Believes Structural Change is Necessary to Unlock Significant Shareholder Value

Seeks Relaunch of Office Depot Separation Process and Sale of Varis

NEW YORK, Dec. 18, 2023 (GLOBE NEWSWIRE) -- AREX Capital Management, LP, together with its affiliates, a long-term shareholder of The ODP Corporation (NYSE: ODP) (the “Company”), today issued an open letter to the Company’s Board of Directors (the “Board”).

The full text of the letter is set forth below:

December 18, 2023

Via Electronic Mail

The Board of Directors

The ODP Corporation

6600 North Military Trail

Boca Raton, FL 33496

Attention: Joseph S. Vassalluzzo, Chairman of the Board

Dear Joseph and Members of the Board:

AREX Capital Management, LP and its affiliates (together, “AREX” or “we”) have been shareholders of The ODP Corporation (“ODP” or the “Company”) for several years. During that time, we have generally been pleased with the Company’s operational results and share repurchase program, and we were particularly impressed by its best-in-class supply-chain execution during the disruptions of 2021 and 2022. Even the decision at the end of 2021 to sell CompuCom at a loss of more than $750 million spoke well of the Board’s willingness to admit mistakes and act decisively.1

We have also appreciated our open and candid dialogue with ODP’s Board and management team. As we have privately communicated to the Board recently, we believe that the results of the past few years strongly suggest that solid execution and ongoing share repurchases are insufficient to create meaningful and sustainable value for ODP shareholders. To that point, since January 2021, when Sycamore Partners made its unsolicited offer to acquire the Company, ODP’s shares are roughly flat. Incredibly, this disappointing performance has come against the backdrop of the Company reducing its share count by over 25% during this period.

Unfortunately, our most recent conversations with the Company have left us concerned that the Board and management do not feel the appropriate sense of urgency to promptly take the necessary steps to maximize shareholder value. Consequently, we find it necessary to publicly share our views and outline our perspective on the two primary issues adversely affecting ODP’s stock, along with the obvious remedial actions.

ISSUE 1: ODP IS STILL THOUGHT OF AS A BRICK-AND-MORTAR RETAILER

We believe that the primary explanation for ODP’s share price challenges and valuation malaise is that the omni-channel, but still majority brick-and-mortar, Office Depot retail business (“Office Depot”) creates a consistent deterrent for prospective investors who might otherwise provide higher multiples to ODP’s more attractive businesses. As a result, Office Depot ends up anchoring the trading value of the overall enterprise. ODP’s multiple should actually be increasing as ODP Business Solutions contributes a growing portion of the Company’s EBITDA and as Veyer rapidly expands its third-party logistics business. Instead, ODP’s valuation has stubbornly remained below 4x EBITDA, which is unreasonable for a healthy, unlevered company that should be growing its EBITDA over the next several years and enjoys strong free cash flow conversion. Too many investors simply think of ODP as a challenged brick-and-mortar retailer, and this misperception will likely persist for as long as Office Depot contributes a meaningful portion of the Company’s EBITDA, regardless of management’s efforts to tell its story better. It should be evident to all that structural changes are necessary for ODP’s share price and valuation to have a chance to approximate the fair value of its underlying assets.

Recent history suggests that the Board understands our thinking and appreciates the need for structural change. In its May 2021 press release announcing its plan to split into two independent, publicly traded companies, ODP eloquently articulated the compelling reasons for separating its enterprise-focused business from its consumer-focused one: distinct investment and growth strategies, increased focus on the unique needs of differing customer bases, attracting talent motivated by the specific mission of each business, and maximizing valuations through better alignment with different shareholder bases. During the separation process, multiple parties expressed interest in acquiring ODP’s consumer-focused business, and it is our understanding that a sale announcement was imminent before market volatility in June 2022 scuttled the deal.

Fortunately for shareholders, the work that was completed prior to the aborted divestiture was not in vain. As the Company stated in the June 2022 press release announcing the termination of the sale process, “The completion of our internal reorganization will make such a potential separation substantially simpler should the Company determine to resume the separation process following a change of market conditions in the future.”2 By almost any conceivable definition, market conditions today are dramatically improved, and the separation benefits that the Company itself previously enumerated are as relevant today as they have ever been. In fact, there is no compelling reason to maintain the existing corporate structure, and the process of executing on a tax-free Office Depot spin-off should begin immediately. Of note, while the spin-off process is progressing, the Company could also explore whether any of the prior bidders for Office Depot remain interested, or if additional prospective buyers may have emerged in the improved M&A environment.

ISSUE 2: VARIS IS SEEN AS A CASH-BURNING SCIENCE PROJECT

Another issue that plagues ODP’s shares is Varis. While the Company’s initial investment thesis may have been reasonable, Varis’ results to date have been unambiguously disappointing, as evidence of commercial progress has been sorely lacking and milestones have continuously been pushed out. Meanwhile, the Company continues to pump shareholders’ cash into the venture, and we estimate that between operating losses, capital expenditures, and the acquisition of BuyerQuest, ODP will have invested more than $300 million into Varis by the end of 2023. Varis is currently expected to generate less than $10 million in revenue this year, most of which is subscription revenue that was acquired through BuyerQuest as opposed to new platform revenue. We suspect the 2025 Varis revenue objective of $120 million that was presented little more than a year ago at the Company’s Investor Day is now internally acknowledged to be wildly unachievable.

It is time to change course. The core of ODP’s investment proposition is modest growth and prodigious free cash flow generation. Investors who find that type of opportunity appealing are a very poor audience for a highly speculative, cash-consuming venture capital project—which remains an accurate description of Varis despite three full years of investment and business-building efforts. Nothing in ODP’s history or present remotely suggests it is the appropriate home for such a concept. Furthermore, ODP has zero credibility with investors in making large allocations of capital into tangential business areas given its disastrous acquisition of CompuCom.

To be clear, this is not a personal critique of the highly qualified team attempting to build Varis, and we readily acknowledge that Varis may eventually achieve commercial success. We are simply stating that we do not want more of our money invested into this project given the enormous uncertainty surrounding it and the highly attractive alternative that exists for that capital—namely, the repurchase of ODP’s significantly undervalued shares. We suspect that other shareholders feel similarly.

The Company should immediately explore the divestiture of at least a majority stake in Varis. If Varis’ prospects are as exciting as ODP has previously articulated, there should be no shortage of third parties eager to invest in or acquire what has already been built. Divesting a majority stake would establish a real-world valuation mark for Varis and should provide the capital needed to bridge it to profitability, while also potentially allowing ODP to recoup some of its historical investment. Alternatively, a full sale of Varis would provide ODP with additional capital for share repurchases, further focus the enterprise, and vastly improve the ODP investment story by completely eliminating an overhang. The Company should not be concerned with whether the valuation achieved in either scenario even approximates its basis—the simple reality is that the highest price that a third party is willing to pay for Varis today is, in fact, the value of the asset. And if no third parties are willing to invest capital into or acquire Varis at any price, that too speaks volumes about the project’s prospects and would provide clear evidence of the need to immediately shutter it. In short, simply continuing the status quo at Varis is unacceptable.

THE DAY AFTER

After taking the steps that we outline above—for simplicity, we will call it the “AREX Plan”— existing ODP shareholders would own shares in two new companies: “RemainCo,” consisting of ODP Business Solutions and Veyer, and “NewCo,” consisting of Office Depot. As part of the separation, we anticipate NewCo signing a long-term contract with Veyer under which Veyer will continue providing the services that it currently provides at market rates. Further, we anticipate NewCo being spun out on a net-debt-free basis.

We believe that the market will have a dramatically more favorable view of RemainCo once it no longer operates a primarily brick-and-mortar retailer. And a RemainCo with two attractive businesses—a modestly growing, highly cash generative B2B distribution business and a logistics business with strong growth driven by expanding third-party activity—should enjoy a vastly improved valuation relative to ODP’s current reality.

In our analysis of RemainCo’s prospective trading value, we use a multiple of 6.5x EBITDA for ODP Business Solutions and 7.0x EBITDA for Veyer (see Appendix for a discussion of our segment valuation rationales). Further, we assume that Varis is sold in its entirety for $150 million, or roughly half of invested capital.

For NewCo, we use a multiple of 3.0x EBITDA, a discount to where similarly situated omni-channel retailers trade. In fact, none of the retailers in the Russell 2000 with positive EBITDA trade below ~3.5x EBITDA. We use this extreme multiple to illustrate the point that if the separation produces a re-rating of RemainCo, NewCo’s valuation is, in fact, fairly irrelevant. While the Company has at times expressed concerns that Office Depot’s standalone valuation would be a material risk in a separation, the analysis presented here clearly refutes this notion. Further, if ODP shareholders do not feel that NewCo is trading at an appropriate level upon separation, they could continue to own the standalone business, only now in a far more focused structure. Of note, the valuation we present for NewCo equates to a ~25% free cash flow yield on this year’s estimates, and if NewCo initially traded at that level, it could quickly repurchase a substantial portion of its shares, which would likely lead to an improvement in its valuation.

| Value Creation from the AREX Plan | |||||||||||

| ($ in millions, except per share amounts) | |||||||||||

| EBITDA | Value | ||||||||||

| 2024E | 2025E | Multiple | 2024E | 2025E | |||||||

| ODP Business Solutions | $ | 199 | $ | 227 | 6.5x | $ | 1,293 | $ | 1,475 | ||

| Veyer | 77 | 89 | 7.0x | 540 | 626 | ||||||

| Total RemainCo Enterprise Value | $ | 276 | $ | 316 | $ | 1,833 | $ | 2,102 | |||

| Net Cash(1) | 211 | 211 | |||||||||

| Other Assets(2) | 208 | 208 | |||||||||

| Varis Sale | 150 | 150 | |||||||||

| RemainCo Equity Value | $ | 2,402 | $ | 2,671 | |||||||

| per share | $ | 60 | $ | 67 | |||||||

| NewCo Equity Value | $ | 197 | $ | 182 | 3.0x | $ | 591 | $ | 547 | ||

| per share | $ | 15 | $ | 14 | |||||||

| Total ODP Equity Value | $ | 473 | $ | 499 | $ | 2,993 | $ | 3,218 | |||

| per share | $ | 75 | $ | 81 | |||||||

| % upside to current | 46 | % | 62 | % | |||||||

| Note: AREX segment-level estimates of ODP 2024E and 2025E EBITDA include corporate allocations. Share count based upon expected year-end 2023 level of ~40 million fully diluted shares. (1) AREX estimates for cash balance on December 31, 2023. (2) Includes cash surrender value of company-owned life insurance, CompuCom promissory note, and held for sale assets. | |||||||||||

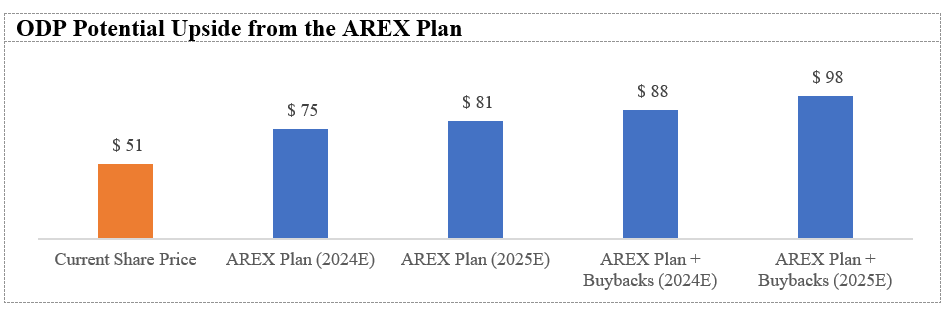

As shown above, based on our forecasts for 2024 EBITDA and valuation assumptions, the AREX Plan should deliver value to ODP shareholders of ~$75 per share, or nearly 50% above current levels. Applying the same framework using 2025 estimates suggests the delivery of ~$81 per share of value to ODP shareholders, or more than 60% above current levels. Of note, our upside values and return estimates do not incorporate the more than $6 per share in cash that we expect ODP to generate over the course of 2024.

ADDITIONAL VALUE CREATION OPPORTUNITY

While we believe the steps outlined above will create substantial shareholder value, there is material additional upside potential if the Company were prepared to modestly increase its leverage to support larger share repurchases ahead of a prospective separation. And while we appreciate the Company’s desire to maintain a conservative balance sheet, its current net cash position seems unnecessary, particularly considering its significant free cash flow generation.

As illustrated below, a modestly leveraging buyback could drive meaningful value creation through the acquisition of undervalued shares. Specifically, we estimate that if the Company were willing to migrate its balance sheet to a net leverage position of 1.0x 2023 EBITDA, it would immediately have an incremental ~$875 million of capital available for share repurchases.3 This would represent more than 40% of the Company’s current market capitalization! While we recognize that Office Depot is less “leverageable” than other parts of the business, this scenario would still leave the Company with an appropriately conservative balance sheet—specifically, the resulting post-repurchase capital structure would result in a very reasonable leverage ratio for RemainCo of ~1.7x following the implementation of the AREX Plan.

In an admittedly abstract analysis, if ODP were to use the aforementioned ~$875 million to repurchase its shares at $55 per share, our sum-of-the-parts estimate for ODP’s shares based on 2024 estimates would increase from ~$75 per share to ~$88 per share, or more than 70% above current levels. The same analysis on our 2025-based approach increases our fair value estimate from ~$81 per share to ~$98 per share, or ~90% above current levels.

CONCLUSION

We are firm believers in ODP’s long-term prospects, and particularly in the valuable ODP Business Solutions and Veyer businesses. However, we are also sober about the enormous challenge that ODP’s current business mix presents for public market investors as the Company attempts to argue its way to a fair valuation. The steps that we have outlined should generate significant value for shareholders, far greater than what the Company is likely to deliver in any version of the status quo. No more time should be wasted exploring whether the 4-BU framework might ultimately resonate with investors or continuing a very expensive hope-based strategy with Varis. We feel that the Board must act decisively to unlock this value for shareholders, and if it does not, we will consider taking additional steps to hold the Board accountable and ensure that shareholder value is maximized.

We hope to discuss these matters with the Board soon. We eagerly await your response.

Best regards,

|  |

| Andrew Rechtschaffen Managing Partner | James T. Corcoran Partner |

APPENDIX: SEGMENT VALUATIONS

ODP Business Solutions: Determining the correct multiple for ODP Business Solutions is complicated by the lack of an appropriate, pure-play public comp. Veritiv Corporation, a B2B distributor that was recently taken private and has more than 40% of its business in markets that overlap with ODP Business Solutions, offers one relevant data point. Over the past five years, when public, Veritiv traded at an average EV/EBITDA multiple of ~6x, and it was recently acquired by private equity firm Clayton, Dubilier & Rice at an EV/EBITDA multiple of ~5.5x. However, the majority of Veritiv’s business is focused on packaging products, its overlap with ODP Business Solutions is generally in lower-growth core office categories (and in challenged customer segments, such as commercial printers and publishers, within those categories), and it has a worse medium-term organic growth outlook than ODP Business Solutions (its merger proxy filing forecast annual revenue growth of ~1%).

There are other publicly traded B2B distributors with large market shares, including W.W. Grainger, Inc. and Fastenal Company. However, while these companies have historically traded at much higher EBITDA multiples, they are generally focused on the industrial segment and have superior growth prospects. As such, we value ODP Business Solutions at 6.5x EBITDA, which represents a modest premium to the historical and take-private valuation of what we believe to be an inferior comparable company. We would also note that, setting aside relative valuation, on an absolute basis, 6.5x EBITDA feels inexpensive for a growing distribution business with limited capital needs (capital expenditures are ~2% of EBITDA for ODP Business Solutions).

Veyer: In valuing Veyer, we employ a weighted average approach to balance the fact that, on the one hand, more than 60% of Veyer’s 2025 EBITDA will still be coming from ODP’s two primary businesses that collectively offer very modest growth prospects (and create significant customer concentration), while on the other hand, Veyer’s fast-growing third-party EBITDA stream merits a higher valuation.

We arrive at a multiple of 5x EBITDA for the “legacy ODP portion” of Veyer’s business based on ODP Business Solutions’ and Office Depot’s relative contributions to Veyer and the multiples we use to value those segments. Given the rapid near-term projected growth for Veyer’s third-party EBITDA, we consider the higher end of the range for publicly traded non-brokerage focused 3PLs like GXO, Inc. and asset-based transportation companies like Saia, Inc., and conclude that a multiple of 11x EBITDA is appropriate. The resulting blended multiple for Veyer is 7x EBITDA—though as the higher growth third-party EBITDA becomes a larger part of the mix over time, the segment’s “fair” multiple should increase.

Office Depot: While there is a range of valuations for omni-channel retailers with end markets about which investors have medium-term concerns, a multiple of 3.0x EBITDA is an outlier, and we use it only for the sake of conservatism. It is also worth noting that our valuations for Office Depot are well below the levels that were being discussed during the 2021-2022 sale process.

About AREX

AREX Capital Management, LP is a value-oriented investment firm based in New York City. AREX takes a long-term, opportunistic approach to investing and focuses primarily on publicly traded companies with significant, unrealized potential.

Media Contact

Valerie Toomey, Chief Operating Officer

AREX Capital Management, LP

(646) 679-4000

info@arexcapital.com

1 CompuCom was acquired in 2017 for $937 million. ODP ultimately received sales proceeds consisting of $100 million in cash, a promissory note of $59 million, and a potential earnout with a maximum theoretical value of $125 million that the Company valued at $9 million as of September 30, 2023.

2 “The ODP Corporation Completes Realignment of Operating Business Entities to Better Serve Customers,” June 21, 2022.

3 Inclusive of the cash surrender value of Company-owned life insurance policies and CompuCom promissory note.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f5d55236-69b5-4d41-8262-fc4c1eb405a4