Communications platform-as-a-service company Bandwidth (NASDAQ: BAND) announced better-than-expected revenue in Q3 CY2024, with sales up 27.5% year on year to $193.9 million. On top of that, next quarter’s revenue guidance ($203 million at the midpoint) was surprisingly good and 7.2% above what analysts were expecting. Its non-GAAP profit of $0.43 per share was also 35.3% above analysts’ consensus estimates.

Is now the time to buy Bandwidth? Find out by accessing our full research report, it’s free.

Bandwidth (BAND) Q3 CY2024 Highlights:

- Revenue: $193.9 million vs analyst estimates of $182 million (6.5% beat)

- Adjusted EPS: $0.43 vs analyst estimates of $0.32 (35.3% beat)

- EBITDA: $23.97 million vs analyst estimates of $18.83 million (27.3% beat)

- Revenue Guidance for Q4 CY2024 is $203 million at the midpoint, above analyst estimates of $189.4 million

- EBITDA guidance for the full year is $79 million at the midpoint, above analyst estimates of $74.75 million

- Gross Margin (GAAP): 37.7%, down from 39.1% in the same quarter last year

- Operating Margin: -0.5%, up from -4% in the same quarter last year

- EBITDA Margin: 12.4%, up from 9.1% in the same quarter last year

- Free Cash Flow Margin: 7.3%, down from 10.6% in the previous quarter

- Market Capitalization: $514.3 million

"We're pleased to report solid momentum carrying us into the end of the year, with record revenue and profitability performance, strong conversion to free cash flow and continued operating discipline," said David Morken, CEO of Bandwidth.

Company Overview

Started in 1999 by David Morken who was later joined by Henry Kaestner as co-founder in 2001, Bandwidth (NASDAQ:BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

Communications Platform

The first shift towards voice communication over the internet (VOIP), rather than traditional phone networks, happened when the enterprises started replacing business phones with the cheaper VOIP technology. Today, the rise of the consumer internet has increased the need for two way audio and video functionality in applications, driving demand for software tools and platforms that enable this utility.

Sales Growth

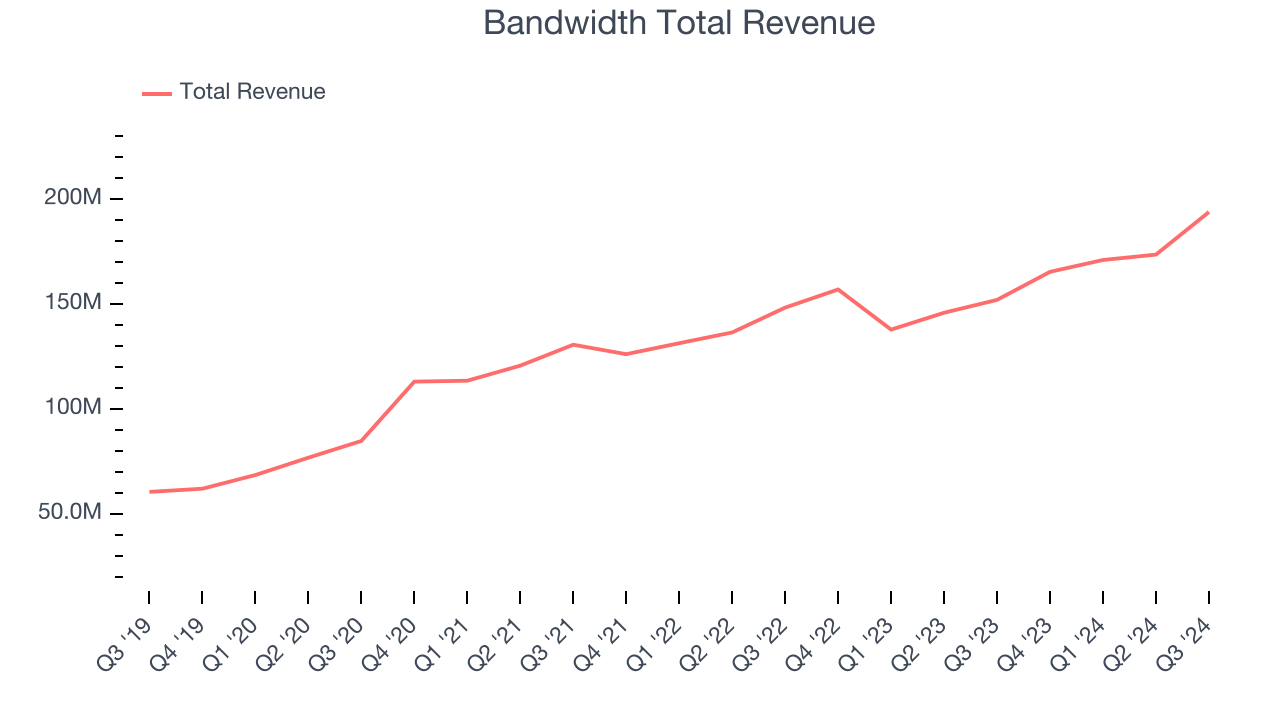

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Bandwidth’s 13.8% annualized revenue growth over the last three years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Bandwidth reported robust year-on-year revenue growth of 27.5%, and its $193.9 million of revenue topped Wall Street estimates by 6.5%. Management is currently guiding for a 22.7% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and shows the market believes its products and services will see some demand headwinds.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Customer Acquisition Efficiency

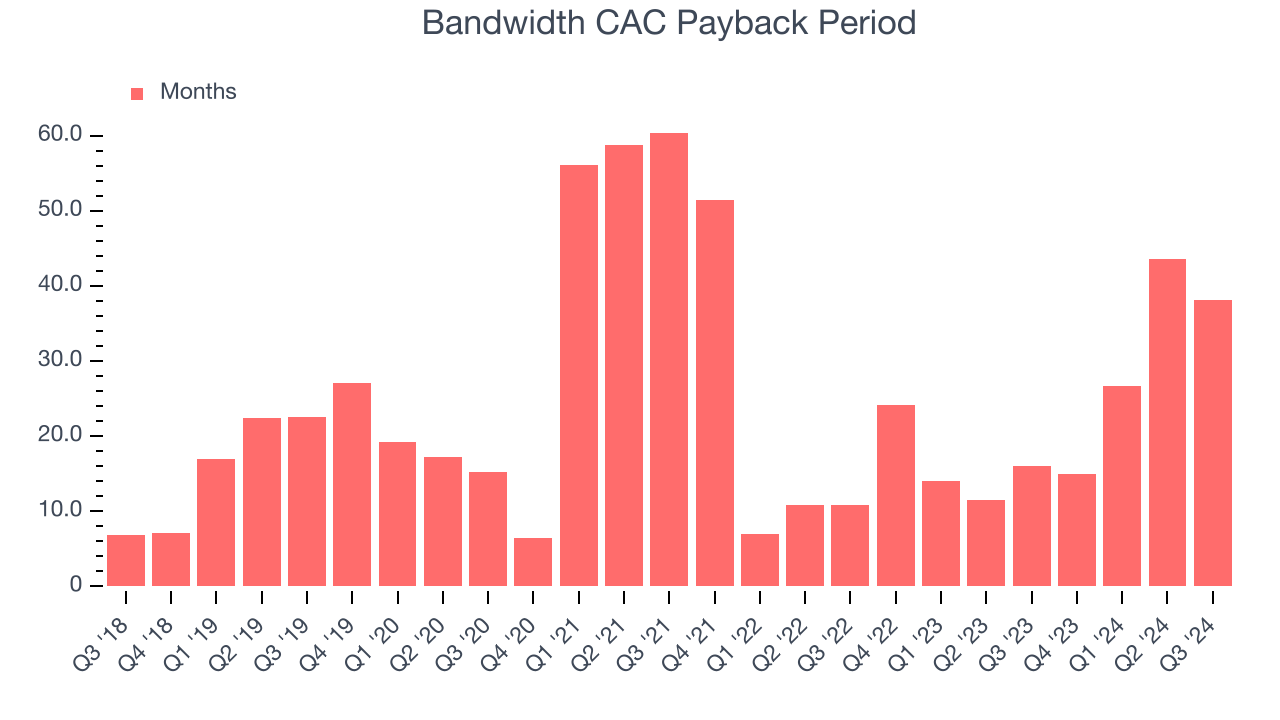

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Bandwidth is efficient at acquiring new customers, and its CAC payback period checked in at 38.2 months this quarter. The company’s performance indicates relatively solid competitive positioning, giving it the freedom to invest its resources into new growth initiatives.

Key Takeaways from Bandwidth’s Q3 Results

We were impressed by how significantly Bandwidth blew past analysts’ revenue and EBITDA expectations this quarter. We were also glad it raised its full-year revenue and EBITDA guidance. Zooming out, we think this was a good "beat and raise" quarter with some key areas of upside. The stock traded up 6.1% to $20 immediately after reporting.

Bandwidth may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.