Landscaping service company BrightView (NYSE:BV) announced better-than-expected revenue in Q3 CY2024, but sales fell 2% year on year to $728.7 million. The company expects the full year’s revenue to be around $2.80 billion, close to analysts’ estimates. Its non-GAAP profit of $0.30 per share was 1.8% below analysts’ consensus estimates.

Is now the time to buy BrightView? Find out by accessing our full research report, it’s free.

BrightView (BV) Q3 CY2024 Highlights:

- Revenue: $728.7 million vs analyst estimates of $723.4 million (0.7% beat)

- Adjusted EPS: $0.30 vs analyst expectations of $0.05 (1.8% miss)

- Adjusted EBITDA: $105.2 million vs analyst estimates of $105.2 million (in line)

- Management’s revenue guidance for the upcoming financial year 2025 is $2.80 billion at the midpoint, in line with analyst expectations and implying 1% growth (vs -1.6% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $345 million at the midpoint, below analyst estimates of $347.1 million

- Gross Margin (GAAP): 25%, in line with the same quarter last year

- Operating Margin: 7.1%, in line with the same quarter last year

- EBITDA Margin: 14.4%, in line with the same quarter last year

- Free Cash Flow Margin: 2.9%, down from 5.6% in the same quarter last year

- Market Capitalization: $1.74 billion

“Fourth quarter results reconfirmed the delivery of a breakout year in fiscal 2024 as we continue to transform this business. Our One BrightView culture is gaining traction, and we are positioned for fiscal 2025 to be a second consecutive record year,” said BrightView President and Chief Executive Officer Dale Asplund.

Company Overview

An official field consultant for Major League Baseball, BrightView (NYSE:BV) offers landscaping design, development, and maintenance.

Facility Services

Many facility services are non-discretionary (office building bathrooms need to be cleaned), recurring, and performed through contracts. This makes for more predictable and stickier revenue streams. However, COVID changed the game regarding commercial real estate, and office vacancies remain high as hybrid work seems here to stay. This is a headwind for demand, and facility services companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact commercial construction projects that drive incremental demand for these companies’ services.

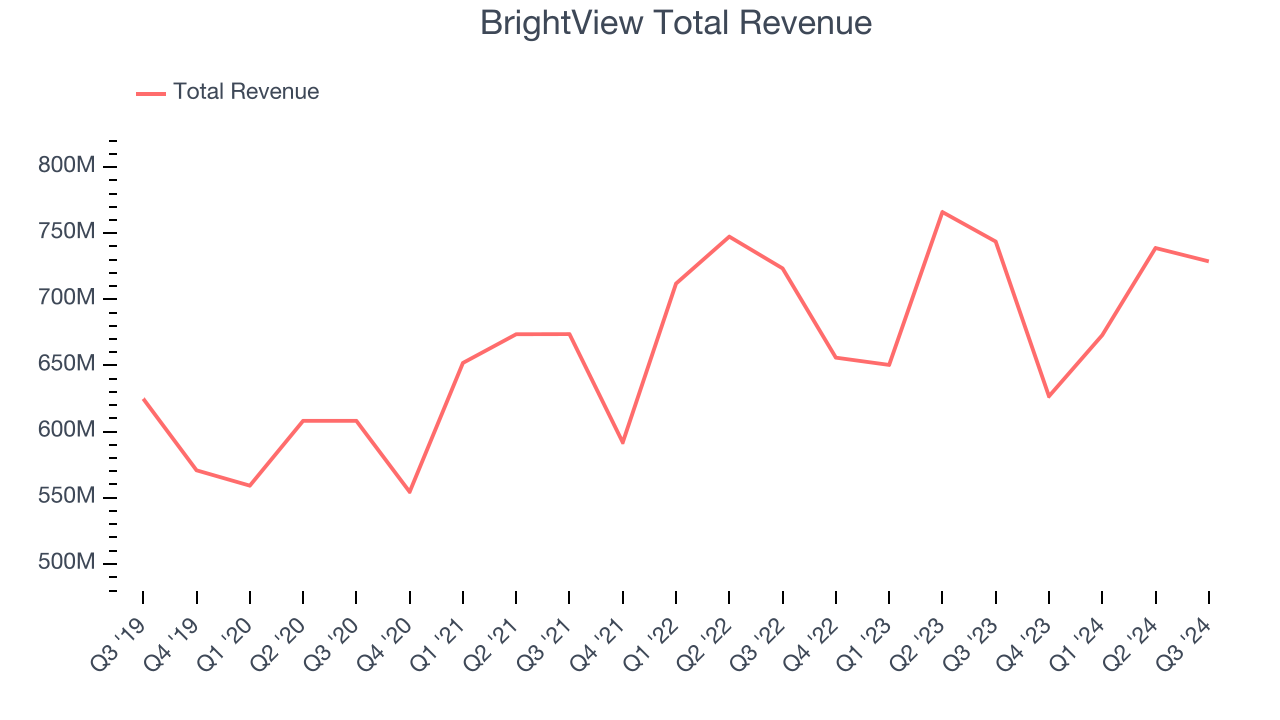

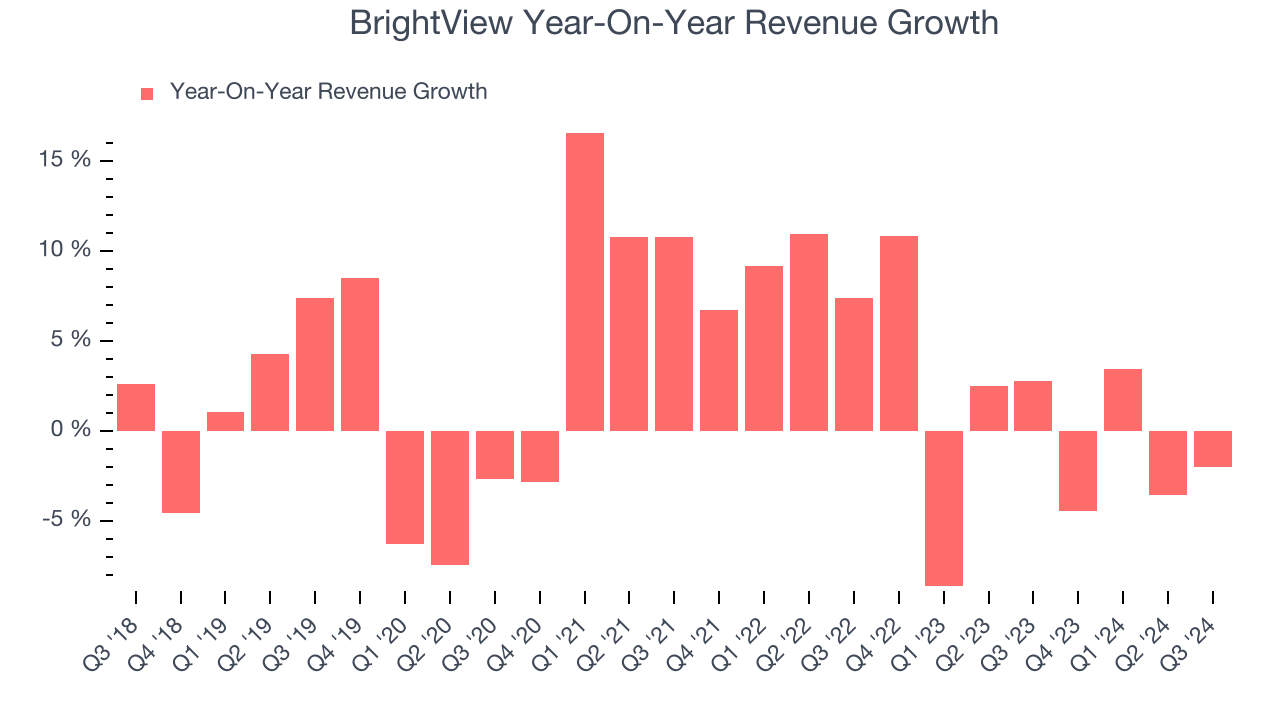

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, BrightView grew its sales at a sluggish 2.8% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. BrightView’s recent history shows its demand slowed as its revenue was flat over the last two years.

BrightView also breaks out the revenue for its most important segment, Maintenance. Over the last two years, BrightView’s Maintenance revenue (landscaping, snow removal) averaged 2.5% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, BrightView’s revenue fell 2% year on year to $728.7 million but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months, an improvement versus the last two years. Although this projection indicates its newer products and services will spur better performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

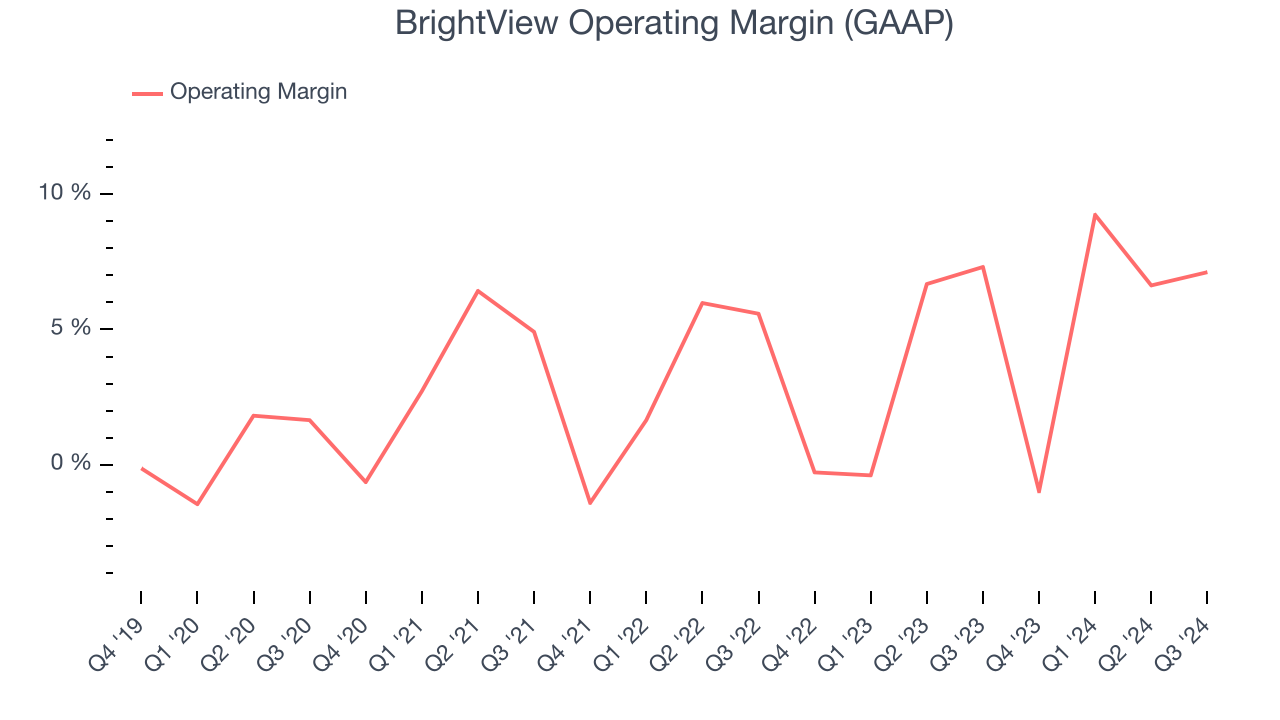

Operating Margin

BrightView was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.4% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, BrightView’s annual operating margin rose by 5.2 percentage points over the last five years.

In Q3, BrightView generated an operating profit margin of 7.1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

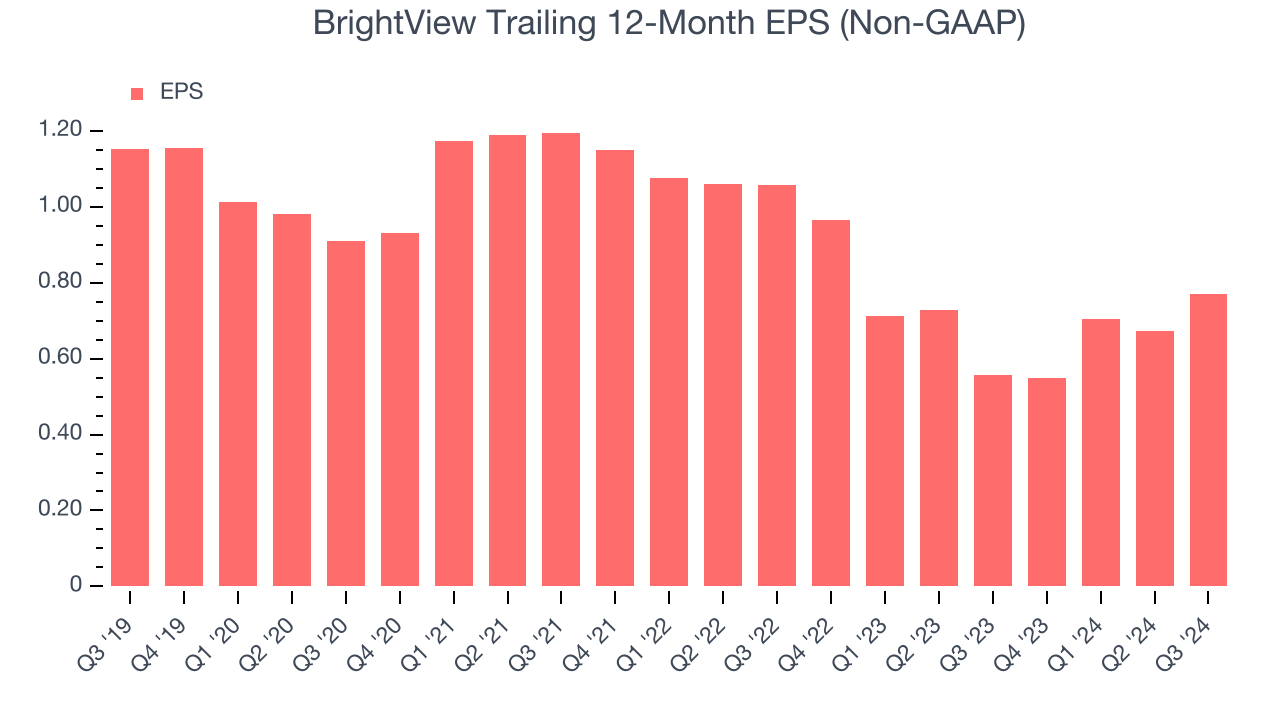

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for BrightView, its EPS declined by 7.7% annually over the last five years while its revenue grew by 2.8%. However, its operating margin actually expanded during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For BrightView, its two-year annual EPS declines of 14.6% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, BrightView reported EPS at $0.30, up from $0.20 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates. Over the next 12 months, Wall Street expects BrightView’s full-year EPS of $0.77 to grow by 12.6%.

Key Takeaways from BrightView’s Q3 Results

It was good to see BrightView narrowly top analysts’ revenue expectations this quarter. On the other hand, its Maintenance revenue missed and its EPS fell short of Wall Street’s estimates. Guidance was also mixed. Full-year revenue guidance was on line while full-year EBITDA guidance missed. Overall, this quarter had something for bulls and something for bears. The stock remained flat at $18.25 immediately after reporting.

Big picture, is BrightView a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.