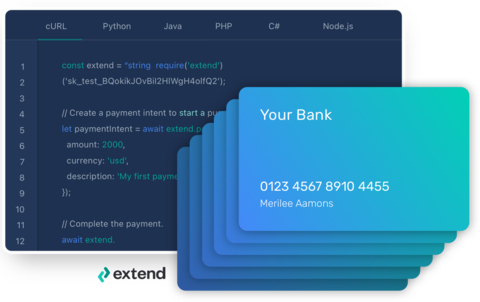

Extend API makes integrated payments more accessible by offering digital card issuance from traditional bank credit lines

Extend, a leading virtual card and spend management platform, today announced the launch of its open API, the most flexible API for making and managing card payments from existing credit card accounts. By integrating virtual card issuance directly into their existing workflows and systems, tech-savvy small and medium businesses (SMBs) can streamline operations and solve payment reconciliation, control, and volume challenges.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221101005412/en/

(Graphic: Business Wire)

SMBs that rely heavily on payments to run their businesses struggle with inadequate solutions that are often manual and sit across multiple platforms, creating inefficiencies and a lack of control. Manual processes can delay payments, sink valuable resources into tedious reconciliation and bookkeeping, and fuel costly fraud or misuse. While businesses want to automate and streamline payment processes, they also want to retain the customer service, rewards programs, trusted relationships, and credit lines they enjoy from their banks. The Extend API provides an onramp to payment innovation that allows SMBs to keep the financial partners they trust and the credit lines they already use. To date, these sorts of powerful APIs have been reserved for a bank's largest customers. With the release of Extend's open API, this power is made available to SMBs of all sizes for the first time.

“SMBs want payment innovation - whatever industry they’re in,” said Trina Dutta, vice president and general manager, B2B payments automation, global commercial services at American Express, an Extend partner. “American Express continues to enhance our API infrastructure, and the way we are working with Extend is one example of that innovation. By integrating virtual card issuance and management directly into their systems, SMBs gain the benefits of virtual cards within existing workflows and records, simplifying commercial transactions.”

The pain of manual payment processes is most intensely felt by SMBs that have put card payments at the core of their operations or issue a high volume of virtual cards - up to tens of thousands or even hundreds of thousands per month. For example:

- Commission-based businesses, like travel booking platforms, rapidly receive and send payments back-to-back. Their ability to quickly and accurately link payments to customer records is mission-critical.

- Others, like wholesalers, rely heavily on their invoicing solutions, and direct integration ensures payments are sent correctly and on time.

- And companies that have invested heavily in their procurement technology, such as home design firms, want to continue using their existing request-and-approval systems as they grow. All can benefit from integrating virtual card issuance and management directly into customer relationship management (CRM), enterprise resource planning (ERP), and other systems.

"With the Extend API, we manage thousands of payments every month to our hotel partners, all in a frictionless, behind-the-scenes process," said Adam Gleiss, vice president of technology at aResTravel, an industry-leading booking engine powering online reservations. "Our customers get a high-touch service, and we get more control over payments, while maximizing the benefit of our card rewards."

The Extend API enables SMBs to tackle three must-solve challenges, all within the core platforms they already use:

- Manage high-volume transactions: Businesses reliant on a large number of individual cards and transactions can instantly create virtual cards for specific purposes at scale, get real-time authentication and clearing, and maximize their card rewards.

- Instantly match transactions: SMBs can integrate payments directly into their existing workflow and systems, thereby linking all card controls and transactions to client and payment records.

- Set strict security controls: Companies can leverage the Extend API to send unique card numbers directly to individuals and merchants, and set strict controls related to dollar amount and time period for use. Such controls eliminate the risk of overcharging and reduce fraud.

“SMBs have rarely had access to open APIs to issue and manage virtual cards for payments, let alone options that work with their current and preferred financial institutions,” said Orna Albus, chief product officer at Extend. “By using the Extend API, businesses across industries can now speed reconciliation, increase control, and manage heavy transaction volume, freeing up valuable time and resources that can be put toward growth, not drudgery.”

To learn more, visit https://www.paywithextend.com/integrated-payments.

About Extend

Extend helps banks innovate like fintechs, so SMBs get a simple, powerful way to streamline spend management while keeping the financial partners they know and trust. Thousands of companies use Extend’s spend management and virtual card distribution platform to empower their teams, improve core financial processes, and manage billions of dollars in transactions. Extend was founded in 2017 by industry veterans of American Express, Capital One, and other Fortune 500 companies. For more information visit paywithextend.com or follow Extend on LinkedIn.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221101005412/en/

Contacts

Bristol Jones — Extend@bevelpr.com