- Millennials Experienced Greatest Decline in Preparedness Among Generations Since Study Last Conducted in 2020, Despite Highest Increase in Income

- Fidelity Investments® Reveals Three Actions to Improve America’s Retirement Score

- Want to Know Where You Stand? Check Out the Fidelity Retirement Score

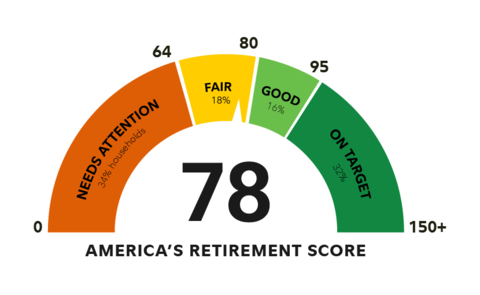

Fidelity Investments® today released its latest Retirement Savings Assessment, revealing a decline in retirement readiness as American savers continue to navigate market volatility and disruption. America’s Retirement Score1 has moved back into the yellow to 78, a five-point decline from an all-time high of 83 reported in 2020, with American savers estimated to have only 78% of the income needed to cover expenses during retirement. In the midst of continuing uncertainty, Fidelity reveals actions that can be taken to help people improve their financial wellness.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230321005312/en/

America's Retirement Score, according to Fidelity's 2023 Retirement Savings Assessment (Graphic: Business Wire)

The assessment finds over half (52%) of those surveyed may need to make modest to significant adjustments to their retirement lifestyle if they don’t take action to make up for the shortage. More than one-third (34%) of households are in the red on the preparedness spectrum, meaning significant adjustments may be likely. Notably, the assessment is based on a household’s ability to cover estimated retirement expenses2 in a down market3.

The decline in preparedness is being driven by two primary factors: people are saving less and investing more conservatively, which are natural reactions during a challenging financial environment, from the pandemic to market volatility to the latest turmoil in the banking industry. In fact, among those taking a conservative approach, nearly six in ten (57%) respondents expressed concern about losing their savings by investing too aggressively.

- Savings levels decline, even while asset balances increase. Even though Americans across generations have more money saved since 2020 (up by $40,000), Millennials and Boomers decreased their savings rate (down by 0.2% and 2.2%, respectively) while Gen X-ers increased their savings rate (up by 1.4%)4. Looking at median incomes, Millennials saw the biggest increase since 2020 (up by $12,500), while Gen X stayed flat ($120,000).

- Age-appropriate equity allocations decline, particularly among Millennials. The study finds the percentage of respondents allocating assets in a manner Fidelity considers age-appropriate5 is at 59.4%, a slight decline (by 0.6%) from 2020. Millennials saw the largest drop, by 2%, which means many may not have the appropriate number of equities when considering their long-term goal.

“American savers continue to navigate through uncertainty, and as a result, may consider pulling back on saving for the future,” said Rita Assaf, vice president of retirement at Fidelity Investments. “When it comes to long-term investing, staying focused on your individual goals is critical. Having a plan in place is one solid way to help weather any storm, as we’ve seen the last few years and weeks with the pandemic, inflation and market volatility.”

As part of its efforts to reach more people with financial wellness in this challenging environment, Fidelity has identified three actions to help improve preparedness levels, regardless of age or income. (Go here for comparative views of preparedness across generations, along with the most significant actions each generation6 can take and resources to help.)

While an ideal retirement varies and is unique to the individual, every vision starts with gaining clarity on what’s possible for retirement and then taking steps to get there. To help people get started, Fidelity created the Fidelity Retirement Score, which provides a rough estimate of how much you may need in retirement and suggests ways to help improve your score. Fidelity also offers a variety of additional resources, including:

-

Fidelity’s retirement planning hub, which offers online tips and resources to help you improve your retirement preparedness, no matter what stage of the journey you are in.

- For young savers starting out: “Where to put long-term savings,” “Ways to snowball your retirement savings in your 20s and 30s” and explainers on retirement terms.

- For people in their peak retirement savings years: “Just 1% more can make a big difference,” “4 rules of thumb for retirement savings” and “Learn more about how to build a retirement plan.”

- For people getting ready to retire: “3 keys to your retirement income plan,” “5 ways to help protect your retirement income,” “Claiming Social Security” and “Creating a retirement income plan.”

- Fidelity’s market volatility hub, which offers “Viewpoints” articles and “Market Sense” webcasts to help people understand the latest headlines, including implications of recent bank turmoil and what it all means for you.

- Individual consultations with an investment professional at one of Fidelity’s 197 Investor Centers or by phone at 1-800-FIDELITY (1-800-343-3548). You can also get started online here.

- Plus, for those with Fidelity workplace retirement accounts, there is access to one-on-one appointments, phone consultations and workshops through their employers.

About the Fidelity Investments Retirement Savings Assessment

The findings in this study are the culmination of a year-long research project that analyzed the overall retirement readiness of American households based on data such as workplace and individual savings accounts, Social Security benefits, pension benefits, inheritances, home equity and business ownership. The analysis for working Americans projects the retirement income for the typical household, compared to projected income need, and models the estimated effect of specific steps to help improve preparedness based on the anticipated length of retirement. Data for the Fidelity Investments Retirement Savings Assessment were collected through a national online survey of 3,569 working households earning at least $25,000 annually with respondents [and spouses, if married] age 25 to 75, from August 22 through September 26, 2022. All respondents expect to retire at some point and have already started saving for retirement. Data collection was completed by Versta Research using NORC’s probability-based nationally representative online panel. The responses were benchmarked and weighted against data from the American Community Survey and Current Population Survey conducted by the U.S. Census Bureau and the U.S. Bureau of Labor Statistics. Versta Research and NORC are independent research firms not affiliated with Fidelity Investments. Fidelity Investments was not identified as the survey sponsor. Fidelity’s Retirement Score is calculated through Fidelity’s proprietary financial planning engine. Of note, Fidelity continually enhances and evolves the retirement readiness methodology, guidance tools and product offerings. This year’s survey processing includes enhancements including, but not limited to, demographic weighting, retirement income projections and social security estimates. This analysis is for educational purposes and does not reflect actual investment results. An investor’s actual account balance and ability to withdraw assets during retirement at any point in the future will be determined by the contributions that have been made, any plan or account activity, and any investment gains or losses that may occur. For more information on Fidelity Investments® Retirement Savings Assessment, an executive summary can be found on Fidelity.com.

About Fidelity Investments

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. With assets under administration of $10.3 trillion, including discretionary assets of $3.9 trillion as of December 31, 2022, we focus on meeting the unique needs of a diverse set of customers. Privately held for over 75 years, Fidelity employs nearly 67,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Fidelity Brokerage Services LLC, Member NYSE, SIPC,

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC,

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

245 Summer Street, Boston, MA 02205

1079129.1.0

©2023 FMR LLC. All rights reserved

__________________________________________

1 This number represents the median Retirement Score derived from the Retirement Savings Assessment. IMPORTANT: The projections or other information generated by Fidelity Retirement Score regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary with each use and over time.

2 Retirement Expenses are estimated by Fidelity using replacement rates derived from Consumer Expenditure Survey (CEX). The replacement rate estimation is a function of total pre-retirement income, user selected lifestyle choices (default is average), and effective tax rate corresponding to pre-retirement income. 80% of total estimated expenses are considered essential in nature.

Score Assessment: <65 Significant adjustments to plan are required to sufficiently cover your estimated retirement expenses in an underperforming market

65–80 Modest adjustments to plan are required to sufficiently cover your estimated retirement expenses in an underperforming market

81–95 On track to cover most of your estimated retirement expenses in an underperforming market

>95 On track to cover 95% or more of your estimated expenses, even in an underperforming market

3 Fidelity uses an underperforming market for planning projections based on Monte Carlo simulations and its proprietary financial planning engine. Underperforming market conditions mean that in 9 out of 10 market scenarios the hypothetical portfolio performed at least as well, while 1 out of 10 times the hypothetical portfolio failed to perform as well. Using underperforming markets as a planning measure leads to conservative results. Using a lower confidence level would improve results, but also increase the risk that investors would fall short of projections.

4 Previously reported 2020 numbers have been recalculated for a fair comparison.

5 Age-appropriate asset allocation involves investing in a mix of stocks and fixed-income investments to align with one’s risk-tolerance, age and time horizon. “Appropriate” refers to what Fidelity considers to be an appropriate mix, derived from data reported in the Retirement Savings Assessment about an individual’s equity allocation distribution that is placed into four categories, based on that person’s age. Those categories are “On track”: within 25 percent on target date equity allocation; “Aggressive”: an equity percentage more than 25 percent above the age-appropriate target equity; “Conservative”: an equity percentage less than 25 percent below the age-appropriate equity target; as well as a category for assets held in a Target Date Fund. For Asset Allocation purposes, age appropriate equity allocation is defined as the participant's current age and equity holdings in a retirement portfolio compared with an example table containing age-based equity holding percentages based on an equity glide path. The Fidelity Equity Glide Path is an example we use for this measure and is a range of equity allocations that may be generally appropriate for many investors saving for retirement and planning to retire around ages 65 to 67. It is designed to become more conservative as participants approach retirement and beyond. The glide path begins with 90% equity holdings within a retirement portfolio at age 25 continuing down to 19% equity holdings 10-19 years after retirement. Equities are defined as domestic equity, international equity, company stock, and the equity portion of blended investment options. The indicator for asset allocation is determined by being within 10% (+ or -) of the Fidelity Equity Glide Path. We assume self-directed account balances (if any) are allocated 75% to equities, regardless of participant age and so the Asset Allocation Indicator has limited applicability for those affected participants. For purposes of this metric, participants enrolled in a managed account or invested greater than or equal to 80% of their account balance in a single target date fund are considered to have age appropriate equity allocation. Investors should allocate assets based on individual risk tolerance, investment time horizon and personal financial situation. A particular asset allocation may be achieved by using different allocations in different accounts or by using the same one across multiple accounts.

6 These numbers represent the median Retirement Scores by generation, based on the average age of household.

7 Fidelity's suggested total pre-tax savings goal of 15% of annual income (including employer contributions) is based on our research, which indicates that most people would need to contribute this amount from an assumed starting age of 25 through an assumed retirement age of 67 to potentially support a replacement annual income rate equal to 45% of preretirement annual income (assuming no pension income) through age 93. The income replacement target is based on the Consumer Expenditure Survey 2011 (BLS), Statistics of Income 2011 Tax Stats, IRS 2014 tax brackets, and Social Security Benefit Calculators. The 45% income replacement target (excluding Social Security and assuming no pension income) from retirement savings was found to be fairly consistent across a salary range of $50,000-$300,000; therefore, the savings rate suggestions may have limited applicability if your income is outside that range. Individuals may need to save more or less than 15% depending on retirement age, desired retirement lifestyle, assets saved to date, and other factors.

8 As defined by the Social Security Administration website. Fidelity has not been involved in the preparation of the content supplied at this unaffiliated site and does not guarantee or assume any responsibility for its content.

9 The basis for this increase: based on Social Security Administration’s rules, claiming social security before full retirement age (FRA) results reduction. Delaying social security after FRA increases one’s benefits by around eight percent per year of delaying until age 70. Assume FRA of 67.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230321005312/en/

Contacts

Corporate Communications

(617) 563-5800

fidelitycorporateaffairs@fmr.com

Sohana O’Hare

(214) 693-4501

sohana.ohare@fmr.com

Follow us on Twitter @FidelityNews

Visit our online newsroom