Capstone Copper Corp. (“Capstone” or the “Company”) (TSX:CS) today announced production and financial results for the quarter ended March 31, 2022 (Q1 2022) and production and cost guidance for the remainder of 2022. Quarterly consolidated copper production totaled 22,500 tonnes at C1 cash costs1 of $2.31 per payable pound of copper produced. Link HERE for Capstone’s Q1 2022 management’s discussion and analysis (“MD&A”) and financial statements and HERE for the webcast presentation.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220512006071/en/

(Graphic: Business Wire)

“It is with great pleasure that I report the inaugural first quarter’s results of the new Capstone Copper, and I would particularly like to take this opportunity to thank everybody in our organization for their tremendous support as we integrate our business. Despite inflationary pressures facing the entire mining industry, Capstone delivered strong financial results, highlighted by adjusted EBITDA of $123 million that included only a nine-day contribution from our Mantoverde and Mantos Blancos mines since the combination took effect on March 23, 2022,” said John MacKenzie, CEO. “This is a transformational year for Capstone as we ramp-up our new Mantos Blancos mill, construct the Mantoverde sulphides project and deliver a District Integration Plan for Santo Domingo with Mantoverde. These are critical steps toward achieving over 40% copper production growth by 2024 and a further 45% when Santo Domingo goes into production. In the context of the current macro-environment we have critically evaluated our business to provide guidance for the remaining 9-months of 2022, and expect to produce 136,000 to 150,000 tonnes of copper at C1 cash costs of $2.55 to $2.70 per pound.”

Q1 2022 OPERATIONAL AND FINANCIAL HIGHLIGHTS

- The Transaction to combine with Mantos to create Capstone Copper Corp. was completed on March 23, 2022. The Transaction establishes Capstone Copper as a premier copper producer with a diversified portfolio of high-quality, long-life operating assets focused in the Americas with an extensive pipeline of near-term fully-permitted organic growth opportunities.

- Net income of $35.1 million, or $0.08 per share. Adjusted net income1 of $61.1 million or $0.14 per share for Q1 2022, with the main reconciling item for Q1 2022 being $19.9 million of transaction and integration costs related to the Transaction. Operating results include nine days of earnings from operations of the Mantos Blancos and Mantoverde mines.

- Adjusted EBITDA1 of $123.4 million compared to $118.7 million in Q1 2021.

- Operating cash flow before changes in working capital1 of $70.4 million in Q1 2022 compared to $245.0 million in Q1 2021, which includes a $150 million precious metal stream deposit. The variance is related to increased operating cash flow of $21.5 million on copper sales and prices offset by transaction costs of $19.9 million and $22.9 million higher annual tax payment in Mexico related to 2021 income.

- The Company is in a net cash position of $64.9 million and total available liquidity1 is $638.1 million. The balance sheet was further expanded with the acquisition of cash and debt on the Transaction. The net cash position of $64.9 million as at March 31, 2022 consists of cash and short term investments of $413.1 million netted against long term debt of $348.2 million.

- Consolidated copper production of 22,500 tonnes at C1 cash costs1 of $2.31/lb of copper produced for Q1 2022 which consisted of 14,400 tonnes at Pinto Valley, 5,900 tonnes at Cozamin and the balance for the Chilean mines for the nine-day stub period. Mantos Blancos and Mantoverde contributed an additional $0.14 per pound to the consolidated C1 cash costs1; excluding the stub period reporting, Capstone Copper's consolidated C1 cash costs1 were $2.17 per pound.

- Mantos Blancos Concentrator Debottlenecking Project ("MB-CDP") ramp-up to 20,000 tonnes per day (“tpd”) is progressing well. Throughput averaged over 18,000 tpd during the last week of April. The focus is on ramping up to name plate capacity, optimization, and achieving targeted recoveries in Q3 2022.

- Mantoverde Development Project ("MVDP") construction is progressing well with earthworks mostly completed and major construction commenced in late March 2022. Numerous marine cargo shipments of major plant equipment are now en-route to site. The total project capital budget is now estimated to be $825 million compared to previously $787 million. The increase relates to diesel prices impacting pre-stripping costs by $23 million plus additional contingency of $15 million. The majority of the capital costs are fixed due to the nature of the lump sum turn-key contract with Ausenco of $525 million and the purchase of major mining equipment was price fixed prior to the current inflationary environment for approximately $140 million.

- The Mantoverde-Santo Domingo District Integration Plan will outline the approach Capstone Copper is taking to maximize value creation (including synergies) across the district. The integration plan will outline the optimized flowsheet to create a world-class district which is targeted for early Q4 2022 ahead of the Chile analyst tour and Investor Day during the week of November 14th. The Company expects the integration plan to contribute to the feasibility studies for Santo Domingo (H1 2023), Mantoverde Phase II (H2 2023) and Mantoverde & Santo Domingo cobalt and oxides (H2 2023).

- Financial Flexibility enhanced with amendment of Revolving Credit Facility ("RCF") to $500 million plus $100 million accordion. Subsequent to quarter end, the RCF was amended and will become available after all the security is in place and other customary conditions are met, which is expected to occur before July 2022.

Mantos and Capstone Mining Transaction

On November 30, 2021, Capstone Mining announced it had entered into a definitive agreement (the "Agreement") with Mantos to combine, pursuant to a plan of arrangement.

The Transaction was completed on March 23, 2022 and the combined company was renamed Capstone Copper Corp. Capstone Copper is headquartered in Vancouver, B.C. and listed on the TSX. Pursuant to the Agreement, each Capstone Mining shareholder received one newly issued Capstone Copper share per Capstone Mining share (the "Exchange Ratio") and the existing Mantos shareholders maintained their Capstone Copper shares. At completion of the Transaction, former Capstone Mining and Mantos shareholders collectively owned approximately 60.75% and 39.25% of Capstone Copper, respectively, on a fully-diluted basis. Refer to the business combination note in the condensed interim consolidated financial statements.

Following completion of the Transaction, Capstone Copper operates four mines, including two mines run by Mantos Copper in Chile since 2015: The Mantos Blancos (100% owned) open pit copper mine is located forty-five kilometers northeast of Antofagasta in the Antofagasta Region and produces copper concentrate and copper cathodes. The Mantoverde (70% owned) open pit mine is located fifty kilometers southeast of Chanaral, in the region of Atacama and produces copper cathodes. Mantoverde is the site of the MVDP sulphide expansion, currently in construction.

The new Capstone Copper has a broad portfolio of (largely permitted) brownfield projects located at our sites that facilitate disciplined capital allocation and a phased approach to growth.

Operational Overview |

||

Refer to Capstone’s Q1 2022 MD&A and Financial Statements for detailed operating results. |

||

|

Q1 2022 |

Q1 2021 |

Copper production (000s tonnes) |

|

|

Pinto Valley |

14.4 |

16.5 |

Cozamin |

5.9 |

5.2 |

Total2 |

22.5 |

21.7 |

Copper sales2 |

|

|

Copper sold (000s tonnes) |

25.5 |

22.3 |

Realized copper price ($/pound) |

4.78 |

4.12 |

C1 cash costs1 ($/pound) produced |

|

|

Pinto Valley |

2.60 |

1.94 |

Cozamin |

1.12 |

0.91 |

Consolidated2 |

2.31 |

1.70 |

1 |

These are alternative performance measures. Refer to the section entitled “Alternative Performance Measures” in the Cautionary Notes |

|

2 |

Includes nine days of Mantos Mines production, sales and costs. |

Consolidated

Q1 2022 consolidated production of 22,500 tonnes of copper is higher than the 21,700 tonnes in Q1 2021 and primarily relates to addition of nine-day production at the Mantos Blancos and Mantoverde mines.

The main driver for the $0.61/lb increase in C1 cash costs1 in Q1 2022, compared to Q1 2021, is higher unit costs at Pinto Valley plus the inclusion of the Mantos Blancos and Mantoverde mines which impacted consolidated C1 cash costs1 by $0.14/lb. Prior to the inclusion of the Mantos Blancos and Mantoverde results for the stub period, the Capstone Mining results would have been $2.17/lb. C1 cash costs1 increased from $1.70 to $2.17/lb due to $0.12/lb on lower production of 1,400 tonnes, $0.09/lb due to higher TCRC's, $0.05 due to lower by-product revenue and stockpile drawdown and the balance of $0.20/lb due to inflationary pressures.

Pinto Valley Mine

Q1 2022 production decreased by 13% compared to the same period last year due to 11% lower head grades for Q1 2022 (0.32% versus 0.36% in Q1 2021) due to mine sequencing and lower recoveries (82.3% versus 85.7% in Q1 2021) offset partially by higher mill throughput (58,412 tpd in Q1 2022 versus 58,095 tpd in Q1 2021).

An increase in Q1 2022 C1 cash costs1 of $0.66/lb was primarily attributable to lower production ($0.30/lb), higher operating costs related to an inflation price increase on diesel, power, grinding media; increased spend on rental equipment, mining equipment tools, contractors and dust suppression ($0.22/lb) and an increase in treatment and refining rates in 2022 ($0.09/lb).

PV4 Study

During the quarter, work progressed on the pre-feasibility study ("PFS") for PV4 which aims to maximize the conversion of approximately one billion tonnes of mineral resources to mineral reserves, significantly extending Pinto Valley’s mine life and increasing the mine’s copper production profile. The PV4 study is focused on modest expansion of existing mill throughput to range of 65,000 to 70,000 tpd with an extended life of mine. The PV4 study is expected to be released in H1 2023. The application of the following new technologies and innovation is being considered:

- Expansion of the use of Jetti catalytic leach technology which has the potential to increase mill cut-off-grades and increase tonnage available for leaching. Column leach and test heap work are ongoing and the results will be included in the PV4 Study. An expanded dump leach strategy would translate to higher grades sent to the mill for processing and increased copper cathode production by expanding dump leach tonnage.

- Pyrite Agglomeration, with strong positive environmental, social and governance ("ESG") implications as it would divert acid-generating minerals including pyrite and chalcopyrite from tailings to the dump leach operation. Additional copper recovery and lower costs via production of sulphuric acid would be key economic drivers for this project.

Cozamin Mine

Q1 2022 production increased by 15% compared to the same period last year mainly due to higher mill throughput (3,704 tpd versus 3,345 tpd in Q1 2021) and head grades (1.84% versus 1.79% in Q1 2021). Recoveries were comparable quarter over quarter.

C1 cash costs1 in Q1 2022 were higher than the same period last year due to planned higher mechanical part spend in order to increase underground equipment availability and reliability and some inflationary pressures on steel and explosives ($0.13/lb), lower zinc by-product credits due to planned lower zinc production ($0.06/lb) and higher treatment and refining costs ($0.03/lb), partially offset by higher copper production (-$0.06/lb).

Mantoverde Development Project

Construction of the MVDP located at the existing Mantoverde (oxide) operation continues to progress well. The MVDP is expected to enable us to process 235 million tonnes of copper sulphide reserves over a 20-year expected mine life, in addition to our existing oxide reserves. The MVDP involves the addition of a sulphide concentrator (12.3 million tonnes per year) and tailings storage facility, and the expansion of our existing desalination plant.

We expect completion of the MVDP to increase production from approximately 49,000 tonnes of copper (cathodes only) in 2021 to approximately 120,000 tonnes of copper (copper concentrate and cathodes) post project completion in 2024. In parallel, C1 cash costs1 are expected to decrease from $2.79/lb in 2021 to under $1.70/lb to $1.80/lb in 2024. The decline in expected costs will be driven by the mine's transition to becoming a primary producer of copper concentrate. The mine will also benefit from the production of approximately 31,000 ounces of gold per year that will generate by-product credits. Upon completion of MVDP, approximately 75% of Mantoverde's production will come from the lower-cost sulphide copper.

MVDP is being progressed under a lump-sum turn-key engineering, procurement and construction (EPC) arrangement with Ausenco Limited, a multi-national engineering, procurement and construction management company, with broad experience in the design and construction of copper concentrator projects of this scale in the international market. The execution plan includes a Capstone Copper owner’s team working with the contractors during the execution phase.

As of April 30, 2022, the MVDP had achieved overall progress of 49% and construction progress of 14% and the schedule remains intact. The target for completion of construction remains late 2023. All contractors have been mobilized to site and all required permits are in place. Work completed in Q1 includes:

- Bulk earthworks for the Primary Crusher and Grinding Area Platforms

- Bypass water pipeline with the internal lining, trench excavation and pipeline installation in the trench

- Drilling for all pumping and monitoring wells at the tailings storage facility ("TSF") allowing for the commencement of the major TSF construction activities

- 13 Komatsu 830E haulage trucks have been received according to plan and are operating at mine site

- Construction camp complete and operational

The costs to date of the major equipment purchases, pre-stripping, owner’s costs and the EPC lump sum turnkey are aligned with the budget. Close ongoing monitoring is being done to identify potential impacts due to an environment marked by COVID-19, stressed logistics chains and inflation in costs.

The total project capital budget is now estimated to be $825 million and spend to date totals $338 million. The EPC contract total budget is approximately $525 million of which $220 million has been spent to date. The total project costs have increased slightly from $787 million to $825 million due to diesel price impact on pre-stripping costs of $23 million plus additional contingency of $15 million. The majority of the capital costs are fixed due to the nature of the lump sum turn-key contract with Ausenco of $525 million or 67% of the original capital. Major mining equipment was price fixed prior to the current inflationary environment for approximately $140 million or 18% of the total original capital.

Mantos Blancos Concentrator Debottlenecking Project

The purpose of the MB-CDP is to increase throughput capacity at the sulphide concentrator plant from 11,000 tpd to 20,000 tpd (or from 4.2 million tonnes per year to 7.3 million tonnes per year).

Construction of the MB-CDP was completed, and includes the modification of certain processes and the installation of new crushers, one new ball mill, four new rougher flotation cells and a new thickener. At quarter-end, the project commissioning is complete and the ramp-up of the project continued to progress. Throughput of the plant averaged over 18,000 tpd during the last week of April, representing over 90% of nameplate capacity.

Looking forward, the focus becomes sustaining throughput at targeted levels, and optimization of the circuit to achieve targeted recoveries in Q3 2022.

Upon completion of the MB-CDP, we expect Mantos Blancos production to increase from approximately 45,000 tonnes of copper in 2021 to approximately 53,000 tonnes of copper in 2023. In parallel, C1 cash costs1 are anticipated to decrease from current guidance of $2.81/lb in 2021 to ~$2.00/lb in 2023 as an even greater share of Mantos Blancos' production is sourced from the lower cost copper concentrate production.

Mantos Blancos Phase II

Mantos Blancos is currently analyzing the potential to increase the throughput of the Mantos Blancos sulphide concentrator plant from 7.3 million tonnes per year to 10.0 million tonnes per year using the existing (currently unused/underutilized) ball mills and process equipment. As part of the Mantos Blancos Phase II Project we are also evaluating the potential to extend the life of copper cathode production. A pre-feasibility study on the Mantos Blancos Phase II Project will be completed in Q2 2022 which will be incorporated into a Feasibility Study (“FS”) in Q4 2022.

Santo Domingo

Upon closing of the Transaction, the Santo Domingo team has been integrated into the larger Capstone Copper team in Chile. The integrated project team is focused on identifying and evaluating the optimal integrated development plan for the Mantoverde-Santo Domingo district. The Mantoverde operation is located approximately ~30km southwest of the Santo Domingo project. The Company expects the integrated district plan to study alternatives and identify the best path forward to develop the copper (sulphides and oxides), gold, iron, and cobalt across both properties. An integrated development approach is likely to maximize potential synergies associated with the proximity of Santo Domingo to the existing Mantoverde operation, existing infrastructure (including a desalination plant, roads, power, and pipelines), and integration of other assets, such as the Santo Domingo port contract with Puerto Abierto S.A.

The potential synergies the Company expects to be maximized through an optimal integrated district development plan include the following:

- Infrastructure synergies (including desalination plant, power, pipelines, port)

- Integrated mine and process approach

- Construction and supply chain synergies

- Cobalt and sulphuric acid enhancements

- Enabling revenue lines for Mantoverde cobalt and magnetite

- Using excess solvent extraction and electrowinning ("Sx-Ew") capacity

The revenue enhancing opportunities include using excess electrowinning capacity at Mantoverde to potentially process both Santo Domingo oxide material and additional low-grade sulphides enabled by Jetti catalytic leach technologies which Capstone Copper has been first to implement at Pinto Valley. In addition, the potential cobalt plant may unlock cobalt production from Mantoverde while producing a by-product of sulphuric acid which can then be used internally to further significantly lower operating costs on the leaching process at Mantoverde.

Cobalt feasibility study update

The cobalt recovery process consists of a concentration step, an oxidation step, and a cobalt recovery step. The concentration step considers a conventional froth flotation circuit treating copper flotation tails to produce a cobaltiferous pyrite concentrate. For the base case, the pyrite concentrate, which contains between 0.5% and 0.7% Co, is oxidized in a fluidized bed roaster to produce a cobalt calcine and a concentrated sulphuric acid by-product. The calcine is then subjected to various precipitation, leaching, solvent extraction and crystallization steps to produce battery grade cobalt sulphate heptahydrate. At an expected 10.4 million pounds of cobalt production per year, this would be one of the largest and lowest cost cobalt producers in the world. Additional benefits of this project include the generation of carbon-free energy from waste heat emitted by the roaster, and the production of by-product sulphuric acid which can be used for heap or dump leaching to produce low-cost copper cathodes at Mantoverde and elsewhere in the district.

The prefeasibility study is also evaluating different flow sheet alternatives for Cobalt production in consideration of potential synergies between Mantoverde and Santo Domingo. Initial trade-off studies have confirmed the potential of acid pressure oxidation (POX) as a potentially lower cost alternative to roasting. The Company is developing both options in parallel to gain maturity and provide a robust recommendation on the path forward in Q4 2022.

Along the same timeline (Q4 2022) we intend to release an updated cobalt resource for Santo Domingo, as well as an initial cobalt resource for Mantoverde.

Oxide drilling program

Santo Domingo contains oxide ore that could be processed with available capacity of the electrowinning plant at Mantoverde for cathode production. During Q1 2022, the Company developed a preliminary business case and started an exploratory metallurgical program scheduled to be completed in Q3 2022 which will improve the understanding of copper solubility and acid consumption. Subject to positive metallurgical results the company is planning to complete a subsequent oxide drilling program starting in late 2022 to delineate an oxide mineral resource. Ultimately, this work will feed into a further updated Santo Domingo FS in late-2023.

Corporate Exploration Update

Cozamin exploration: The focus during Q1 2022 was on testing the Mala Noche Footwall Zone and Mala Noche Main Vein West Target with one surface rig and one underground rig from the recently completed west exploration crosscut station.

Copper Cities, Arizona: On January 20, 2022, Capstone Mining announced that it had entered into an 18-month access agreement with BHP Copper Inc. ("BHP") to conduct drill and metallurgical test-work at BHP's Copper Cities project ("Copper Cities"), located ~10 km east of the Pinto Valley Mine. In 2022, Capstone Copper plans to spend $6.7 million in a two-phase drill program aimed at twinning historical drill holes, and to select a portion of these for metallurgical testing. Drilling with two surface rigs is on-going.

Planalto, Brazil: Step-out drilling at the Planalto Iron Ore-Copper-Gold prospect in Brazil, under an earn-in agreement with Lara Exploration Ltd., commenced in Q4 2021 and continued in Q1 2022. Lara is conducting the work and will report results when appropriate.

2022 Capstone Copper Catalysts

The following chart highlights key catalysts and deliverables for Capstone Copper. During the planned analyst tour in November, the Company plans to release the following key items:

- MV-SD District Integration plan

- Cobalt - Initial Mantoverde resource and updated Santo Domingo resource

- Cobalt flow sheet recommendation

- Mantos Blancos Phase II feasibility study

CAPSTONE COPPER NINE-MONTH GUIDANCE (APRIL-DECEMBER 2022)

Production and Cash Cost Guidance

During the nine months from April 1, 2022 to December 31, 2022, Capstone Copper expects to produce between 136,000 and 150,00 tonnes of copper at C1 cash costs1 of between $2.55 and $2.70 per pound payable copper produced.

|

April 1 – December 31, 2022

|

C1 Cash Costs1

|

Sulphides Business |

|

|

Pinto Valley |

41.0 – 45.0 |

$2.45 – $2.60 |

Cozamin |

18.0 – 20.0 |

$1.10 – $1.25 |

Mantos Blancos |

32.0 – 35.0 |

$1.95 – $2.10 |

Total Sulphides |

91.0 – 100.0 |

$2.00 – $2.15 |

|

|

|

Cathode Business |

|

|

Mantos Blancos |

10.0 – 11.0 |

$3.45 – $3.60 |

Mantoverde* |

35.0 – 39.0 |

$3.60 – $3.80 |

Total Cathodes |

45.0 – 50.0 |

$3.55 – $3.75 |

|

|

|

Consolidated Cu Production |

136.0 – 150.0 |

$2.55 – $2.70 |

*Mantoverde production shown on a 100% basis

The updated C1 cash costs1 guidance reflects the current inflationary environment and current spot pricing in the sulphuric acid market for the Chilean mines. In 2022, we have assumed sulphuric acid prices of $280/tonne which compares to $180/tonne in the Mantoverde and Mantos Blancos technical reports, which increases C1 cash costs1 by approximately ~$0.22/lb on a consolidated basis. The purchase price for approximately 65% of required sulphuric acid for the balance of 2022 has been fixed with suppliers.

For the nine month period April 1, 2022 to December 31, 2022, expected sulphuric acid consumption at Mantoverde and Mantos Blancos is ~540,000 tonnes and ~140,000 tonnes respectively (680,000 tonnes total). The impact of a ~$100/tonne price increase is $68 million dollars or $0.22/lb consolidated. The impact to C1 cash costs1 at Mantoverde are $0.70/lb and at Mantos Blancos either $0.15/lb overall or $0.66/lb on cathode C1 cash costs1, respectively. In addition, Mantoverde and Mantos Blancos are experiencing general cost inflation, most notably increased diesel prices.

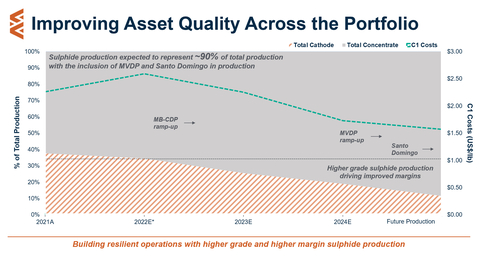

Although sulphuric acid is a significant input cost to our oxide (cathode) business unit, over time, sulphide production is expected to increase with the ramp up of MB-CDP and the completion of the sulphide concentrator at Mantoverde making consolidated C1 cash costs1 less exposed to changes in acid prices in the future. Expected 2022 cathode production is ~33% of total copper production. Cathode production is expected to be only ~18% of total copper production in 2024 and is expected to further decline to under 6% with future production contribution from Santo Domingo.

Pinto Valley C1 cash costs1 are expected to be higher than guidance in January 2022, primarily due to general observed cost inflation.

Planned maintenance at Pinto Valley and the ramp up of MB-CDP in the second quarter are expected to result in lower production in Q2 2022 compared to following quarters with corresponding drop in C1 cash costs1 post Q2 2022.

Capital and Exploration Guidance

Our Capital and Exploration guidance is as follows:

|

Pinto

|

Mantos

|

Manto-

|

Cozamin |

Santo

|

Total |

Capital Expenditure ($ millions) |

|

|

|

|

|

|

Sustaining Capital1 |

65 |

20 |

20 |

25 |

- |

130 |

Capitalized Stripping |

5 |

55 |

65 |

- |

- |

125 |

Expansionary Capital1 |

15 |

20 |

265 |

25 |

40 |

365 |

Total Capital Expenditure |

85 |

95 |

350 |

50 |

40 |

620 |

Exploration ($ millions) |

|

|

|

|

|

|

Brownfield (Cozamin + Chile) |

- |

1 |

1 |

2 |

2 |

6 |

Greenfield (Brazil + Chile) |

- |

- |

- |

- |

- |

2 |

Greenfield (Copper Cities, AZ) |

7 | - |

- |

- |

- |

7 |

Total Exploration |

7 | 1 |

1 |

2 |

2 |

15 |

FINANCIAL OVERVIEW

Please refer to Capstone’s Q1 2022 MD&A and Financial Statements for detailed financial results.

($ millions, except per share data) |

Q1 2022 |

Q1 2021 |

|

Revenue |

268.1 |

|

204.1 |

|

|

|

|

Net income |

35.1 |

|

127.0 |

|

|

|

|

Net income attributable to shareholders |

34.0 |

|

101.0 |

Net income attributable to shareholders per common share – basic ($) |

0.08 |

|

0.25 |

Net income attributable to shareholders per common share – diluted ($) |

0.08 |

|

0.24 |

|

|

|

|

Adjusted net income1 |

61.1 |

|

64.4 |

Adjusted net income attributable to shareholders1 |

61.1 |

|

64.9 |

Adjusted net income attributable to shareholders per common share - basic |

0.14 |

|

0.16 |

Adjusted net income attributable to shareholders per common share - diluted |

0.14 |

|

0.16 |

|

|

|

|

Adjusted EBITDA1 |

123.4 |

|

118.7 |

|

|

|

|

Cash flow from operating activities2 |

(7.8 |

) |

220.3 |

Cash flow (used in) from operating activities per common share1 – basic ($) |

(0.02 |

) |

0.55 |

Operating cash flow before changes in working capital1,2 |

70.4 |

|

245.0 |

Operating cash flow before changes in working capital per common share1 - basic ($) |

0.16 |

|

0.61 |

($millions) |

March 31, 2022 |

December 31, 2021 |

Total assets |

5,264.8 |

1,728.0 |

Long term debt (excluding financing fees) |

348.2 |

- |

Total non-current financial liabilities |

387.1 |

38.4 |

Total non-current liabilities |

1,554.1 |

481.3 |

Cash and cash equivalents and short-term investments |

413.1 |

264.4 |

Net cash1 |

64.9 |

264.4 |

CONFERENCE CALL AND WEBCAST DETAILS

Capstone will host a conference call and webcast on Friday, May 13, 2022 at 08:00 am PT/11:00 am ET.

Link to the audio webcast: https://produceredition.webcasts.com/starthere.jsp?ei=1540858&tp_key=c09a5f7a12

Dial-in numbers for the audio-only portion of the conference call are below. Due to an increase in call volume, please dial-in at least five minutes prior to the call to ensure placement into the conference line on time.

Toronto: (+1) 416-764-8650

Vancouver: (+1) 778-383-7413

North America toll free: 888-664-6383

Confirmation #51309954

A replay of the conference call will be available until May 20, 2022. Dial-in numbers for Toronto: (+1) 416‑764‑8677 and North American toll free: 888-390-0541. The replay code is 309954#. Following the replay, an audio file will be available on Capstone’s website at: https://capstonemining.com/investors/events-and-presentations/default.aspx.

This release is not suitable on a standalone basis for readers unfamiliar with Capstone and should be read in conjunction with the Company’s MD&A and Financial Statements for the three months ended March 31, 2022, which are available on Capstone’s website and on SEDAR, all of which have been reviewed and approved by Capstone's Board of Directors.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document may contain “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). These forward-looking statements are made as of the date of this document and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation.

Forward-looking statements relate to future events or future performance and reflect our expectations or beliefs regarding future events and the impacts of the ongoing and evolving COVID-19 pandemic. Forward-looking statements include, but are not limited to, statements with respect to the estimation of Mineral Resources and Mineral Reserves, the success of the underground paste backfill and tailings filtration projects at Cozamin, the timing and cost of the construction of the paste backfill and dry stack tailings plant at Cozamin, the success and timing of the Mantos Blancos Concentrator Debottlenecking Project, the timing and cost of the Mantoverde Development Project, the timing and results of the PV4 study, timing and success of the Jetti Technology, the successful execution of a port services agreement with Puerto Abierto S.A., the expected reduction in capital requirements for the Santo Domingo project, the timing and success of the Cobalt Study for Santo Domingo, the timing and results of the integrated plan for Mantoverde - Santo Domingo, the realization of Mineral Reserve estimates, the timing and amount of estimated future production, the costs of production and capital expenditures and reclamation, the budgets for exploration at Cozamin, Santo Domingo, Pinto Valley, Mantos Blancos, Mantoverde and other exploration projects, the timing and success of the Copper Cities project, the success of our mining operations, the continuing success of mineral exploration, the estimations for potential quantities and grade of inferred resources and exploration targets, our ability to fund future exploration activities, our ability to finance the Santo Domingo project and other current or future projects and expansions, environmental risks, unanticipated reclamation expenses and title disputes, the success of the synergies and catalysts related to the Transaction, and the anticipated future production, costs of production including the cost of sulphuric acid and oil and other fuel, capital expenditures and reclamation of the Company's operations and development projects. The potential effects of the COVID-19 pandemic on our business and operations are unknown at this time, including Capstone Copper’s ability to manage challenges and restrictions arising from COVID-19 in the communities in which Capstone Copper operates and our ability to continue to safely operate and to safely return our business to normal operations. The impact of COVID-19 to Capstone Copper is dependent on a number of factors outside of our control and knowledge, including the effectiveness of the measures taken by public health and governmental authorities to combat the spread of the disease, global economic uncertainties and outlook due to the disease, supply chain delays resulting in lack of availability of supplies, goods and equipment, and evolving restrictions relating to mining activities and to travel in certain jurisdictions in which we operate.

In certain cases, forward-looking statements can be identified by the use of words such as “anticipates”, “approximately”, “believes”, “budget”, “estimates”, expects”, “forecasts”, “guidance”, intends”, “plans”, “scheduled”, “target”, or variations of such words and phrases, or statements that certain actions, events or results “be achieved”, “could”, “may”, “might”, “occur”, “should”, “will be taken” or “would” or the negative of these terms or comparable terminology. In this document certain forward-looking statements are identified by words including “anticipated”, “expected”, “guidance” and “plan”. By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, amongst others, risks related to inherent hazards associated with mining operations and closure of mining projects, future prices of copper and other metals, compliance with financial covenants, surety bonding, our ability to raise capital, Capstone Copper’s ability to acquire properties for growth, counterparty risks associated with sales of our metals, use of financial derivative instruments and associated counterparty risks, foreign currency exchange rate fluctuations, market access restrictions or tariffs, changes in general economic conditions, availability and quality of water, accuracy of Mineral Resource and Mineral Reserve estimates, operating in foreign jurisdictions with risk of changes to governmental regulation, compliance with governmental regulations, compliance with environmental laws and regulations, reliance on approvals, licences and permits from governmental authorities and potential legal challenges to permit applications, contractual risks including but not limited to, our ability to meet the completion test requirements under the Cozamin Silver Stream Agreement with Wheaton Precious Metals Corp. ("Wheaton"), our ability to meet certain closing conditions under the Santo Domingo Gold Stream Agreement with Wheaton, acting as Indemnitor for Minto Metals Corp.’s surety bond obligations post divestiture, impact of climate change and changes to climatic conditions at our operations and projects, changes in regulatory requirements and policy related to climate change and greenhouse gas ("GHG") emissions, land reclamation and mine closure obligations, aboriginal title claims and rights to consultation and accommodation, risks relating to widespread epidemics or pandemic outbreak including the COVID-19 pandemic; the impact of COVID-19 on our workforce, risks related to construction activities at our operations and development projects, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of Capstone Copper relating to the unknown duration and impact of the COVID-19 pandemic, impacts of geopolitical events and the effects of global supply chain disruptions, uncertainties and risks related to the potential development of the Santo Domingo project, risks related to the Mantos Blancos Concentrator Debottlenecking Project and the Mantoverde Development Project, increased operating and capital costs, increased cost of reclamation, challenges to title to our mineral properties, increased taxes in jurisdictions the Company operates or is subject to tax, changes in tax regimes we are subject to and any changes in law or interpretation of law may be difficult to react to in an efficient manner, maintaining ongoing social licence to operate, seismicity and its effects on our operations and communities in which we operate, dependence on key management personnel, potential conflicts of interest involving our directors and officers, corruption and bribery, limitations inherent in our insurance coverage, labour relations, increasing input costs such as those related to sulphuric acid, electricity, fuel and supplies, increasing inflation rates, competition in the mining industry including but not limited to competition for skilled labour, risks associated with joint venture partners and non-controlling shareholders or associates, our ability to integrate new acquisitions and new technology into our operations, cybersecurity threats, legal proceedings, the volatility of the price of the Common Shares, the uncertainty of maintaining a liquid trading market for the Common Shares, risks related to dilution to existing shareholders if stock options or other convertible securities are exercised, the history of Capstone Copper with respect to not paying dividends and anticipation of not paying dividends in the foreseeable future and sales of Common Shares by existing shareholders can reduce trading prices, and other risks of the mining industry as well as those factors detailed from time to time in the Company’s interim and annual financial statements and MD&A of those statements and Annual Information Form, all of which are filed and available for review under the Company’s profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause our actual results, performance or achievements to differ materially from those described in our forward-looking statements, there may be other factors that cause our results, performance or achievements not to be as anticipated, estimated or intended. There can be no assurance that our forward-looking statements will prove to be accurate, as our actual results, performance or achievements could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on our forward-looking statements.

COMPLIANCE WITH NI 43-101

Unless otherwise indicated, Capstone has prepared the technical information in this document (“Technical Information”) based on information contained in the technical reports, Annual Information Form and news releases (collectively the “Disclosure Documents”) available under Capstone Mining Corp.’s company profile on SEDAR at www.sedar.com. Each Disclosure Document was prepared by or under the supervision of a qualified person (a “Qualified Person”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”). Readers are encouraged to review the full text of the Disclosure Documents which qualifies the Technical Information. Readers are advised that Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The Disclosure Documents are each intended to be read as a whole, and sections should not be read or relied upon out of context. The Technical Information is subject to the assumptions and qualifications contained in the Disclosure Documents.

Disclosure Documents include the National Instrument 43-101 compliant technical reports titled "NI 43-101 Technical Report on the Cozamin Mine, Zacatecas, Mexico" effective October 23, 2020, “NI 43-101 Technical Report on the Pinto Valley Mine, Arizona, USA” effective March 31, 2021 and “Santo Domingo Project, Region III, Chile, NI 43-101 Technical Report” effective February 19, 2020.

The disclosure of Scientific and Technical Information in this document was reviewed and approved by Brad Mercer, P. Geo., Senior Vice President Exploration and Strategic Projects (technical information related to mineral exploration activities and to Mineral Resources at Cozamin), Clay Craig, P.Eng, Manager, Mining & Evaluations (technical information related to Mineral Reserves and Mineral Resources at Pinto Valley) and Tucker Jensen, Superintendent Mine Operations, P.Eng (technical information related to Mineral Reserves at Cozamin), Carlos Guzmán, RM CMC, FAusIMM, Principal, Project Director, NCL, Gustavo Tapia, RM CMC, Metallurgical and Process Consultant, GT Metallurgy, and Ronald Turner, MAusIMM CP(Geo), Golder Associates (technical information related to Mineral Reserves and Mineral Resources at Mantos Blancos and Mantoverde), and Cashel Meagher, P.Geo., President and COO (technical information related to project updates at Santo Domingo) all Qualified Persons under NI 43-101.

Alternative Performance Measures

Alternative performance measures are furnished to provide additional information. These non-GAAP performance measures are included in this MD&A because these statistics are key performance measures that management uses to monitor performance, to assess how the Company is performing, and to plan and assess the overall effectiveness and efficiency of mining operations. These performance measures do not have a standard meaning within IFRS and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

Some of these alternative performance measures are presented in Highlights and discussed further in other sections of the MD&A. These measures provide meaningful supplemental information regarding operating results because they exclude certain significant items that are not considered indicative of future financial trends either by nature or amount. As a result, these items are excluded for management assessment of operational performance and preparation of annual budgets. These significant items may include, but are not limited to, restructuring and asset impairment charges, individually significant gains and losses from sales of assets, share based compensation, unrealized gains or losses, and certain items outside the control of management. These items may not be non-recurring. However, excluding these items from GAAP or Non-GAAP results allows for a consistent understanding of the Company's consolidated financial performance when performing a multi-period assessment including assessing the likelihood of future results. Accordingly, these Non-GAAP financial measures may provide insight to investors and other external users of the Company's consolidated financial information.

C1 Cash Costs Per Payable Pound of Copper Produced

C1 cash costs per payable pound of copper produced is a measure reflective of operating costs per unit. C1 cash costs is calculated as cash production costs of metal produced net of by-product credits and is a key performance measure that management uses to monitor performance. Management uses this measure to assess how well the Company’s producing mines are performing and to assess overall efficiency and effectiveness of the mining operations and assumes that realized by-product prices are consistent with those prevailing during the reporting period.

All-in Sustaining Costs Per Payable Pound of Copper Produced

All-in sustaining costs per payable pound of copper produced is an extension of the C1 cash costs measure discussed above and is also a key performance measure that management uses to monitor performance. Management uses this measure to analyze margins achieved on existing assets while sustaining and maintaining production at current levels. Consolidated All-in sustaining costs includes Corporate general and administrative costs.

Net debt / Net cash

Net debt / Net cash is a performance measure used by the Company to assess its financial position and is composed of Long-term debt (excluding deferred financing costs), Cash and cash equivalents and Short-term investments.

Available Liquidity

Available liquidity is a performance measure used by the Company to assess its financial position and is composed of RCF credit capacity, Cash and cash equivalents and Short-term investments. Available liquidity excludes undrawn portions of committed funding arrangements at the mine or project level as these amounts can only be drawn on a periodic basis in line with the contractual arrangements and are for use on development project capital. Because of these limitations on availability and flexibility, we do not include these undrawn amounts in "Available liquidity". For clarity, Available liquidity does not include undrawn amounts on the $520 million Mantoverde DP facility, the Mantoverde $60 million cost overrun facility from MMC, nor the $260 million undrawn portion of the Gold stream from Wheaton related to the Santo Domingo project.

Operating Cash Flow before Changes in Working Capital per Common Share

Operating Cash Flow before changes in working capital per common share is a performance measure used by the Company to assess its ability to generate cash from its operations, while also taking into consideration changes in the number of outstanding shares of the Company.

Adjusted Net Income

Adjusted net income is net income attributable to shareholders as reported, adjusted for certain types of transactions that in our judgment are not indicative of our normal operating activities or do not necessarily occur on a regular basis.

EBITDA

EBITDA is net income attributable to shareholders before net finance expense, tax expense, and depletion and amortization.

Adjusted EBITDA

Adjusted EBITDA is EBITDA before the pre-tax effect of the adjustments made to adjusted net income (above) as well as certain other adjustments required under the RCF agreement in the determination of EBITDA for covenant calculation purposes.

The adjustments made to Adjusted net income and Adjusted EBITDA allow management and readers to analyze our results more clearly and understand the cash generating potential of the Company.

Sustaining Capital

Sustaining capital is expenditures to maintain existing operations and sustain production levels. A reconciliation to GAAP segment MPPE additions is included within the mine site sections of this document.

Expansionary Capital

Expansionary capital is expenditures to increase current or future production capacity, cash flow or earnings potential. A reconciliation to GAAP segment MPPE additions is included within the mine site sections of this document.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220512006071/en/

Contacts

Jerrold Annett, SVP, Strategy and Capital Markets

647-273-7351

jannett@capstonecopper.com

Kettina Cordero, Director Investor Relations & Communications

604-262-9794

kcordero@capstonecopper.com