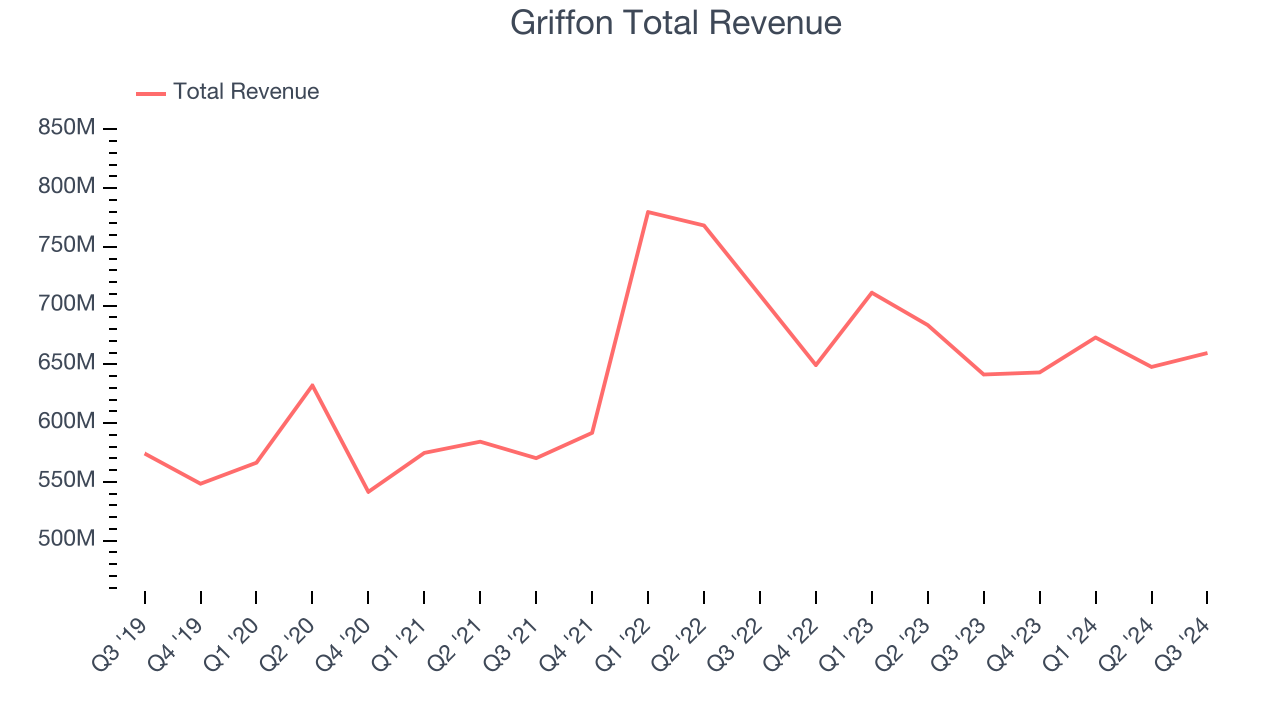

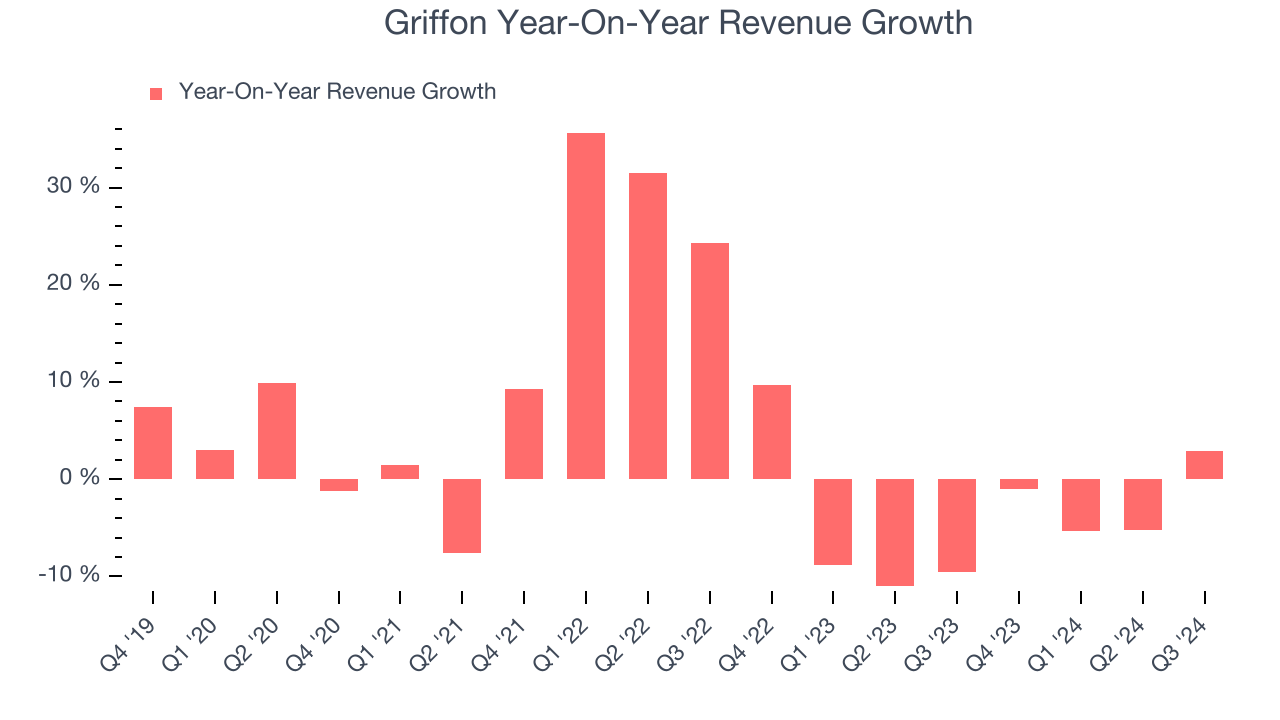

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Griffon’s 3.5% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the industrials sector, but there are still things to like about Griffon.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Griffon’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4% annually.

This quarter, Griffon reported modest year-on-year revenue growth of 2.9% but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months, an improvement versus the last two years. While this projection implies its newer products and services will catalyze better performance, it is still below the sector average. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

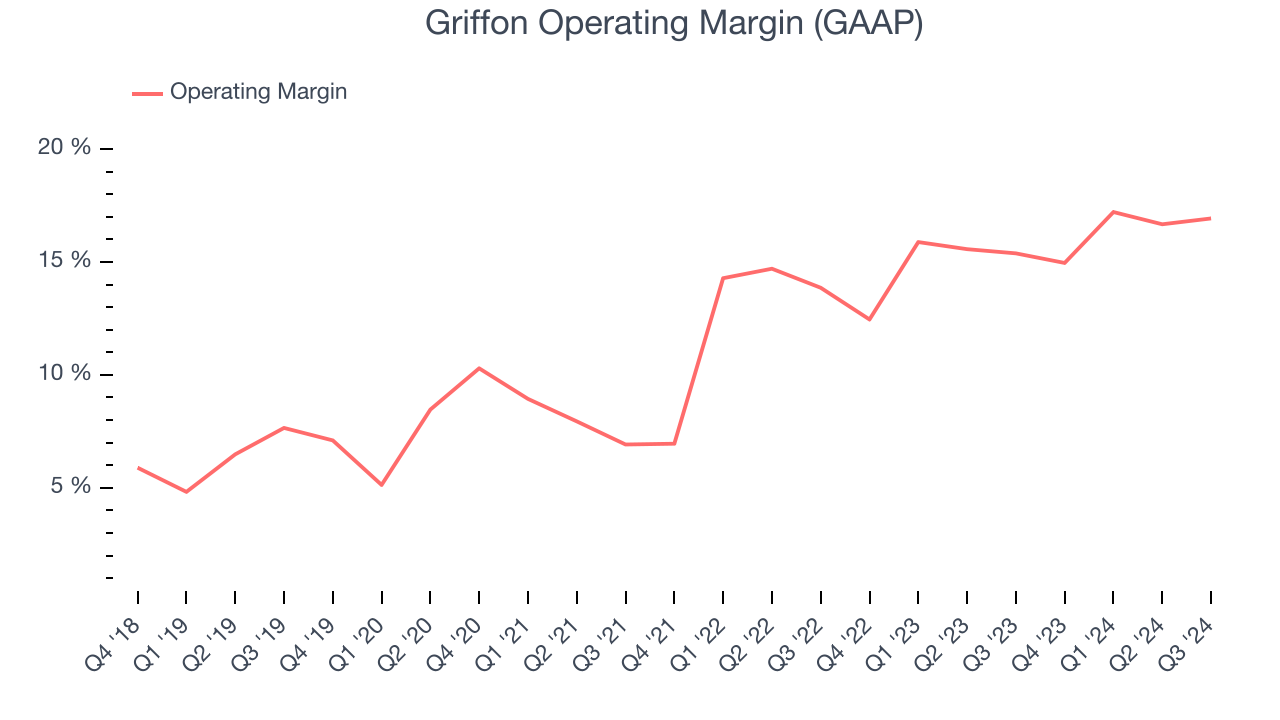

Griffon has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.4%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Griffon’s annual operating margin rose by 9.3 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q3, Griffon generated an operating profit margin of 16.9%, up 1.5 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

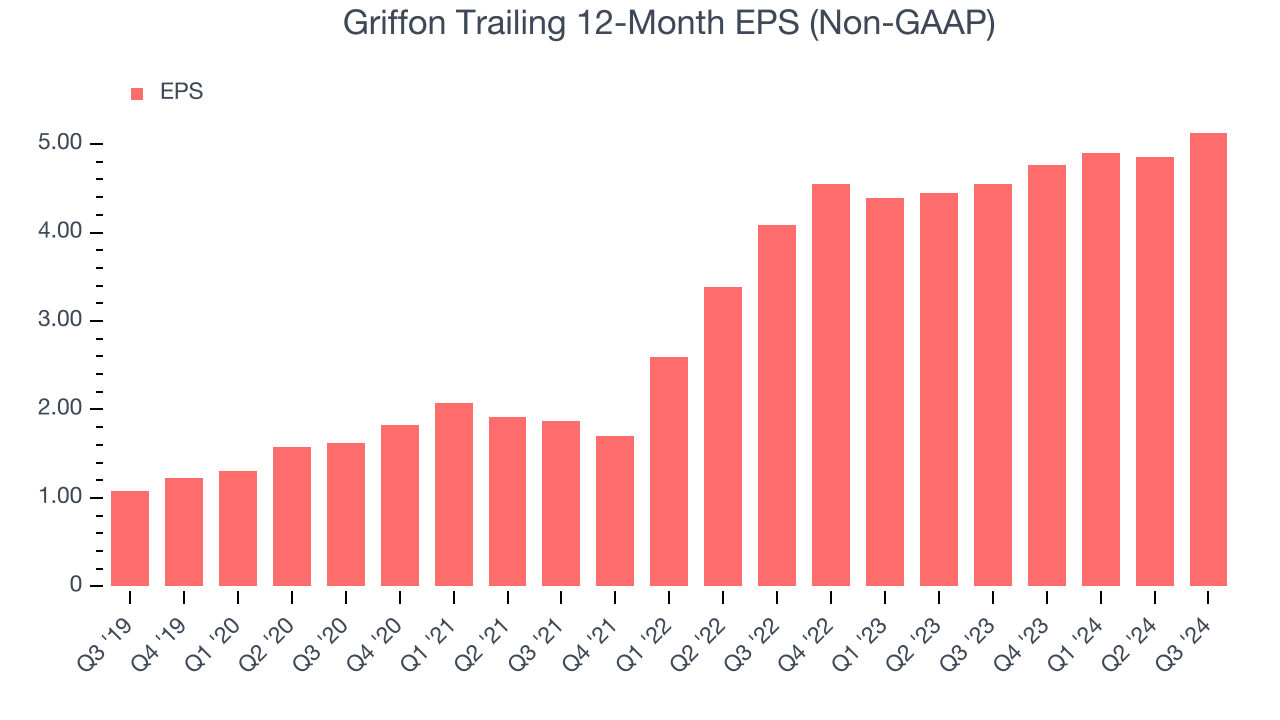

Griffon’s EPS grew at an astounding 36.6% compounded annual growth rate over the last five years, higher than its 3.5% annualized revenue growth. This tells us the company became more profitable as it expanded.

We can take a deeper look into Griffon’s earnings to better understand the drivers of its performance. As we mentioned earlier, Griffon’s operating margin expanded by 9.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Griffon, its two-year annual EPS growth of 12.1% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.In Q3, Griffon reported EPS at $1.47, up from $1.19 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Griffon’s full-year EPS of $5.13 to grow by 10.6%.

Key Takeaways from Griffon’s Q3 Results

We were impressed by how significantly Griffon blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 8.6% to $74 immediately after reporting.

Griffon had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.