Specialty flooring retailer Floor & Decor (NYSE:FND) fell short of the market’s revenue expectations in Q3 CY2024, with sales flat year on year at $1.12 billion. The company’s full-year revenue guidance of $4.42 billion at the midpoint also came in slightly below analysts’ estimates. Its GAAP profit of $0.48 per share was 12.7% above analysts’ consensus estimates.

Is now the time to buy Floor And Decor? Find out by accessing our full research report, it’s free.

Floor And Decor (FND) Q3 CY2024 Highlights:

- Revenue: $1.12 billion vs analyst estimates of $1.14 billion (1.7% miss)

- EPS: $0.48 vs analyst estimates of $0.43 (12.7% beat)

- EBITDA: $132.9 million vs analyst estimates of $128.2 million (3.6% beat)

- The company dropped its revenue guidance for the full year to $4.42 billion at the midpoint from $4.45 billion, a 0.7% decrease

- EPS (GAAP) guidance for the full year is $1.70 at the midpoint, beating analyst estimates by 2.4%

- EBITDA guidance for the full year is $495 million at the midpoint, above analyst estimates of $488.1 million

- Gross Margin (GAAP): 43.5%, in line with the same quarter last year

- Operating Margin: 5.9%, down from 7.7% in the same quarter last year

- EBITDA Margin: 11.9%, in line with the same quarter last year

- Free Cash Flow Margin: 3.3%, down from 7.9% in the same quarter last year

- Locations: 241 at quarter end, up from 207 in the same quarter last year

- Market Capitalization: $10.73 billion

Tom Taylor, Chief Executive Officer, stated, “We are incredibly proud of how our store and store support teams executed our plans and managed costs during a period when demand for large project discretionary home improvement and hard surface flooring spending remained challenging. In the face of these challenges, the hard work and dedication of our associates enabled us to deliver fiscal 2024 third quarter diluted earnings per share of $0.48, which exceeded our expectations. We continue implementing and executing strategies designed to grow our market share while working prudently to manage our profitability and maintain a strong balance sheet in this challenging period. I particularly want to thank our associates affected by the recent hurricanes for their hard work and dedication to their communities. Thanks to their efforts, we quickly reopened our stores to begin serving customers affected by the hurricanes as they began their recovery and rebuilding efforts.”

Company Overview

Operating large, warehouse-style stores, Floor & Decor (NYSE:FND) is a specialty retailer that specializes in hard flooring surfaces for the home such as tiles, hardwood, stone, and laminates.

Home Improvement Retailer

Home improvement retailers serve the maintenance and repair needs of do-it-yourself homeowners as well as professional contractors. Home is where the heart is, so any homeowner will want to keep that home in good shape by maintaining the yard, fixing leaks, or improving lighting fixtures, for example. Home improvement stores win with depth and breadth of product, in-store consultations for customers who need help, and services that cater to professionals. It is hard for non-focused retailers and e-commerce competitors to match these. However, the research, convenience, and prices of online platforms means they can’t be fully written off, either.

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Floor And Decor is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

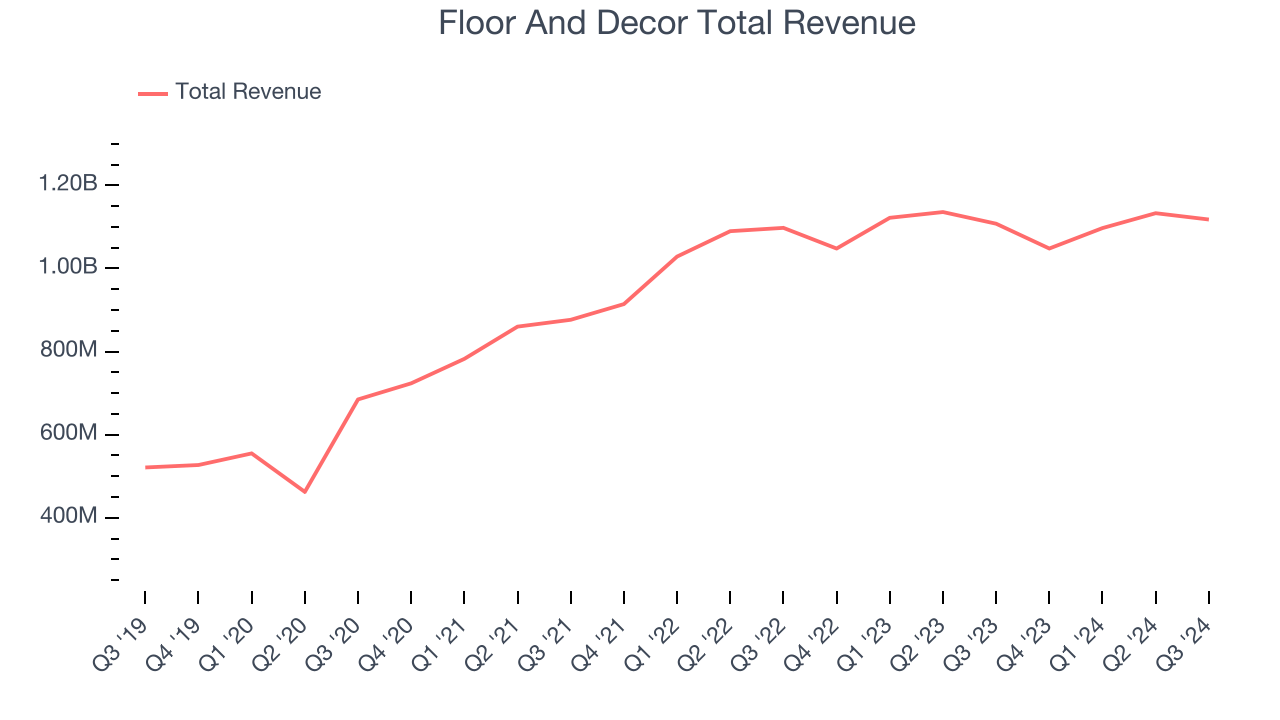

As you can see below, Floor And Decor grew its sales at an excellent 17.6% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and expanded its reach.

This quarter, Floor And Decor’s $1.12 billion of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, a deceleration versus the last five years. Still, this projection is admirable and illustrates the market sees success for its products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

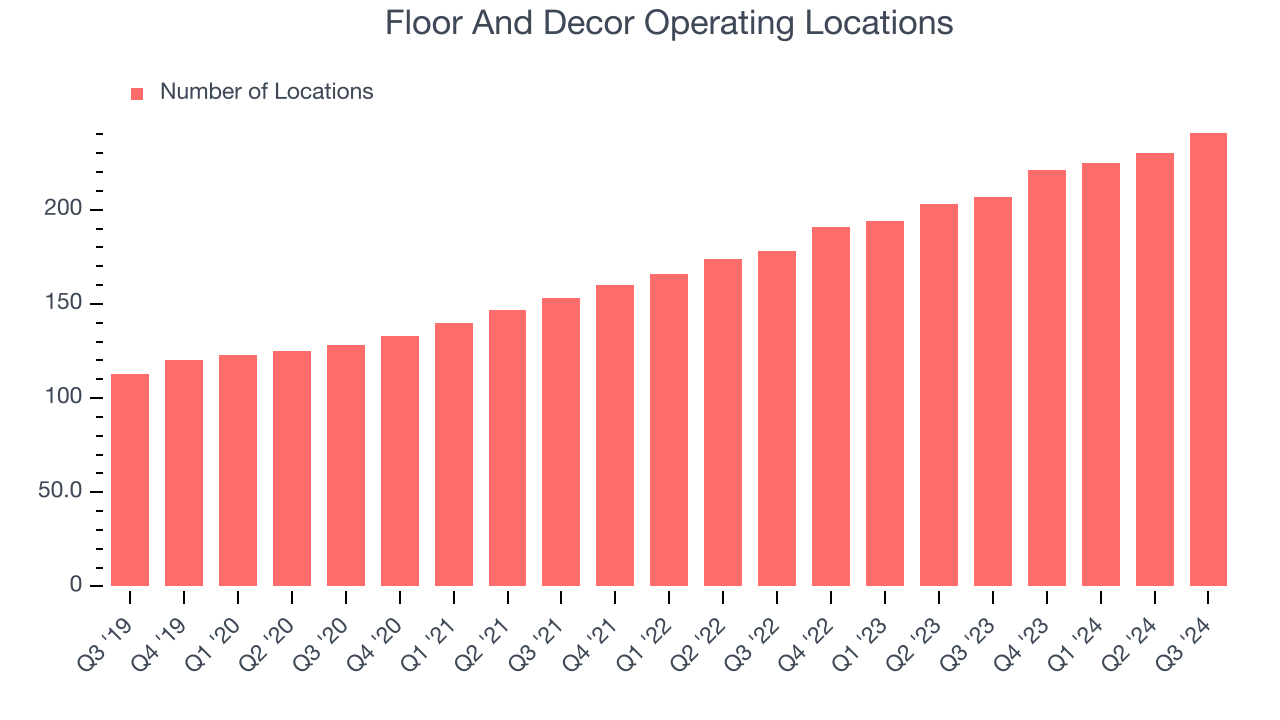

A retailer’s store count often determines how much revenue it can generate.

Floor And Decor operated 241 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years and averaged 16.3% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

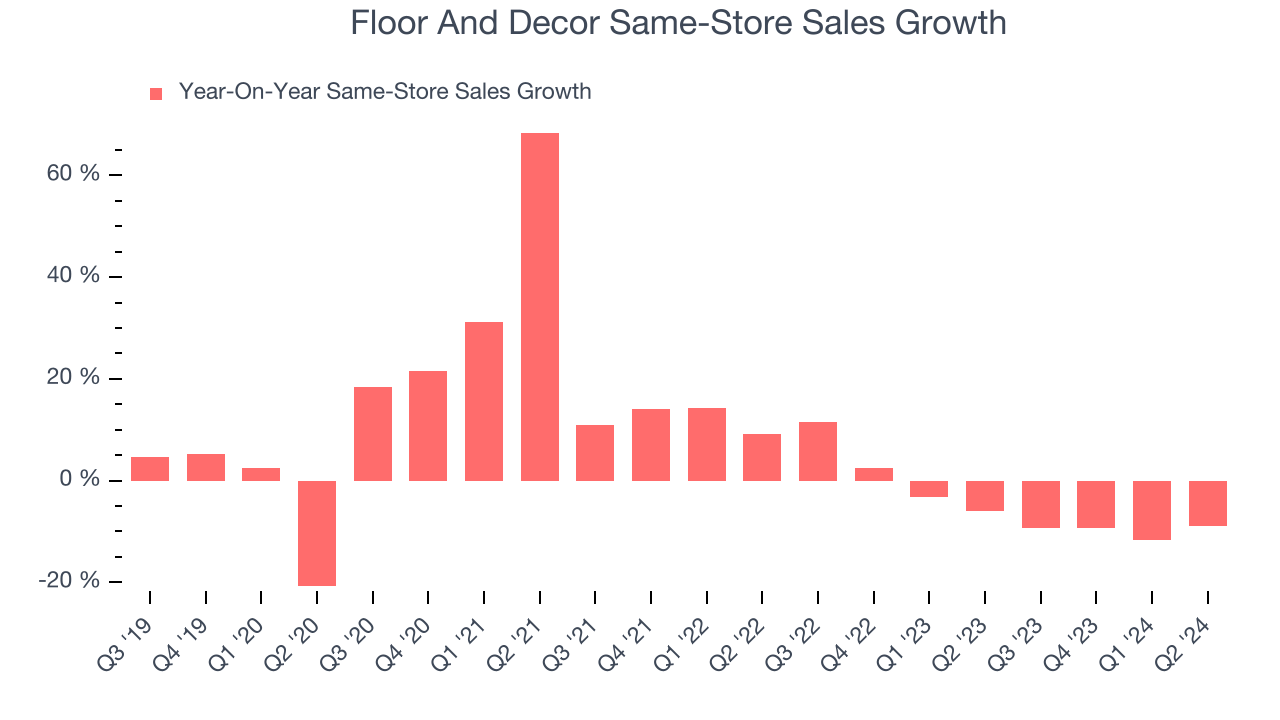

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Floor And Decor’s demand has been shrinking over the last two years as its same-store sales have averaged 6.6% annual declines. This performance is concerning - it shows Floor And Decor artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

Note that Floor And Decor reports its same-store sales intermittently, so some data points are missing in the chart below.

Key Takeaways from Floor And Decor’s Q3 Results

This quarter was a story of good profitability but weaker sales - FND beat analysts’ EBITDA and EPS expectations but missed on revenue. Its full-year guidance also beat Wall Street’s EPS and EBITDA estimates while revenue fell short. Overall, this quarter was mixed but still had some key positives. The stock remained flat at $99.99 immediately following the results.

Is Floor And Decor an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.