E-commerce and gaming company Sea (NYSE:SE) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 30.8% year on year to $4.33 billion. Its GAAP profit of $0.24 per share was 6.9% below analysts’ consensus estimates.

Is now the time to buy Sea? Find out by accessing our full research report, it’s free.

Sea (SE) Q3 CY2024 Highlights:

- Revenue: $4.33 billion vs analyst estimates of $4.08 billion (6% beat)

- EPS: $0.24 vs analyst expectations of $0.26 (6.9% miss)

- EBITDA: $521.3 million vs analyst estimates of $483.3 million (7.9% beat)

- Gross Margin (GAAP): 43%, in line with the same quarter last year

- Operating Margin: 4.7%, up from -3.9% in the same quarter last year

- EBITDA Margin: 12%, up from 1.1% in the same quarter last year

- Paying Users: 50.2 million, up 9.7 million year on year

- Market Capitalization: $55.98 billion

“I’m happy to report that it has been another solid quarter. We are seeing high growth across all our three businesses,” said Forrest Li, Sea’s Chairman and Chief Executive Officer.

Company Overview

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Sea grew its sales at an excellent 23.1% compounded annual growth rate. Its growth beat the average consumer internet company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Sea reported wonderful year-on-year revenue growth of 30.8%, and its $4.33 billion of revenue exceeded Wall Street’s estimates by 6%.

Looking ahead, sell-side analysts expect revenue to grow 17.5% over the next 12 months, a deceleration versus the last three years. Some tapering is natural given the magnitude of its revenue base, and we still think its growth trajectory is attractive.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Paying Users

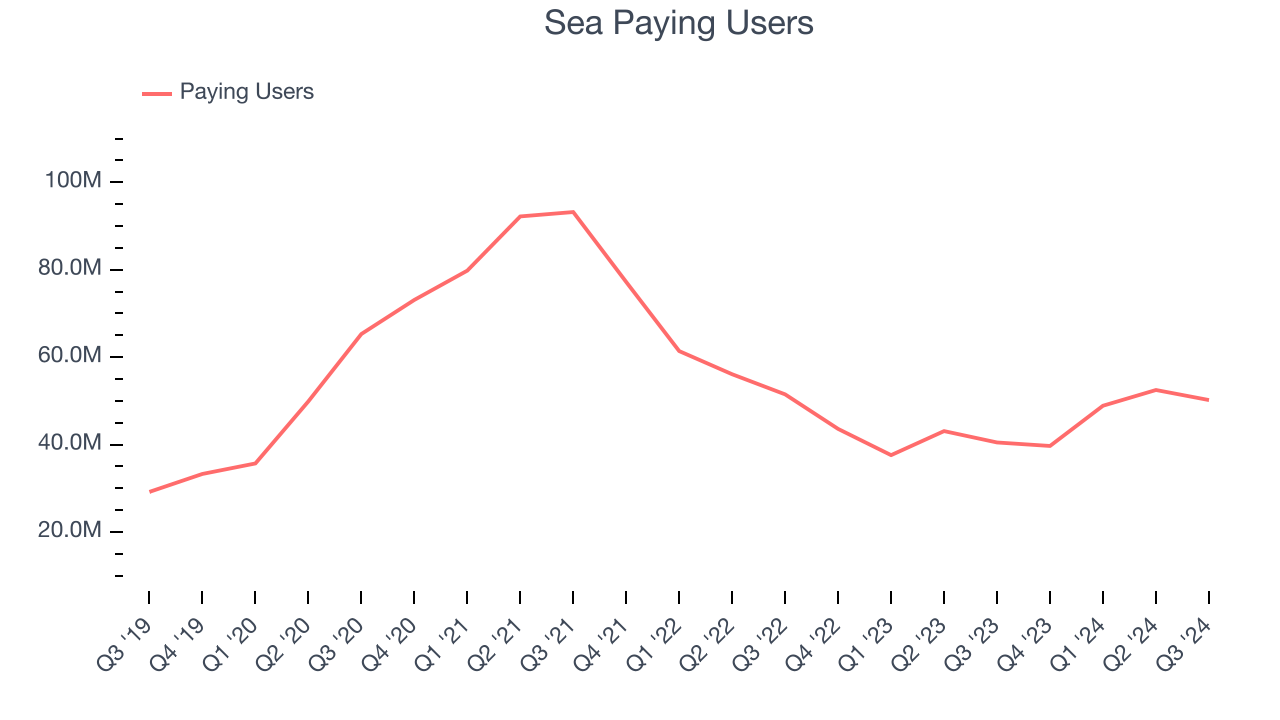

User Growth

As an online marketplace, Sea generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Sea struggled to engage its paying users over the last two years as they have declined by 7.5% annually to 50.2 million in the latest quarter. This performance isn't ideal because internet usage is secular. If Sea wants to accelerate growth, it must enhance the appeal of its current offerings or innovate with new products.

Luckily, Sea added 9.7 million paying users in Q3, leading to 24% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

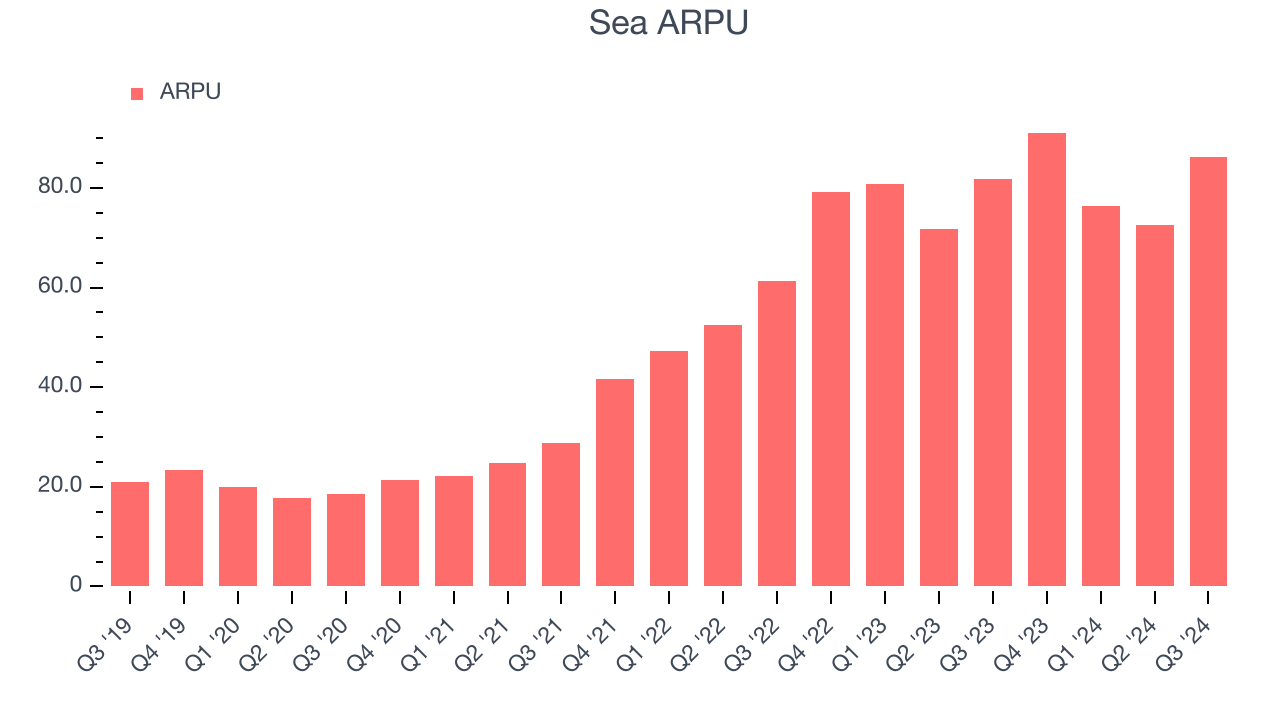

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Sea because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and Sea’s take rate, or "cut", on each order.

Sea’s ARPU growth has been exceptional over the last two years, averaging 30.9%. Although its paying users shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing users.

This quarter, Sea’s ARPU clocked in at $86.22. It grew 5.5% year on year, slower than its user growth.

Key Takeaways from Sea’s Q3 Results

We were impressed by how significantly Sea blew past analysts’ revenue and EBITDA expectations this quarter. The EBITDA beat was partly due to its lower sales and marketing expenses compared to the same quarter last year. This is sending shares higher because a key debate surrounding Sea is whether the company can hop off the treadmill of marketing spend, which used to exceed its revenue in previous years. Overall, this quarter had some key positives. The stock traded up 6.9% to $104.16 immediately after reporting.

Sure, Sea had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.