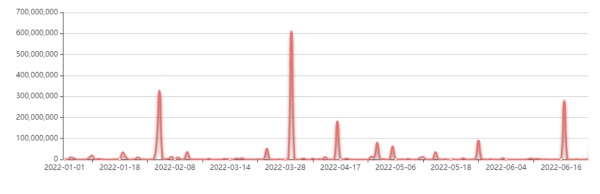

After more than 10 years of development, the total market cap of cryptocurrencies has exceeded 3 trillion US dollars and has become an important financial asset in the world. However, due to the particularity of crypto asset storage methods and the complexity of private keys, the security of crypto assets has also been greatly impacted. According to the statistics of SlowMist Hacked, as of June 30, there were 187 crypto asset security incidents in the first half of 2022, with a loss of up to 1.976 billion US dollars.

Among all the security incidents in the first half of the year, there were 92 attacks caused by the projects’ own design flaws and various contract vulnerabilities, resulting in a loss of 1.06 billion US dollars, of which 19 were attacks caused by the use of flash loans, resulting in a loss of 61.33 million US dollars. The incidence of asset loss due to theft of private keys is about 4%, but the amount of loss reached 720 million US dollars.

According to CCN news, a blockchain forensics company Chainalysis conducted a study and found that many BTC holders had lost their keys due to various reasons, making it impossible to retrieve their crypto assets. The number of lost BTCs is about 3.79 million according to current statistics, which accounts for 18% of the total BTC supply of 21 million.

The ownership of a crypto asset depends on the possession of its private key. The private key is extremely important for coin holders. However, many coin holders still suffer from asset damage mainly for two reasons. First, a private key is an irregular string, which is difficult to remember. Many coin holders save their private keys in the form of a QR code in electronic devices, leading to their disclosure. Second, some coin holders directly store their private keys in third-party service providers, which are often attacked or goes bankrupt, thus indirectly causing asset losses. With the rapid collapse of FTX, it is more convinced that there is no truly secure third-party custodian.

In order to protect the security of user assets and provide convenient key management, BFChainMeta team has innovatively designed a key manager called “MySecret”. Users can use a long custom secret message (such as a favorite line, a song or a poem) as a seed, and then the corresponding private key will be encrypted and stored in this on-chain key manager. It solves a series of problems such as traditional passwords with only a few bits and low strength and easy to be cracked, and meaningless original key characters which are hard to remember, and unreliable third-party centralized custodians (e.g. blockchain.info), so that users can safely and conveniently use keys in a decentralized environment without relying on other third parties.

In 2022, the blockchain has entered the era of multi-chain coexistence, and the total value locked of major public blockchains has also repeatedly hit all-time highs. However, it is a pity that assets have been stolen on almost every chain. In addition to the vulnerability of crypto assets to attacks, one of the main reasons is that the major public chains do not pay enough attention to asset security. BFChainMeta has attached great importance to cryptocurrency security since its design, and its original key storage mechanism has ensured that none of its assets were stolen in the past 7 plus years. In the future, public blockchains may need higher TPS and better ecological development, but the most basic and important thing is the need for a safer way to preserve assets. In this aspect, BFChainMeta is ahead of all public chains.

Media Contact

Company Name: BFChainMeta

Contact Person: Jacky

Email: Send Email

Country: Singapore

Website: https://twitter.com/BFMeta