Aerospace and defense company Boeing (NYSE:BA) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 1.5% year on year to $17.84 billion. Its non-GAAP loss of $10.44 per share was 18.3% below analysts’ consensus estimates.

Is now the time to buy Boeing? Find out by accessing our full research report, it’s free.

Boeing (BA) Q3 CY2024 Highlights:

- Revenue: $17.84 billion vs analyst estimates of $17.94 billion (in line)

- Adjusted EPS: -$10.44 vs analyst estimates of -$8.82

- Boeing’s new CEO Kelly Ortberg said the company must focus on its core business; Boeing’s more than 32,000 striking machinists will also vote on a new contract proposal on Wednesday that could end a more than five-week work stoppage

- EBITDA: -$5.01 billion vs analyst estimates of -$4.01 billion (24.8% miss)

- Gross Margin (GAAP): -19.7%, down from 8.8% in the same quarter last year

- EBITDA Margin: -28.1%, down from -3.4% in the same quarter last year

- Free Cash Flow was -$1.96 billion compared to -$310 million in the same quarter last year

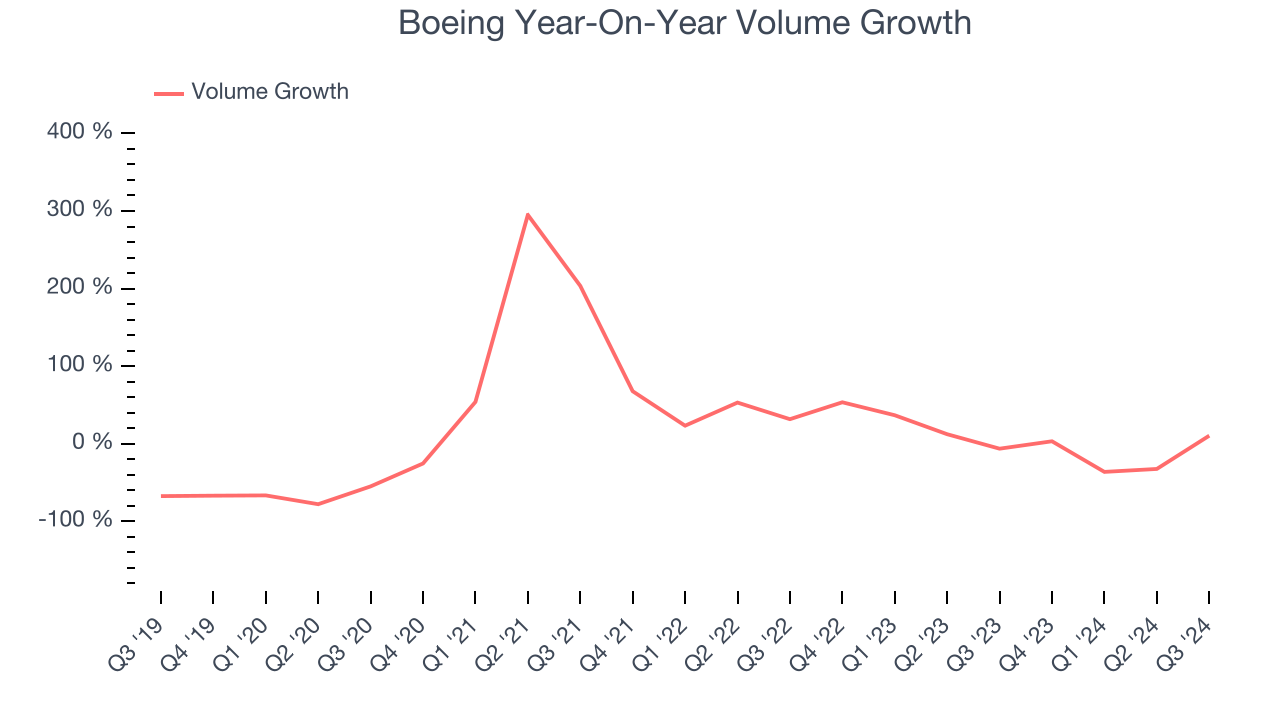

- Sales Volumes rose 10.5% year on year (-6.3% in the same quarter last year)

- Market Capitalization: $98.51 billion

"It will take time to return Boeing to its former legacy, but with the right focus and culture, we can be an iconic company and aerospace leader once again," said Kelly Ortberg, Boeing President and Chief Executive Officer.

Company Overview

One of the companies that forms a duopoly in the commercial aircraft market, Boeing (NYSE:BA) develops, manufactures, and services commercial airplanes, defense products, and space systems.

Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

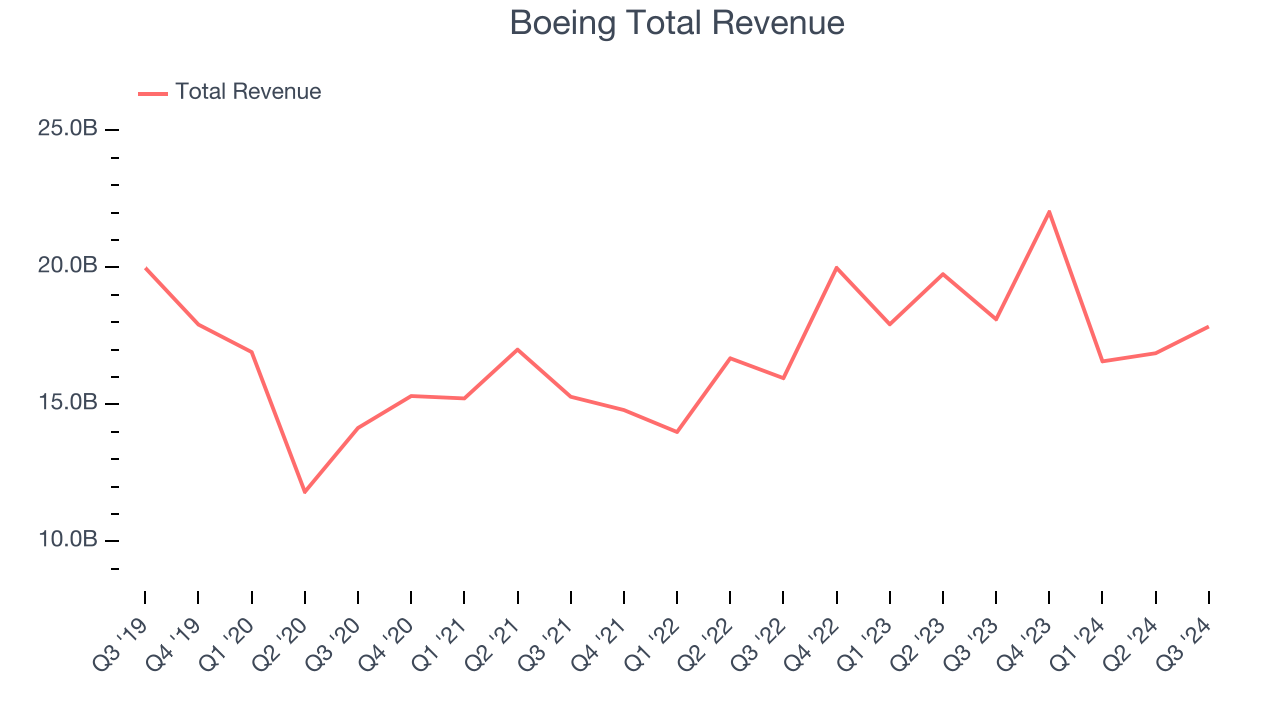

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Boeing’s demand was weak over the last five years as its sales fell by 3.4% annually, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Boeing’s annualized revenue growth of 9.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its sales volumes, which reached 116 in the latest quarter. Over the last two years, Boeing’s sales volumes averaged 5.2% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Boeing reported a rather uninspiring 1.5% year-on-year revenue decline to $17.84 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 14.8% over the next 12 months, an acceleration versus the last two years. This projection is noteworthy and indicates the market thinks its newer products and services will fuel higher growth rates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

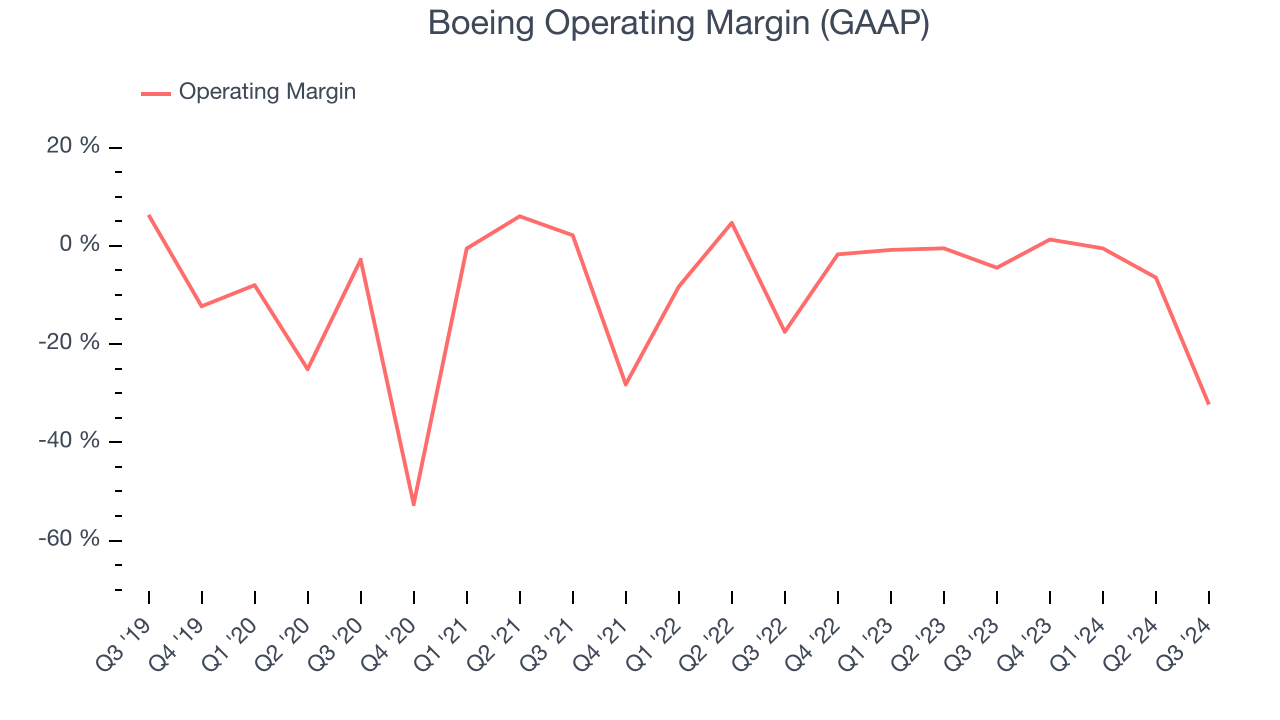

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

On the bright side, Boeing’s annual operating margin rose by 2.3 percentage points over the last five years.

This quarter, Boeing generated an operating profit margin of negative 32.3%, down 27.8 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

Earnings Per Share

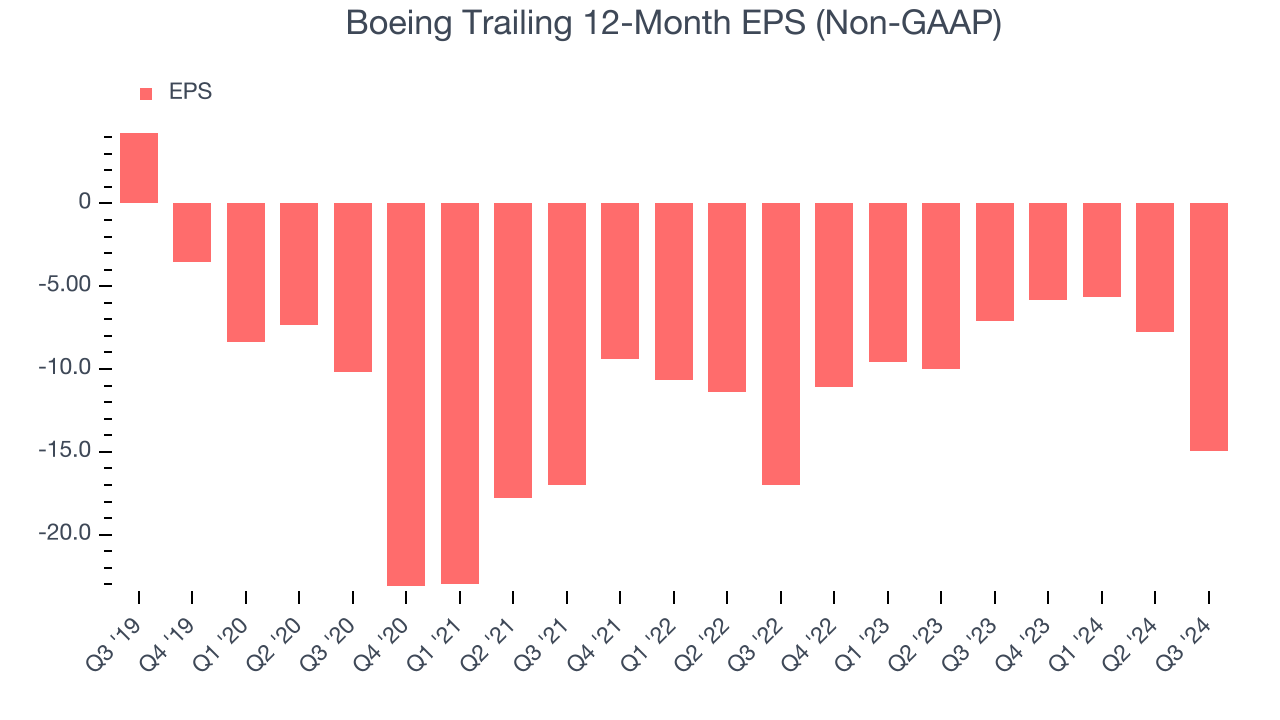

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for Boeing, its EPS by declined more than its revenue over the last five years, dropping 40.6% annually. However, its operating margin actually expanded during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

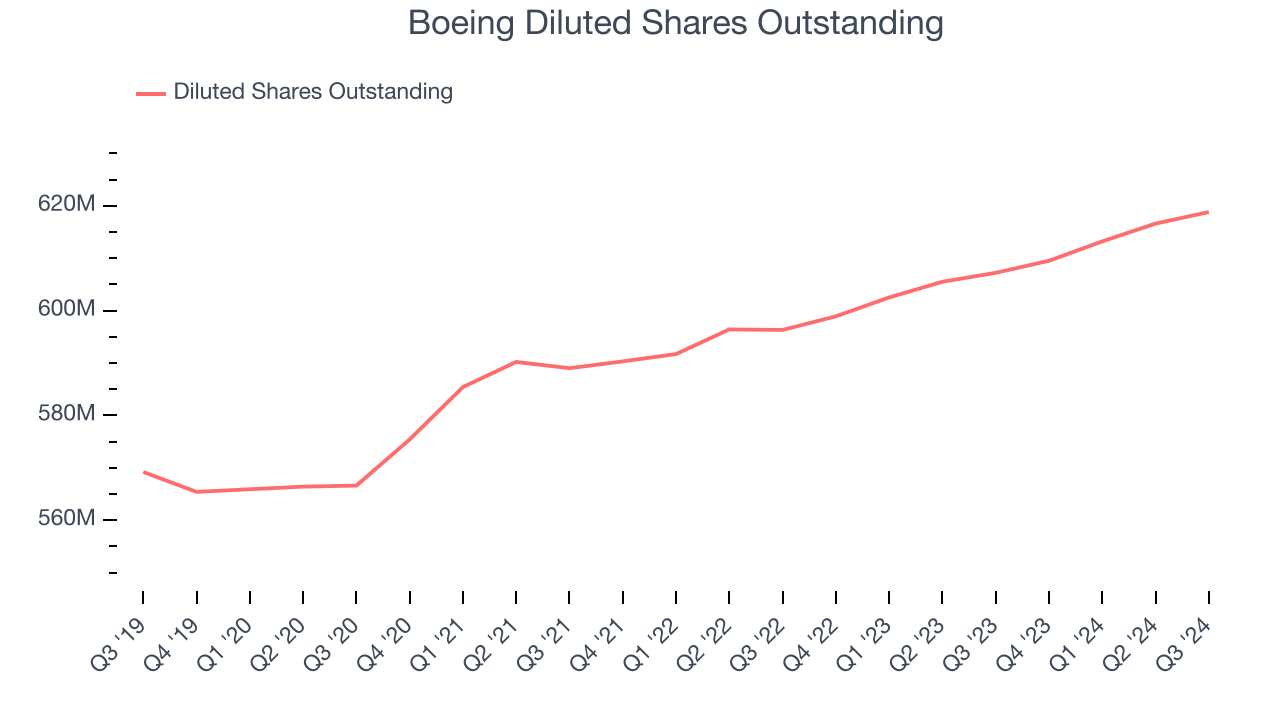

We can take a deeper look into Boeing’s earnings to better understand the drivers of its performance. A five-year view shows Boeing has diluted its shareholders, growing its share count by 8.7%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business. For Boeing, its two-year annual EPS growth of 6.2% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q3, Boeing reported EPS at negative $10.44, down from negative $3.26 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Boeing’s full-year EPS of negative $14.94 will flip to positive $0.68.

Key Takeaways from Boeing’s Q3 Results

We struggled to find many strong positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. Additionally, Boeing’s new CEO Kelly Ortberg said the company must focus on its core business; Boeing’s more than 32,000 striking machinists will also vote on a new contract proposal on Wednesday that could end a more than five-week work stoppage. Overall, this quarter could have been better and the company is facing a number of headwinds. The stock remained flat at $159.20 immediately following the results.

Boeing underperformed this quarter, but does that create an opportunity to invest right now?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.