Lotus Midstream Owns and Operates Centurion Pipeline, a fully Integrated Crude Pipeline and Terminal System in the Permian Basin

- Enhances Energy Transfer’s crude pipeline footprint across the Permian Basin

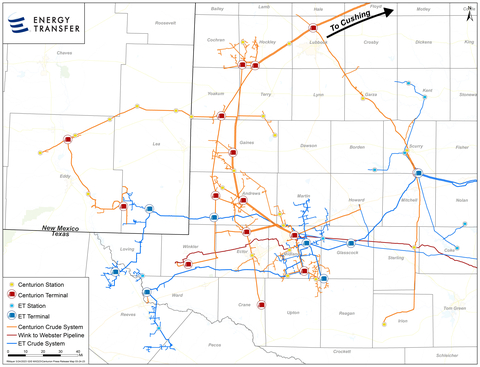

- Adds ~3,000 miles of crude gathering and transportation pipelines that extend from Southeast New Mexico across the Permian Basin of West Texas to Cushing, Oklahoma

- Increases Energy Transfer’s storage capacity in Midland, Texas by ~2 million barrels

- Includes a 5% equity interest in the Wink to Webster Pipeline

- Accretive to free cash flow as well as distributable cash flow per unit

- Structured to continue positive financial momentum and improving leverage ratios

Energy Transfer LP (NYSE: ET) and Lotus Midstream LLC announced today that the parties have entered into a definitive agreement pursuant to which Energy Transfer will acquire Lotus Midstream Operations, LLC (Lotus Midstream) in a transaction valued at approximately $1.45 billion from an affiliate of EnCap Flatrock Midstream (EFM). Consideration for the transaction will be comprised of $900 million in cash and approximately 44.5 million newly issued Energy Transfer common units. Lotus Midstream owns and operates Centurion Pipeline Company LLC, an integrated, crude midstream platform located in the Permian Basin. The transaction is expected to close in the second quarter of 2023, subject to regulatory approval and customary closing conditions.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230327005340/en/

(Graphic: Business Wire)

Complementary Crude Gathering, Transportation and Storage Assets

Lotus Midstream’s Centurion Pipeline Company provides a full suite of midstream services including wellhead gathering, intra-basin transportation, terminalling and long-haul transportation services. Its expansive system, encompassing approximately 3,000 active miles of pipeline, covers major production areas of the Permian with nearly 1.5 million barrels per day of capacity. Lotus Midstream’s Midland Terminal offers 2 million barrels of crude oil storage capacity and additional supply and demand connectivity. The acquisition also includes a 5% equity interest in the Wink to Webster Pipeline, a 650-mile pipeline system transporting more than one million barrels per day of crude oil and condensate from the Permian Basin to the Gulf Coast.

Energy Transfer’s acquisition of Lotus Midstream’s Centurion Pipeline assets will increase the Partnership’s footprint in the Permian Basin and provide increased connectivity for its crude oil transportation and storage businesses. The Centurion assets, located across some of the most active areas of the Permian Basin, provide significant gathering volumes from key producers while also enhancing Energy Transfer’s access to key downstream markets with consistent sources of demand. The assets provide direct access to major hubs including Cushing, Midland, Colorado City, Wink and Crane. The system is anchored by large cap producer customers with firm, long-term contracts, and significant acreage dedications.

Additionally, upon closing Energy Transfer expects to begin construction on a 30-mile pipeline project that will allow Energy Transfer and its customers the ability to originate barrels from its Midland terminals for ultimate delivery to Cushing. This project is expected to be completed in the first quarter of 2024.

Positive Financial Impact

The transaction is expected to be immediately accretive to free cash flow and distributable cash flow per unit as well as neutral to Energy Transfer’s leverage metrics. Lotus Midstream cash flows are supported by fee-based revenues from fixed-fee contracts.

Advisors

J.P. Morgan Securities LLC and TD Securities are serving as financial advisors to Energy Transfer, and Sidley Austin LLP is acting as Energy Transfer’s legal counsel on the transaction. Jefferies is serving as financial advisor to Lotus Midstream, and Vinson & Elkins LLP is acting as Lotus Midstream’s legal counsel.

About Energy Transfer

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with approximately 120,000 miles of pipeline and associated energy infrastructure. Energy Transfer’s strategic network spans 41 states with assets in all of the major U.S. production basins. Energy Transfer is a publicly traded limited partnership with core operations that include complementary natural gas midstream, intrastate and interstate transportation and storage assets; crude oil, natural gas liquids (“NGL”) and refined product transportation and terminalling assets; and NGL fractionation. Energy Transfer also owns Lake Charles LNG Company, as well as the general partner interests, the incentive distribution rights and approximately 34% of the outstanding common units of Sunoco LP (NYSE: SUN), and the general partner interests and approximately 47% of the outstanding common units of USA Compression Partners, LP (NYSE: USAC).

About Lotus Midstream

Based in Sugar Land, Texas, Lotus Midstream is an independent energy company focused on the development of midstream infrastructure and services necessary to transport crude oil and condensate from the wellhead to market. Lotus owns the Centurion Pipeline System, a large-scale, integrated network of approximately 3,000 miles of crude oil gathering and transportation pipelines that extends from southeast New Mexico across the Permian Basin of West Texas to Cushing, Oklahoma. Lotus Midstream is backed by EnCap Flatrock Midstream.

Forward-Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law, such as Energy Transfer’s ability to successfully complete and integrate the transactions described herein and the possibility that the anticipated benefits of the transactions cannot be fully realized. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results are discussed in the Partnership’s Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. The Partnership undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on our website at www.energytransfer.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230327005340/en/

Contacts

Energy Transfer

Investor Relations:

Bill Baerg, Brent Ratliff, Lyndsay Hannah, 214-981-0795

Media Relations:

Media@energytransfer.com

214-840-5820