Tesla Model 3 Ranks Highest Overall; Kia Niro EV Ranks Highest among Mass Market Brands

As automakers continue to build excitement with new electric vehicle (EV)1 launches, first-time owners who have made the switch to battery electric vehicles (BEVs) are discovering that it is a positive experience. Satisfaction among owners who are new to BEVs averages 754 (on a 1,000-point scale), which is comparable to 766 among BEV veterans (those who have owned a BEV prior to their current one), according to the J.D. Power 2022 U.S. Electric Vehicle Experience (EVX) Ownership Study,SM released today.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220127005398/en/

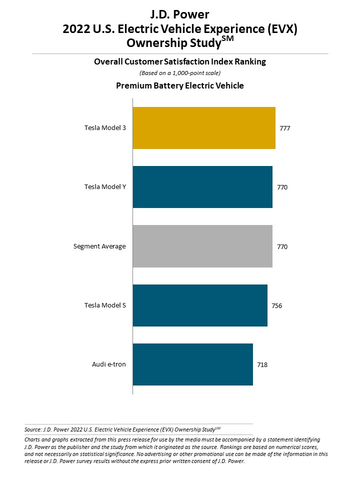

J.D. Power 2022 U.S. Electric Vehicle Experience (EVX) Ownership Study (Graphic: Business Wire)

Additionally, factor satisfaction among first-time BEV owners is higher for service experience (+48), driving enjoyment (+15) and styling (+8) than among BEV veterans. At the same time, while first-time BEV owners have a learning curve to become familiar with driving range, BEV veterans have experience and knowledge with real-world vehicle range that results in higher levels of satisfaction with battery range (+78 points) and accuracy of stated battery range (+49).

The overall EVX ownership index score measures electric vehicle owner satisfaction in both premium and mass market segments. The 2022 study has been expanded to include 10 factors from seven in 2021. Those 10 factors are (in alphabetical order): accuracy of stated battery range; availability of public charging stations; battery range; cost of ownership; driving enjoyment; ease of charging at home; interior and exterior styling (new in 2022); safety and technology features (new); service experience (new); and vehicle quality and reliability.

“Making the initial leap of faith into owning a BEV is proving to be very satisfying,” said Brent Gruber, senior director of global automotive at J.D. Power. “We know from our research that many consumers have concerns during the purchase consideration process with aspects like battery range and vehicle charging. However, once someone has purchased a BEV, they’re pretty much hooked. What will keep first-time owners coming back to buy another BEV is the compelling experience with the safety and technology features, lower service and maintenance costs, and pure driving enjoyment. The new BEVs from traditional brands are helping to attract even more first-time buyers.”

The study finds that 96% of BEV owners whose overall ownership satisfaction exceeds 900 points say they will purchase another BEV in the future. More than half (62%) of these owners say they “definitely will” repurchase from the same brand. However, likelihood to repurchase the same brand lessens considerably as satisfaction declines. Among BEV owners whose overall ownership satisfaction is below 600 points, 78% of first-time owners and 89% of veteran owners indicate they “definitely will” consider purchasing another BEV, but the likelihood to repurchase the same brand drops to 6%.

Following are key findings of the 2022 study:

- Range satisfaction is key purchase reason: As EV batteries and driving ranges continue to improve, veteran BEV owners cite this aspect of ownership as the top purchase reason in both the premium and mass market segments, 86% and 87%, respectively. Further, when owners say BEV range never affects driving habits compared with range regularly affecting driving habits, satisfaction improves 119 points in the premium segment and 107 points in the mass market segment.

- Incentives—when easy to get—improve satisfaction: More than two-thirds (68%) of EV owners received a purchase incentive. Overall satisfaction is higher among owners who say incentives are very easy to get (760) vs. among owners who say incentives are somewhat/very difficult to get (712). Among owners who cite incentives as a key purchase driver, 79% received a federal tax credit/rebate, but only 59% of that group say it was very easy to receive. “Many EV incentives and rebates have to be handled by owners,” Gruber said. “Dealers can facilitate the process for first-time owners by providing necessary links and forms and then walk the customer through the steps for claiming the federal and state tax credits.”

- Quality and reliability vary in premium and mass market segments: While infotainment is the most problematic category for owners of mass market BEVs (26.2 problems experienced per 100 vehicles, or PP100), the leading problems in the premium BEV segment are exterior (14.6 PP100) and squeaks and rattles (13.4 PP100). “Quality and reliability are extremely important factors to which manufacturers will have to pay close attention,” Gruber said. “As the EV market matures, EV owners will compare the build quality to internal combustion engine (ICE) models. Our research finds that, in general, EVs aren’t problematic because of the model type, but problems experienced are often related to technology- and feature-laden models, which present some challenges for minimizing quality issues. There’s essentially more to go wrong.”

Study Rankings

Tesla Model 3 ranks highest overall and highest in the premium BEV segment with a score of 777. Tesla Model Y (770) ranks second. Overall satisfaction in the premium segment averages 770.

Kia Niro EV ranks highest in the mass market BEV segment for a second consecutive year with a score of 744. Ford Mustang Mach-E (741) ranks second. Overall satisfaction in the mass market segment averages 709.

The U.S. Electric Vehicle Experience (EVX) Ownership Study is driven by a collaboration with PlugShare, the leading EV driver app maker and research firm. This study sets the standard for benchmarking satisfaction with the critical attributes that affect the total or overall EV ownership experience for both BEV and PHEV vehicles. Survey respondents for the study include 8,122 owners of 2016-2022 model-year BEVs and PHEVs. The study was fielded in October-November 2021.

For more information about the U.S. Electric Vehicle Experience (EVX) Ownership Study, visit https://www.jdpower.com/business/automotive/electric-vehicle-experience-evx-ownership-study.

See the online press release at http://www.jdpower.com/pr-id/2022006.

About PlugShare

Based in El Segundo, Calif., PlugShare maintains the most comprehensive census of EV infrastructure in the world. They make the PlugShare app for iOS, Android and the Web, the most popular EV driver app globally, in use by most drivers in North America and over one million EV drivers worldwide. PlugShare also provides sophisticated data tools, reports, custom consulting and comprehensive research on EVs for automakers, utilities, charging networks, government and the rest of the EV industry. It operates the world’s largest EV driver survey research panel, PlugInsights, now with over 63,000 members.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: http://www.jdpower.com/business/about-us/press-release-info

1 The electric vehicle (EV) category includes battery electric vehicles (BEVs); plug-in hybrid electric vehicles (PHEVs); and hybrid electric vehicles (HEVs).

View source version on businesswire.com: https://www.businesswire.com/news/home/20220127005398/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

Shane Smith; East Coast; 424-903-3665; ssmith@pacificcommunicationsgroup.com