- Record-breaking revenue performance bolstered by TTM Same Store Sales Growth of approximately 48% year over year1

- TTM revenue exceeds the $878 million revenue projection from December 2021 go-public transaction by more than $122 million or 14%

- MoneyBowl™, the Company’s proprietary skill-based gamification app, is expected to be active in 27 centers by January 13, 2023, and is already operational in 16 locations

- Bowlero added 40 bowling centers over the last 18 months, ending Q2 of FY23 with 326 locations

Bowlero Corp. (NYSE: BOWL) (“Bowlero” or the “Company”), the world’s largest owner and operator of bowling centers, today provided a preliminary business update covering activity through January 1, 2023, the close of its second quarter of fiscal year 2023.2

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230109005313/en/

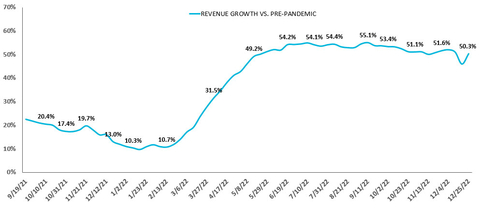

Bowling Center Trailing 13-week Revenue Growth Trend (Graphic: Business Wire)

The Company’s revenue exceeded $1.0 billion on a trailing twelve month basis, marking a major milestone in the Company’s history following record revenue generation throughout calendar year 2022. This performance was driven by strong ongoing demand for bowling, the country’s largest participatory sport, across the portfolio exemplified by Bowlero’s same store sales growth of approximately 48% year over year. In particular, the TTM revenue performance was fueled by dramatic year over year growth in events and continued strong performance from walk-in retail and leagues.

The Company’s deployment of Moneybowl™ continues to gain momentum, growing from two locations on November 16, 2022 to an expected 27 locations by January 13, 2023.

Bowling center additions remain a significant factor in driving total revenue growth. Since June 28, 2021, Bowlero has added 40 new centers and has grown its operating center count by 14%. Of the 40 centers added, two locations were new builds and 38 were acquisitions. The pipeline for new locations remains robust.

Thomas Shannon, Founder and Chief Executive Officer, stated, “The last twelve months have been transformational for Bowlero. Exceeding $1.0 billion in TTM revenue is a remarkable milestone for the Company, capping off a year of notable accomplishments. We ended December of 2022 with 326 locations, after continuing our robust unit addition plan. We launched MoneyBowl™, and it should be in pilot at 27 locations, almost ten percent of our footprint, by the end of this week. These accomplishments were almost unimaginable when we operated only six centers back in 2013, and they are a testament to our world-class team and our relentless pursuit of providing world-class experiences across our growing portfolio of nearly 330 centers and maximizing shareholder value.”

Bowling Center Trailing 13-week Revenue Growth Trend3

[Please see Bowling Center Trailing 13-week Revenue Growth Trend]

About Bowlero Corp.

Bowlero Corp. is the worldwide leader in bowling entertainment. With more than 325 bowling centers across North America, Bowlero Corp. serves nearly 30 million guests each year through a family of brands that includes Bowlero and AMF. Bowlero Corp. is also home to the Professional Bowlers Association, which boasts thousands of members and millions of fans across the globe. For more information on Bowlero Corp., please visit BowleroCorp.com.

Forward Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 that involve risk, assumptions and uncertainties, such as statements of our plans, objectives, expectations, intentions and forecasts. These forward-looking statements are generally identified by the use of forward-looking terminology, including the terms "anticipate," "believe," “confident,” "could," "estimate," "expect," "intend," "may," "plan," “possible,” "potential," "predict," "project," "should," "target," "will," "would" and, in each case, their negative or other various or comparable terminology. These forward-looking statements reflect our views with respect to future events as of the date of this press release and are based on our management’s current expectations, estimates, forecasts, projections, assumptions, beliefs and information. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. All such forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, and could cause future events or results to be materially different from those stated or implied in this press release. It is not possible to predict or identify all such risks. These risks include, but are not limited to: the impact of COVID-19 pandemic and any future outbreaks of contagious diseases on our business; our ability to design and execute our business strategy; changes in consumer preferences and buying patterns; our ability to compete in our markets; the occurrence of unfavorable publicity; risks associated with long-term non-cancellable leases for our centers; our ability to retain key managers; risks associated with our substantial indebtedness and limitations on future sources of liquidity; our ability to carry out our expansion plans; our continued ability to produce content, build infrastructure and market Professional Bowlers Association (“PBA”) events; our ability to successfully defend litigation brought against us; our ability to adequately obtain, maintain, protect and enforce our intellectual property and proprietary rights and claims of intellectual property and proprietary right infringement, misappropriation or other violation by competitors and third parties; failure to hire and retain qualified employees and personnel; the cost and availability of commodities and other products we need to operate our business; cybersecurity breaches, cyber-attacks and other interruptions to our and our third-party service providers’ technological and physical infrastructures; catastrophic events, including war, terrorism and other conflicts; public health issues or natural catastrophes and accidents; changes in the regulatory atmosphere and related private sector initiatives; fluctuations in our operating results; economic conditions, including the impact of increasing interest rates, inflation and recession; and other risks, uncertainties and factors described under the section titled “Risk Factors” in the Company's Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) by the Company on September 15, 2022, as well as other filings that the Company will make, or has made, with the SEC, such as Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this press release and in other filings. We expressly disclaim any obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

1Same-store sales are measured by comparing revenues for centers open for the entire duration of both the current and comparable measurement periods. |

2Our independent registered public accounting firm has not completed its review of our results for our second quarter ended on January 1, 2023. The revenue amounts for this quarter are preliminary estimates of the results of operations that we expect to report for our second quarter ended on January 1, 2023. Our actual results may differ from these estimates due to the completion of our financial closing procedures, final adjustments and other developments that may arise between now and the time the financial results for our second quarter are finalized. |

3Revenue growth is calculated as the growth in Bowling Center Revenue compared to the comparable week during the pre-pandemic 52-week period beginning March 2019 and ending February 2020. Total Bowling Center Revenue (i) excludes media-related revenue and closed bowling centers from both current period and pre-pandemic and prior year periods and (ii) includes new bowling centers that have opened since March 2020. For weeks ending between September 26, 2021 and December 26, 2021, the percentages above are calculated by comparing each week to the comparable week in 2019. For weeks ending between January 2, 2022 and February 27, 2022, the percentages above are calculated by comparing each week to the comparable week in 2020. For weeks ending between March 6, 2022 and January 1, 2023, the percentages above are calculated by comparing each week to the comparable week in 2019. Total Bowling Center Revenue for each date is the 13-week rolling average of weekly Total Bowling Center Revenue. We use the 13-week rolling average because the revenue performance in individual weeks can be positively or negatively impacted by timing shift of holiday/sporting events, holidays moving to weekends, and extreme weather events. Data for all weeks following the close of the quarter ended on October 2, 2022 are preliminary and have not been audited or reviewed and are forward-looking statements based solely on information available to us as of the date of this announcement. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20230109005313/en/

Contacts

For Media:

Bowlero Corp. Public Relations

pr@bowlerocorp.com

For Investors:

Bowlero Corp. Public Relations

IRSupport@BowleroCorp.com

Ashley DeSimone

Ashely.desimone@icrinc.com