Morgan Stanley Wealth Management today announced results from its quarterly individual investor pulse survey:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240717163807/en/

Credit: Morgan Stanley

- Amid record market highs, bullishness remains elevated. 61% of investors are bullish this quarter–in line with last quarter (60%).

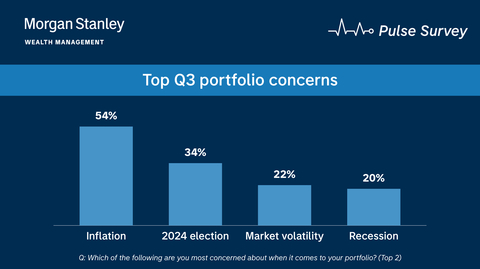

- And higher prices continue to be a concern. Inflation remains the top concern for investors (54%), followed by the 2024 election (34%), market volatility (22%), and a recession (20%).

- Investors are skeptical on rate cuts. Less than half (48%) believe the U.S. economy is healthy enough for the Fed to cut rates this quarter, down from 51% last quarter.

- Though the majority believe cuts are on the horizon. 54% believe the Fed will cut rates in the second half of the year.

- And many believe the market will continue to rise before Q4. Over half of investors (59%) predict the market will rise by the end of the third quarter.

“It’s understandable to see bullishness remaining steady this quarter as the market pushed higher driven by mega-caps,” said Chris Larkin, Managing Director, Head of Trading and Investing, E*TRADE from Morgan Stanley. “On the flipside, the narrow market could make some traders jittery especially when compounded by a higher for longer rate stance from the Fed. So, it’s easy to see how investors can have mixed emotions about where we stand when it comes to the market and the economy.”

The survey explored investor views on sector opportunities for the third quarter of 2024:

- IT – Tech continues to take the leading spot for investor interest, as mega-cap tech names dominate, with the chips and AI space holding its ground.

- Energy – As oil prices trended higher, positive views of energy stocks mounted this quarter.

- Health care – Amid political and economic uncertainty, investors continue to look at health care—a traditionally defensive sector, although interest dipped from the previous quarter by 2 percentage points as the market moved higher.

About the Survey

This wave of the survey was conducted from July 1 to July 16 of 2024 among an online US sample of 891 self-directed investors, investors who fully delegate investment account management to financial professionals, and investors who utilize both. The survey has a margin of error of ±3.20 percent at the 95 percent confidence level. It was fielded and administered by Dynata. The panel is broken into three investable assets: less than $500k, between $500k to $1 million, and over $1 million. The panel is 60% male and 40% female and self-select as having moderate+ investing experience, with an even distribution across geographic regions, and age bands.

About Morgan Stanley Wealth Management

Morgan Stanley Wealth Management, a global leader, provides access to a wide range of products and services to individuals, businesses and institutions, including brokerage and investment advisory services, financial and wealth planning, cash management and lending products and services, annuities and insurance, retirement and trust services.

About Morgan Stanley

Morgan Stanley (NYSE: MS) is a leading global financial services firm providing a wide range of investment banking, securities, wealth management and investment management services. With offices in 42 countries, the Firm’s employees serve clients worldwide including corporations, governments, institutions and individuals. For further information about Morgan Stanley, please visit www.morganstanley.com.

This has been prepared for informational purposes only and is not a solicitation of any offer to buy or sell any security or other financial instrument, or to participate in any trading strategy. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Morgan Stanley recommends that investors independently evaluate particular investments and strategies and encourages investors to seek the advice of a Financial Advisor.

Morgan Stanley Portfolio Solutions are portfolios available in our Select UMA platform under either Firm Discretionary UMA or Managed Advisory Portfolio Solutions. Please see the Select UMA ADV at www.morganstanley.com/ADV

Past performance is not a guarantee or indicative of future performance. Historical data shown represents past performance and does not guarantee comparable future results.

This material contains forward-looking statements and there can be no guarantee that they will come to pass. Diversification and asset allocation do not guarantee a profit or protect against loss in a declining financial market.

This material should not be viewed as investment advice or recommendations with respect to asset allocation or any particular investment.

Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States.

Morgan Stanley Smith Barney LLC and Dynata are not affiliates.

© 2024 Morgan Stanley Smith Barney LLC. Member SIPC.

Referenced Data

When it comes to the current market are you? |

||

|

Q2’ 24 |

Q3’ 24 |

Bullish |

60% |

61% |

Bearish |

40% |

39% |

Which of the following are you most concerned about when it comes to your portfolio? (Top 2) |

|

|

Q3’24 |

Inflation |

54% |

2024 election |

34% |

Market volatility |

22% |

A recession |

20% |

Earnings |

14% |

Geopolitical conflict |

12% |

Energy costs |

12% |

Narrow market driven by mega-caps |

11% |

Fed monetary policy |

10% |

None |

2% |

Please rate how much you agree or disagree with the following statements. The U.S. economy is healthy enough for the Fed to cut rates this quarter. |

||

|

Q2’ 24 |

Q3’ 24 |

Agree (Top 2) |

51% |

48% |

Strongly agree |

16% |

16% |

Somewhat agree |

35% |

32% |

Neither agree nor disagree |

22% |

26% |

Somewhat disagree |

19% |

18% |

Strongly disagree |

8% |

8% |

When do you expect the Fed to first cut rates? |

|

|

Q3’24 |

2H ‘24 |

54% |

Q3 ‘24 |

13% |

Q4 ‘24 |

41% |

Not until 2025 |

30% |

I don’t know |

11% |

I don’t think they will cut rates |

5% |

Where do you predict the market will end this quarter? |

|

|

Q3’24 |

Rise (Top 4) |

59% |

Rise 20% |

1% |

Rise 15% |

6% |

Rise 10% |

15% |

Rise 5% |

37% |

0/stay where it is |

20% |

Drop – 5% |

14% |

Drop – 10% |

5% |

Drop – 15% |

2% |

Drop – 20% |

0% |

What industries do you think offer the most potential this quarter? (Top three) |

||

|

Q2’24 |

Q3’24 |

Information technology |

52% |

57% |

Energy |

43% |

47% |

Health care |

36% |

34% |

Real estate |

30% |

29% |

Financials |

27% |

28% |

Utilities |

24% |

25% |

Industrials |

20% |

20% |

Communication services |

20% |

19% |

Consumer staples |

20% |

19% |

Materials |

16% |

14% |

Consumer discretionary |

12% |

10% |

View source version on businesswire.com: https://www.businesswire.com/news/home/20240717163807/en/

Contacts

Media Relations: Lynn Cocchiola, Lynn.Cocchiola@morganstanley.com