Foot Locker (NYSE: FL) is down 25% after reporting a horrible quarter. Repositioning efforts impact the results, but other details overshadow them. The takeaway is that the tide of discretionary spending is receding. Results were weak, and the guidance was cut meaningfully due to trends reported by other major retailers. Names like Target (NYSE: TGT) and Walmart (NYSE: WMT) issued decent reports because they are diversified retailers. Their customers are shifting away from discretionary items like shoes in favor of food and well-being products, sustaining business and even providing some growth.

The scary fact is that pullbacks in discretionary spending and shifting to staples are not resulting in a general retail recession because of inflation. You can’t save money by cutting out discretionary spending if the cost of everything else is through the roof and still rising. The detail of Target, Walmart’s, and The Home Depot’s (NYSE: HD) reports investors should note is the weak Q2 guidance that Foot Locker echoed. If that weakness persists into the 2nd half, the big box diversified retailers will also cut their guidance.

Foot Locker’s Q1 Is Nothing But Ugly

Foot Locker embarked on a transition at a bad time, no fault to them, but it and the times cut deeply into results. The company reported $1.93 billion in revenue for a decline of 11.5 compared to last year, 10% on an FX-neutral basis, which missed the consensus by 300 basis points. The decline is driven by a 9.1% decline in comp sales that Champs Sports led. Champs Sports declined 24% YOY compared to single-digit declines in all other channels. Champs is about 17% of the net, which is a significant headwind to business.

Markdowns are a problem that hit the top and bottom lines impacting revenue and margin. The markdowns are intended to help manage inventory which is still up 25% compared to last year. What was once a tailwind for business is now a liability that will impact results later in the year. Gross margin fell by 400 basis points, including the impact of shrinkage, a problem also reported by Target and not for the 1st time. SG&A expenses also rose due to deleveraging and higher costs, and both led to a significant shortfall in the bottom line. The adjusted $0.70 in EPS is $0.08 or 1000 basis points below consensus and down 56% YOY.

The guidance is worse. The company expects these headwinds to persist through the end of the year and lowered guidance for revenue and earnings. Revenue is expected to fall -from 6.5% to -8.0%, 300 basis points worse than the prior guidance, and the margin news is the worst. The adjusted EPS is expected to range from $2.00 to $2.25 compared to $3.35, which is the low end of the analysts' target range.

How Safe Is Foot Locker’s Dividend?

Foot Locker’s dividend is safe for now. The company is paying about 80% of the low-end guidance, which is high but manageable given the balance sheet. Investors should not expect repurchases to continue; none were listed for Q1 other than what was required for tax purposes.

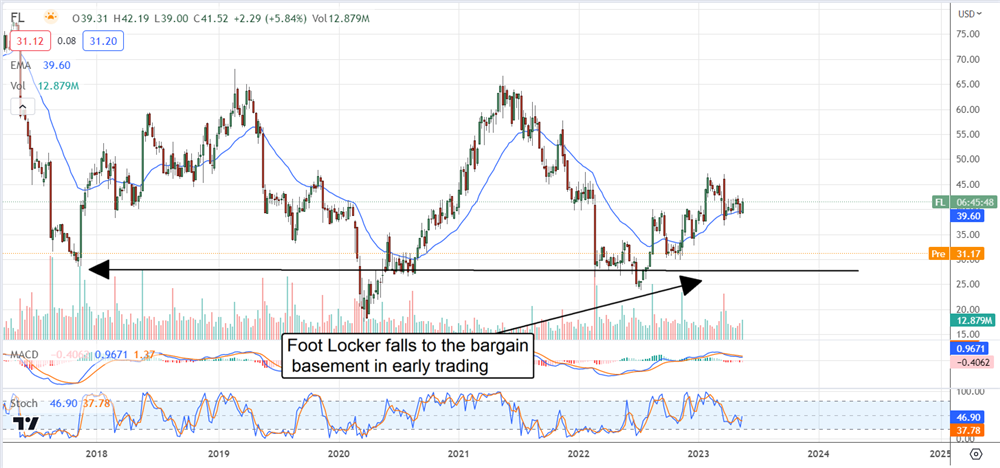

The chart isn’t pretty, but there is an opportunity for new money. Foot Locker is on the rocks but should be able to bounce back from these lows. The stock is trading at a significant support zone marked by lows in the pre, pandemic, and post-pandemic periods. Assuming this low produces support, shares of Foot Locker will likely move sideways from here if in a wide range.