Project management software maker Monday.com (NASDAQ:MNDY) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 32.7% year on year to $251 million. The company expects next quarter’s revenue to be around $261 million, close to analysts’ estimates. Its non-GAAP profit of $0.85 per share was also 34.6% above analysts’ consensus estimates.

Is now the time to buy Monday.com? Find out by accessing our full research report, it’s free.

Monday.com (MNDY) Q3 CY2024 Highlights:

- Revenue: $251 million vs analyst estimates of $246.3 million (1.9% beat)

- Adjusted EPS: $0.85 vs analyst estimates of $0.63 (34.6% beat)

- Adjusted Operating Income: $32.18 million vs analyst estimates of $22.49 million (43.1% beat)

- Revenue Guidance for Q4 CY2024 is $261 million at the midpoint, roughly in line with what analysts were expecting

- Adj. Operating Income Guidance for Q4 CY2024 is $30 million at the midpoint, above analyst estimates

- Gross Margin (GAAP): 89.7%, up from 88.5% in the same quarter last year

- Operating Margin: -10.9%, down from -1.3% in the same quarter last year

- Free Cash Flow Margin: 32.8%, up from 21.5% in the previous quarter

- Customers: 2,907 customers paying more than $50,000 annually

- Market Capitalization: $16.17 billion

“We are very pleased with our results in Q3, with solid revenue growth and profitability, as well as improving retention trends as we continue to expand to larger customers,” said Eliran Glazer, monday.com CFO.

Company Overview

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platform that helps teams plan and track work efficiently.

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

Sales Growth

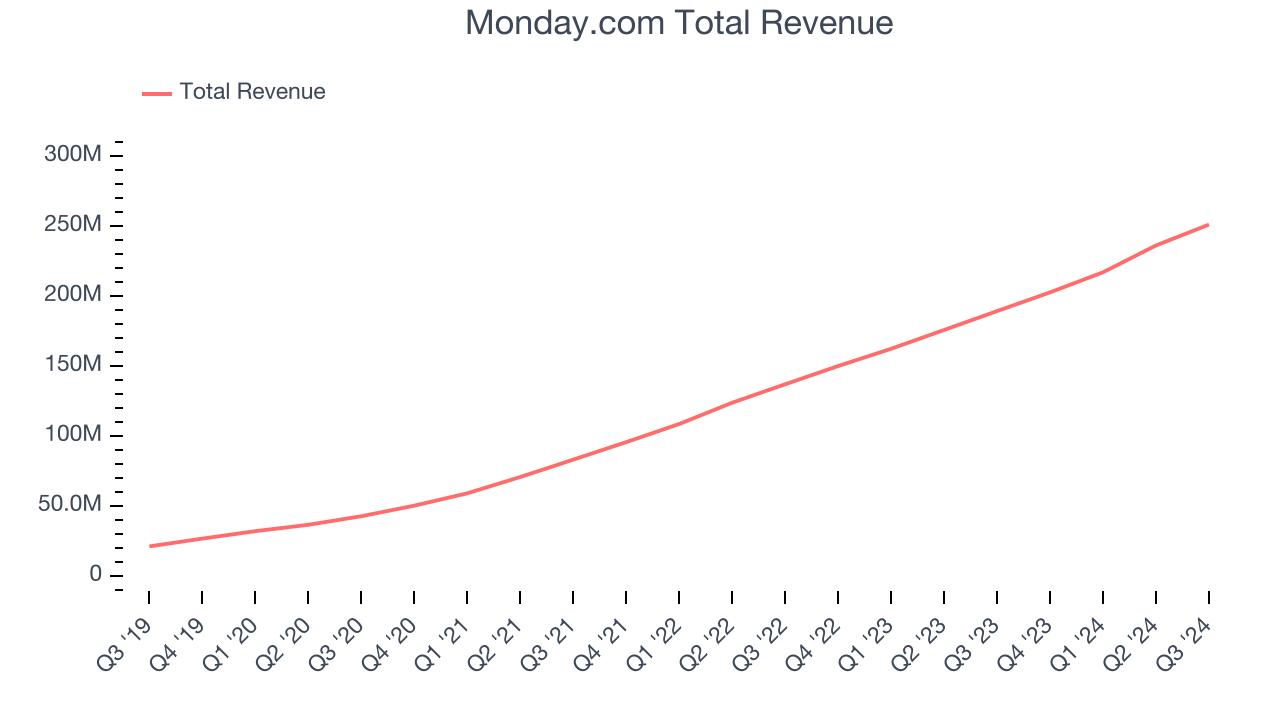

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Monday.com’s 51.1% annualized revenue growth over the last three years was incredible. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Monday.com reported wonderful year-on-year revenue growth of 32.7%, and its $251 million of revenue exceeded Wall Street’s estimates by 1.9%. Company management is currently guiding for a 28.8% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 26.7% over the next 12 months, a deceleration versus the last three years. This projection is still noteworthy and implies the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Key Takeaways from Monday.com’s Q3 Results

We enjoyed seeing Monday.com beat on revenue and adjusted operating income. Guidance for next quarter's revenue was just in line, and the market seems to be punishing the company for not guiding above. The stock traded down 13.1% to $282 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.