Audi Dealerships Rank Highest in Customer Satisfaction for Second Consecutive Year

After more than a year of pandemic-related lockdowns and lifestyle disruptions, the shift in driving and vehicle ownership habits in Canada have had a significant effect on the automotive service industry. According to the J.D. Power 2021 Canada Customer Service Index—Long-Term (CSI-LT) Study,SM released today, the total size of the four- to 12-year-old automotive service market plunged to $6.6 billion in 2021 from $9.2 billion in 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210909005029/en/

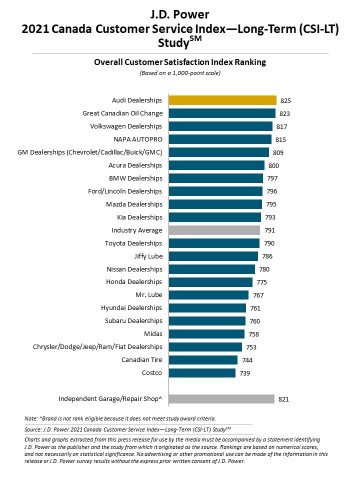

J.D. Power 2021 Canada Customer Service Index—Long-Term (CSI-LT) Study (Graphic: Business Wire)

With fewer kilometres driven and a shortage of service availability in some major markets, the industry experienced a drop in total service occasions of almost 20% year over year, with aftermarket locations capturing 54% of those service occasions remaining, compared with 46% for new-vehicle dealers. What’s more, aftermarket locations increased their share of overall industry revenue to 44% in 2021 from 40% in 2020, representing a swing of more than $200 million in relative revenue share. This reverses a multi-year trend of new-vehicle dealerships steadily taking a greater share of revenue.

The study also finds that while dealerships had more than 3.5 million fewer service visits year over year, the average cost per service at those dealerships also fell to $332 from $375 a year ago. Total revenues are also down in the aftermarket, with the average spend among non-dealer facilities decreasing to $226 from $241 in 2020. In total, dealer revenues fell approximately $1.83 billion while non-dealer service facilities declined $725 million.

“We’re seeing the effect of broader macro-economic forces in the automotive space,” said J.D. Ney, automotive practice lead at J.D. Power Canada. “Besides the decline in service visits and revenue, there is a bright spot for the service business. Many vehicle owners opted to make more expensive repairs to their current vehicle rather than to trade it in for a new vehicle or absorb the added cost of a pre-owned vehicle, where we’ve seen prices soar recently.”

While the number of customer visits and spend per visit declines year over year, overall satisfaction with auto service departments remains constant. Combined overall satisfaction with dealerships and non-dealers is 791 (on a 1,000-point scale) , which is unchanged from 2020. Satisfaction with non-dealers averages 796 and satisfaction with dealerships averages 786.

Following are some key findings of the 2021 study:

- Macro-economics forcing some owners into more significant repairs: With major inventory constraints in the new-vehicle marketplace, J.D. Power has seen a rapid and significant increase in used-vehicle values. There is evidence of more owners opting for more expensive repairs this year, ultimately choosing to keep their four- to 12-year-old vehicle on the road longer. Because working from home and other pandemic-related influences have had a dampening effect on average kilometres driven in 2021, this would appear to be a very pragmatic decision for owners.

- Effective communication increases satisfaction: The age-old advice of effective communication being key to a successful relationship also applies to relationships between automotive service facilities and customers. Tracking the effect of dozens of diagnostic factors or key performance indicators (KPIs) across multiple study years reveals that actions such as keeping customers informed of the status of their repair have become much more effective over time. This year, the KPI for keeping customers informed is sixth-most effective vs. being 10th in 2019. In addition, utilizing the customer’s preferred communication method (i.e., phone, text, email, etc.) has jumped to 11th this year from 18th in 2019.

Study Ranking

Audi Dealerships ranks highest in overall customer satisfaction for a second consecutive year, with a score of 825. Great Canadian Oil Change (823) ranks second and Volkswagen Dealerships (817) ranks third.

The Canada Customer Service Index—Long-Term (CSI-LT) Study measures satisfaction and intended loyalty among owners of vehicles that are four to 12 years old and analyzes the customer experience in both warranty and non-warranty service visits. Overall satisfaction is based on five factors (in order of importance): service initiation (24%); service quality (23%); service advisor (20%); service facility (17%); and vehicle pick-up (16%). The study is based on responses of 8,101 owners and was fielded from April through June 2021.

See the online press release at http://www.jdpower.com/pr-id/2021109.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit https://canada.jdpower.com/.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20210909005029/en/

Contacts

Gal Wilder, Cohn & Wolfe, Toronto, Canada; 647-259-3261; gal.wilder@cohnwolfe.ca

Nicole Herback, Cohn & Wolfe; 403-200-1187; nicole.herback@cohnwolfe.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com