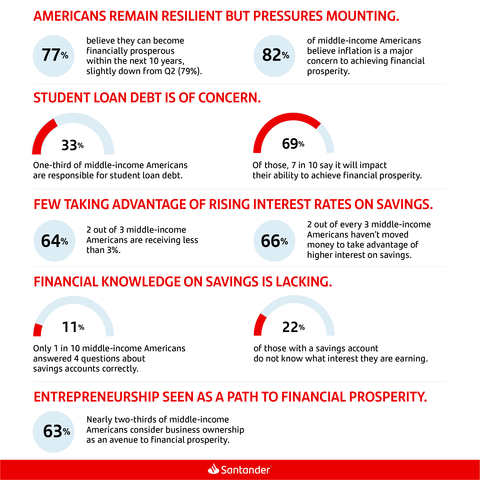

- 77% of middle-income Americans believe they will achieve financial prosperity in the next 10 years.

- Of those responsible for student-debt payments, 7 in 10 expected to be impacted by resumption of federal student-loan payments.

- Two-thirds have not yet taken advantage of rising interest rates on savings.

- Auto access remains essential to achieving financial prosperity.

Santander Holdings USA, Inc. (“Santander US”) today announced findings from a new survey that shows American consumers are optimistic about their futures despite mounting financial pressures. The results found 68% of middle-income households believe they are on the right track toward achieving financial prosperity, which remains unchanged from Q2.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231030238461/en/

(Graphic: Business Wire)

However, prolonged inflation and the resumption of federal student-loan payments are clear economic stressors for middle-income households. More than 7 in 10 say they are unable to save as much as a result of inflation, which remained the number one obstacle to achieving prosperity. Approximately a third of respondents – across all generations – are responsible for student-loan debt, with 69% of this group stating that the resumption of federal student-loan payments is a challenge to achieving financial prosperity.

The study also revealed that many middle-income Americans are missing out on an opportunity to offset these inflationary pressures by earning more on their savings. Interest rates on savings have climbed steadily to the highest levels in decades, yet two-thirds (66%) of middle-income Americans have not moved money into higher-yielding accounts to take advantage of these rates since the beginning of 2022. A lack of financial knowledge may be a contributing factor to the inertia. Just 1 in 10 respondents (11%) could answer four questions about savings accounts correctly. Those who responded to all correctly (41%) were more likely to have moved money to take advantage of higher rates versus those who answered all questions incorrectly (25%).

“Having the information needed to make important financial decisions is crucial for reaching one’s financial goals,” said Tim Wennes, Santander US CEO. “At Santander, we recognize our important role in providing customers with the support and guidance they need — in a way that is simple and easy to understand — so they can take control of their decision-making. Conducting this research each quarter provides us with essential insights, so that we can best meet our customers where they are in their journey to financial prosperity.”

The study, which built upon research conducted in the first and second quarters, assessed middle-income Americans’ current financial state and future aspirations, with a focus on how current economic conditions have impacted their households. It also identified areas for economic growth and demand, including entrepreneurship, financial education, and vehicle ownership.

Auto Access

The majority of middle-income Americans (76%) rely on a vehicle for their work commute. However, gas prices and higher auto prices have made vehicle access more difficult. To maintain access to their vehicles, 7 in 10 (69%) are willing to sacrifice other budgetary items. While half of respondents say they delayed purchasing an automobile in the past year due to cost, demand persists with 41% considering purchasing a vehicle over the next 12 months. A quarter would be more likely to purchase a vehicle in the year ahead if they are able to secure financing.

Entrepreneurship a Ticket to Prosperity

Business ownership was identified by middle-income Americans as a driver of financial prosperity, especially among Black (74%) and Hispanic (69%) consumers. While 47% of respondents expressed interest in starting a business, 60% said financing was their biggest challenge. Additionally, roughly half (51%) reported they lack the know-how to undergo the process of starting a business.

This research on financial prosperity, conducted by Morning Consult on behalf of Santander US, surveyed 2,213 American bank and/or financial services customers, ages 18-76. Survey participants had household income in the “middle-income” range of $47,000 to $142,000. The study was conducted from September 7-8, 2023. The interviews were conducted online, and the margin of error is +/- 2 percentage points for the total audience. The data was weighted to target population proportions for a representative sample based on age, gender, ethnicity, region, and education.

The full report and more information about the Santander US survey is available here.

About Santander US

Santander Holdings USA, Inc. (SHUSA) is a wholly owned subsidiary of Madrid-based Banco Santander, S.A. (NYSE: SAN) (Santander), a global banking group with 166 million customers in the U.S., Europe and Latin America. As the intermediate holding company for Santander’s U.S. businesses, SHUSA is the parent company of financial companies with approximately 13,700 employees, 4.5 million customers, and $168 billion in assets, as of December 2022. These include Santander Bank, N.A., Santander Consumer USA Holdings Inc., Banco Santander International, Santander Securities LLC, Santander US Capital Markets LLC and several other subsidiaries. Santander US is recognized as a top 10 auto lender, a top 10 multifamily lender, and a top 10 commercial real estate lender, and has a growing wealth management business. For more information about Santander US, please visit www.santanderus.com.

Santander Bank, N.A. is a Member FDIC and a wholly owned subsidiary of Banco Santander, S.A. © 2023 Santander Bank, N.A. All rights reserved. Santander, Santander Bank, the Flame Logo are trademarks of Banco Santander, S.A. or its subsidiaries in the United States or other countries.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231030238461/en/

Contacts

Media:

Andrew Simonelli

andrew.simonelli@santander.us

Caroline Connolly

caroline.connolly@santander.us