Will Provide Additional Natural Gas Capacity to Serve Growing Market Needs

Energy Transfer LP (NYSE: ET) today announced that it has reached a positive final investment decision (FID) for the construction of an intrastate natural gas pipeline connecting Permian Basin production to premier markets and trading hubs. The new large-diameter pipeline, previously called the Warrior Pipeline, is being renamed in honor of Hugh Brinson and will now be known as the Hugh Brinson Pipeline. The pipeline will provide much needed transportation capacity out of the Permian Basin to serve growing natural gas demand.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241206711495/en/

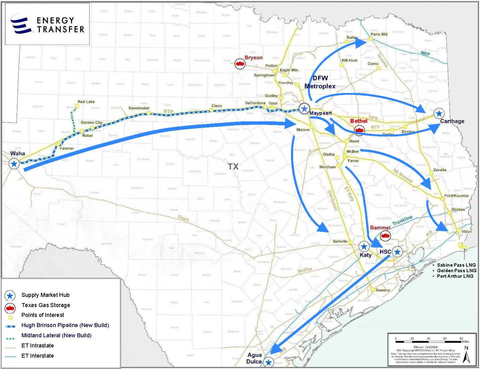

Hugh Brinson Pipeline (Graphic: Business Wire)

The Hugh Brinson Pipeline is expected to be constructed in two phases with the first phase including the construction of approximately 400 miles of 42-inch pipeline with a capacity of 1.5 billion cubic feet per day (Bcf/d). It will extend from Waha to Maypearl, Texas located south of the Dallas/Ft. Worth Metroplex, where it will then connect to Energy Transfer’s vast pipeline and storage infrastructure. Phase I is expected to be in service by the end of 2026.

As part of Phase I, Energy Transfer will also construct the Midland Lateral, which is expected to be a 42-mile, 36-inch lateral to connect Energy Transfer and third-party processing plants in Martin and Midland Counties to the Hugh Brinson Pipeline.

Phase II of the project would include the addition of compression to increase the capacity of the new pipeline to approximately 2.2 Bcf/d. Depending on shipper demand, Phase II could be constructed concurrently with Phase I.

Combined costs of Phase I and Phase II are expected to be approximately $2.7 billion. The project is backed by long-term, fee-based commitments with strong investment grade counterparties.

The Hugh Brinson Pipeline will connect shippers to Energy Transfer’s existing intrastate natural gas pipeline network and other downstream pipelines. In addition, it will provide shippers with the optionality to access prolific markets and trading hubs throughout Texas and beyond, including Carthage and Katy. This project is also expected to further establish Energy Transfer as the premier option to support power plant and data center growth in the state of Texas.

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with more than 130,000 miles of pipeline and associated energy infrastructure. Energy Transfer’s strategic network spans 44 states with assets in all of the major U.S. production basins. Energy Transfer is a publicly traded limited partnership with core operations that include complementary natural gas midstream, intrastate and interstate transportation and storage assets; crude oil, natural gas liquids (“NGL”) and refined product transportation and terminalling assets; and NGL fractionation. Energy Transfer also owns Lake Charles LNG Company, as well as the general partner interests, the incentive distribution rights and approximately 21% of the outstanding common units of Sunoco LP (NYSE: SUN), and the general partner interests and approximately 39% of the outstanding common units of USA Compression Partners, LP (NYSE: USAC). For more information, visit the Energy Transfer LP website at www.energytransfer.com.

Forward-Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results, are discussed in the Partnership’s Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. The Partnership undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on our website at www.energytransfer.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241206711495/en/

Contacts

Investor Relations:

Bill Baerg

Brent Ratliff

Lyndsay Hannah

214-981-0795

Media Relations:

Vicki Granado

214-840-5820