Gains in nonresidential unable to overcome a pullback in single family

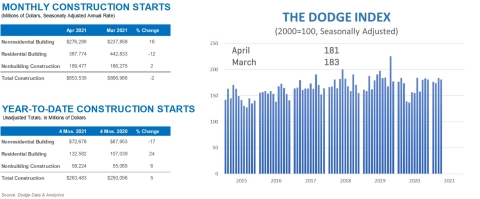

Total construction starts fell 2% in April to a seasonally adjusted annual rate of $853.5 billion, according to Dodge Data & Analytics. Single family construction posted a sizeable decline following months of strong activity, while nonresidential building and nonbuilding starts both gained.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210518005325/en/

April starts (Graphic: Business Wire)

“The pullback in single family construction starts was inevitable after showing exceptional strength over the past year,” said Richard Branch, Chief Economist for Dodge Data & Analytics. “Higher material prices, supply shortages, and a dearth of skilled construction labor were bound to catch up with housing and will ultimately limit the ability of this sector to show the same rate of expansion this year as it did last. Meanwhile, nonresidential starts are stabilizing and should continue to heal throughout 2021, however, this sector will also be challenged by similar issues facing the housing market that will cause its starts to be below pre-pandemic levels for months to come.”

Below is the full breakdown across nonbuilding, nonresidential, and residential construction:

-

Nonbuilding construction starts rose 2% in April to a seasonally adjusted annual rate of $189.5 billion. The utility and gas plant category rose 5%, while environmental public works and highways and bridges gained 2% and 1% respectively. The miscellaneous nonbuilding category dropped 3% in April. On a year-to-date basis, total nonbuilding starts were 6% higher than during the first four months of 2020. Starts in the environmental public works category were 37% higher, while miscellaneous nonbuilding starts were up 25%, and utility and gas plant starts were 3% higher. Highway and bridge starts were down 11%.

For the 12 months ending April 2021, total nonbuilding starts were 9% lower than the 12 months ending April 2020. Environmental public works starts were up 14%, while highway and bridge starts were up 1%. Utility and gas plant starts were down 34% for the 12 months ending April 2021 and miscellaneous nonbuilding starts were down 15%.

The largest nonbuilding projects to break ground in April were the $625 million Atkina Solar Power in Wharton County, TX, the $530 million New York Energy Solution Transmission Project in Claverack, NY, and the $357 million North City Pure Water Facility in San Diego, CA.

-

Nonresidential building starts rose 16% in April to a seasonally adjusted annual rate of $276.3 billion. Institutional building starts rose 19%, driven by education, transportation, and recreation buildings, while commercial starts rose 12% due to gains in the office and warehouse categories. Manufacturing starts also increased in April, climbing 25%. On a year-to-date basis, nonresidential building starts were 17% lower than during the first four months of 2020. Commercial starts were down 20%, while institutional starts were down 18%. Through the first four months of 2021, manufacturing starts were up 13%.

For the 12 months ending April 2021, nonresidential building starts were 26% lower than the 12 months ending April 2020. Commercial starts were down 27%, while institutional starts were 18% lower. Manufacturing starts were down 53% for the 12 months ending April 2021.

The largest nonresidential building projects to break ground in April were a $1.2 billion conversion of a storage building to an office project in New York, NY, the $530 million Mickey Leland International Terminal in Houston, TX, and a $325 million Amazon office project in Bellevue, WA.

-

Residential building starts fell 12% in April to a seasonally adjusted annual rate of $387.8 billion. Single family starts fell 18%, while multifamily starts rose 5%. On a year-to-date basis, total residential starts were 24% higher. Single family starts were up 31%, while multifamily starts were 6% higher.

For the 12 months ending April 2021, total residential starts were 12% higher than the 12 months ending April 2020. Single family starts gained 20%, while multifamily starts were down 8% on a 12-month sum basis.

The largest multifamily structures to break ground in April were the $232 million Travis Residential Tower 1 in Austin, TX, the $173 million 241 W 28th St mixed-use project in New York, NY, and the $165 million Union Square Tower in Somerville, MA.

- Regionally, April’s starts rose in the Northeast and Midwest but fell in the West, South Central, and South Atlantic regions.

About Dodge Data & Analytics

Dodge Data & Analytics is North America’s leading provider of commercial construction project data, market forecasting & analytics services and workflow integration solutions for the construction industry. Building product manufacturers, architects, engineers, contractors, and service providers leverage Dodge to identify and pursue unseen growth opportunities that help them grow their business. On a local, regional or national level, Dodge empowers its customers to better understand their markets, uncover key relationships, seize growth opportunities, and pursue specific sales opportunities with success. The company’s construction project information is the most comprehensive and verified in the industry.

As of April 15th, Dodge Data & Analytics and The Blue Book -- the largest, most active network in the U.S. commercial construction industry -- combined their businesses in a merger. The Blue Book Network delivers three unparalleled databases of companies, projects, and people.

Dodge and The Blue Book offer 10+ billion data elements and 14+ million project and document searches. Together, they provide a unified approach for new business generation, business planning, research, and marketing services users can leverage to find the best partners to complete projects and to engage with customers and prospects to promote projects, products, and services. To learn more, visit: construction.com and thebluebook.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210518005325/en/

Contacts

Media:

Nicole Sullivan | AFFECT Public Relations & Social Media | +1-212-398-9680, nsullivan@affectstrategies.com