Stock photography and footage provider Shutterstock (NYSE:SSTK) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 7.4% year on year to $250.6 million. The company expects the full year’s revenue to be around $937.5 million, close to analysts’ estimates. Its non-GAAP profit of $1.31 per share was also 16.3% above analysts’ consensus estimates.

Is now the time to buy Shutterstock? Find out by accessing our full research report, it’s free.

Shutterstock (SSTK) Q3 CY2024 Highlights:

- Revenue: $250.6 million vs analyst estimates of $240.8 million (4.1% beat)

- Adjusted EPS: $1.31 vs analyst estimates of $1.13 (16.3% beat)

- EBITDA: $70 million vs analyst estimates of $64.25 million (8.9% beat)

- The company slightly lifted its revenue guidance for the full year to $937.5 million at the midpoint from $931.5 million

- Management slightly raised its full-year Adjusted EPS guidance to $4.27 at the midpoint

- EBITDA guidance for the full year is $248.5 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 58.3%, down from 60% in the same quarter last year

- Operating Margin: 7.2%, in line with the same quarter last year

- EBITDA Margin: 27.9%, in line with the same quarter last year

- Free Cash Flow Margin: 18.2%, up from 8.6% in the previous quarter

- Paid Downloads: 32.9 million, down 3.5 million year on year

- Market Capitalization: $1.05 billion

Commenting on the Company's performance, Paul Hennessy, the Company's Chief Executive Officer, said, "Shutterstock generated record Revenue and Adjusted EBITDA during the third quarter, exceeding our expectations. With the Envato acquisition now closed, we could not be more pleased with the results we are seeing. With the unlimited multi-asset subscription now part of our overall product suite, we are now well positioned to fulfill our customer needs. Content performance improved yet again in the quarter, and Data, Distribution, and Services has grown 40% year to date. As a result of this business momentum, we are pleased to be able to raise our guidance for both revenue and Adjusted EBITDA for 2024."

Company Overview

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE:SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

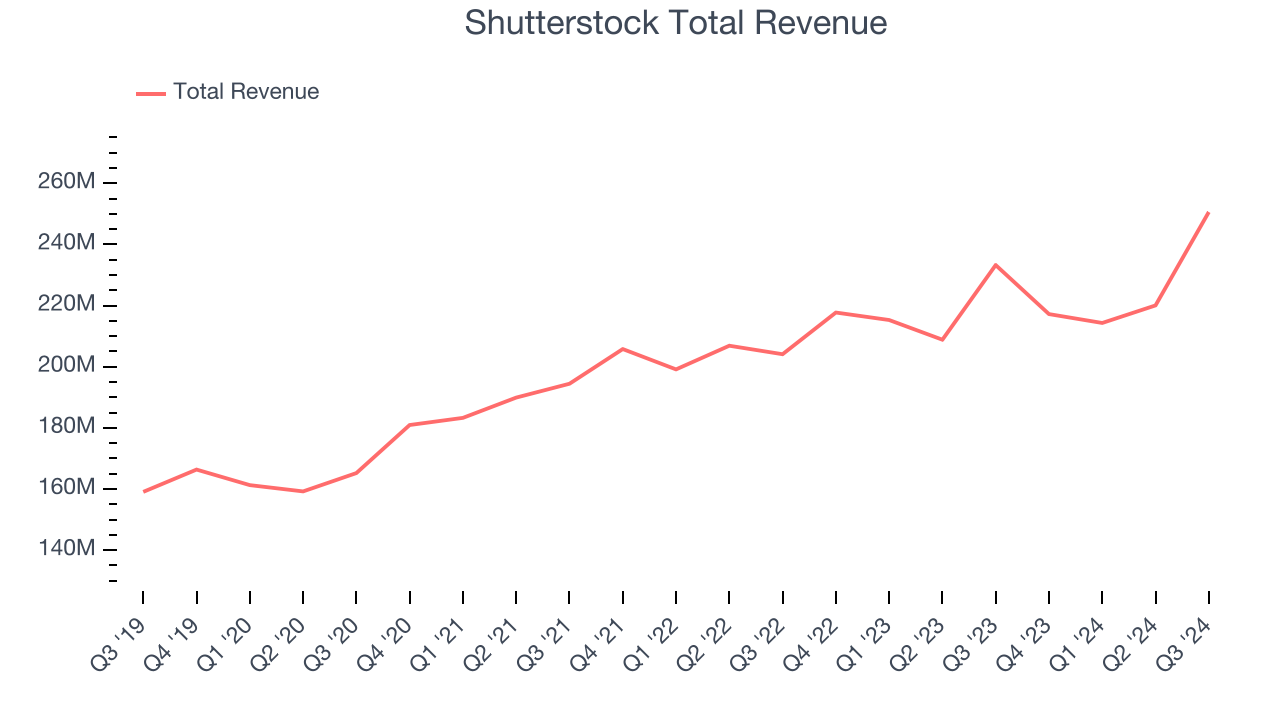

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Shutterstock grew its sales at a tepid 6.4% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Shutterstock reported year-on-year revenue growth of 7.4%, and its $250.6 million of revenue exceeded Wall Street’s estimates by 4.1%.

Looking ahead, sell-side analysts expect revenue to grow 15.8% over the next 12 months, an acceleration versus the last three years. This projection is healthy and illustrates the market believes its newer products and services will catalyze higher growth rates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Requests

Request Growth

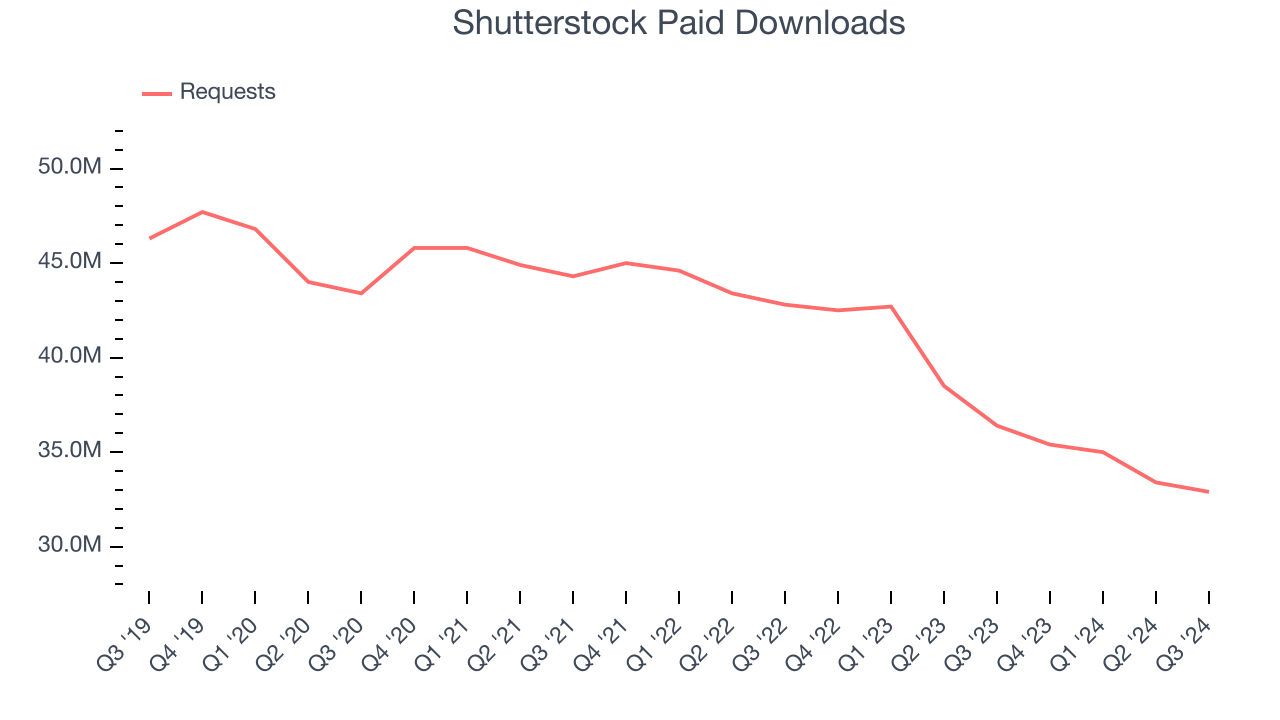

As an online marketplace, Shutterstock generates revenue growth by increasing both the number of requests on its platform and the average order size in dollars.

Shutterstock struggled to engage its service requests over the last two years as they have declined by 11.7% annually to 32.9 million in the latest quarter. This performance isn't ideal because internet usage is secular. If Shutterstock wants to accelerate growth, it must enhance the appeal of its current offerings or innovate with new products.

In Q3, Shutterstock’s service requests once again decreased by 3.5 million, a 9.6% drop since last year. On the bright side, the quarterly print was higher than its two-year result and suggests its new initiatives are accelerating request growth.

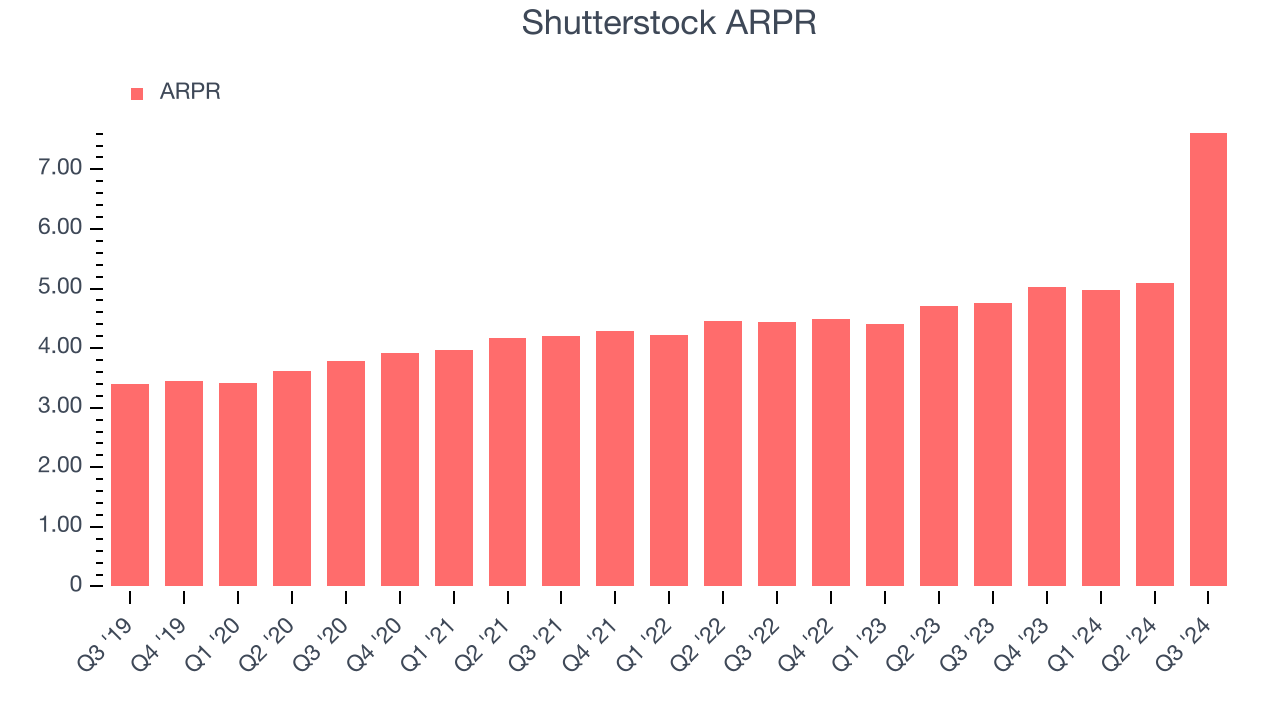

Revenue Per Request

Average revenue per request (ARPR) is a critical metric to track for consumer internet businesses like Shutterstock because it measures how much the company earns in transaction fees from each request. ARPR also gives us unique insights into a user’s average order size and Shutterstock’s take rate, or "cut", on each order.

Shutterstock’s ARPR growth has been exceptional over the last two years, averaging 14.4%. Although its service requests shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing requests.

This quarter, Shutterstock’s ARPR clocked in at $7.62. It grew 60% year on year, faster than its service requests.

Key Takeaways from Shutterstock’s Q3 Results

We were impressed by how significantly Shutterstock blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Looking ahead, full year revenue and EPS guidance were both raised, which is always encouraging. Overall, this quarter was solid. The stock traded up 3.5% to $30.55 immediately after reporting.

So should you invest in Shutterstock right now?We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.