ARMSTRONG, IA / ACCESSWIRE / July 3, 2024 / Art's Way Manufacturing Co., Inc. (Nasdaq:ARTW) (the "Company"), a diversified manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for the second quarter of fiscal 2024 and six months ended May 31, 2024.

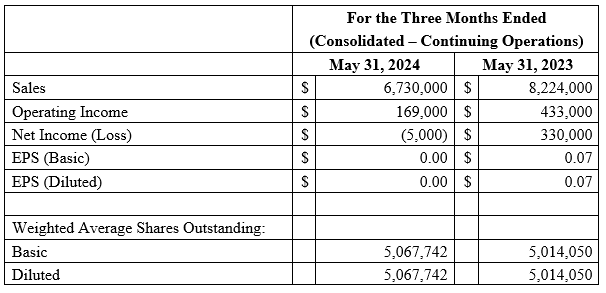

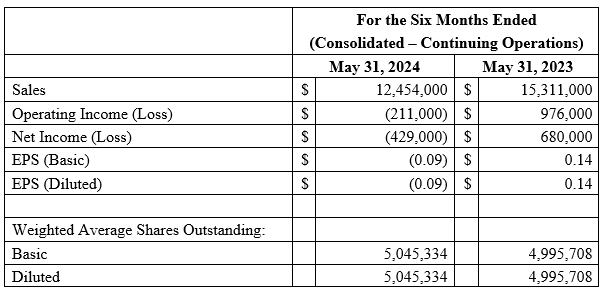

Sales: Our consolidated corporate sales from continuing operations for the three- and six-month periods ended May 31, 2024 were $6,730,000 and $12,454,000 compared to $8,224,000 and $15,311,000 during the same respective periods in fiscal 2023, a $1,494,000, or 18.2% decrease for the three-month periods and a decrease of $2,857,000, or 18.7% decrease for the six-month periods.

Our second quarter sales in our Agricultural Products segment were $4,555,000 compared to $6,368,000 during the same period of fiscal 2023, a decrease of $1,813,000, or 28.5%. For the six months ended May 31, 2024, our sales were $8,792,000 compared to $11,813,000, a decrease of $3,021,000, or 25.6% for the same period of 2023. In February of 2024, the US Department of Agriculture reported a 25% expected decline in farm income levels for 2024 due to weaker row crop prices and expected increases in production expenses. Our sales year to date have mirrored the USDA's sentiments on projected farm income. Incoming orders on the fall 2023 and spring 2024 early order programs declined for the first time in three years. As we approach mid-year of calendar 2024, live cattle, lean hogs, sugar beet and milk commodity prices are all exceeding their five-year averages while corn, soybeans and wheat commodity prices are all down significantly from where they were a year ago. High interest rates are putting additional pressure on farmers' bottom lines and also reducing the amount of inventory dealers are able to carry on their lots. We expect sales are going to be more speculative in the near future and product availability will be a key factor in sales success moving forward. We began cost cutting measures in the first quarter of fiscal 2024 to partially mitigate the effect on cash flow from decreased sales, including layoffs of non-production employees and offering early retirement incentives to employees at retirement age. We also entered the Iowa Work Force Development's voluntary workshare program in April 2024 which eliminates the need for additional production layoffs by allowing us to cut employee's hours while employees receive unemployment benefits for lost hours. We will be putting additional focus on investments that move our operational improvement strategy towards increased automation and production efficiency as we move forward in fiscal 2024. From a sales standpoint, we continue to work with dealers to help move field inventory to generate more sales opportunities for our products. We are targeting new dealer acquisitions to penetrate geographic markets in which we lack a substantial presence.

Our second quarter sales in our Modular Buildings segment were $2,175,000 compared to $1,856,000 for the same period in fiscal 2023, an increase of $319,000, or 17.2%. For the six months ended May 31, 2024 our sales were $3,662,000 compared to $3,498,000 for the same period of fiscal 2023, an increase of $164,000, or 4.7%. Two large research projects are driving the sales increase for the three- and six-month periods. We anticipate seeing increased sales quarter on quarter for the remainder of fiscal 2024 due to the strength of our backlog.

Net Income (Loss): Consolidated net loss from continuing operations was $5,000 for the three-month period ended May 31, 2024, compared to net income of $330,000 for the same period in fiscal 2023. For the six months ended May 31, 2024 our consolidated net loss was $429,000 compared to net income of $680,000 for the same period of fiscal 2023. While we had positive operating income from continuing operations for the three months ended May 31, 2024, high interest rates on our debt, have put strain on our bottom line in fiscal 2024. We expect that our sales in the Agricultural Products segment will continue to follow the 25% farm income decrease trend predicted by the USDA. We will rely on inventory reduction, debt retirement and cost cutting to minimize losses in an attempt to again generate net income from this segment. The Modular Buildings segment recorded revenue increases and profitability for both the three and six months ended May 31, 2024. We anticipate continued positive performance from this segment due to strong backlog for the remainder of fiscal 2024.

Income (Loss) per Share: Loss per basic and diluted share for the second quarter of fiscal 2024 was $0.00, compared to income per basic and diluted share of $0.07 for the same period in fiscal 2023. Loss per basic and diluted share for the first six months of fiscal 2024 was $0.09, compared to income per basic and diluted share of $0.13 for the same period in fiscal 2023.

"Our Modular Building segment continues to flourish as we finalized contracts and began full production on new projects in the first six months of fiscal 2024," said David King, Chief Executive Officer. "We expect increased revenue for the remainder of the year and a strong start to fiscal 2025 as the backlog remains at historic levels and demand continues to be high as evidenced by quoting activity."

King added, "Lower commodity prices continue to affect farm income, resulting in demand softness and putting pressure on the Agricultural Products segment. We are committed to navigating these challenging market conditions by focusing on operational efficiency and prudent fiscal management. We have adjusted our production output to meet current demand and help manage inventory levels. As we move forward, we remain dedicated to supporting our dealers and customers, ensuring we are well-positioned for future growth once market conditions improve."

Art's-Way Manufacturing Co., Inc.

Art's Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 125 employees across two branch locations: Art's Way Manufacturing in Armstrong, Iowa and Art's Way Scientific in Monona, Iowa. Art's Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art's Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact:

David King, Chief Executive Officer

712-208-8467

davidk@artsway.com

Or visit the Company's website at www.artsway.com/

Cautionary Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. Statements made in this release that are not strictly statements of historical facts, including the Company's expectations regarding: (i) the Company's business position; (ii) demand and potential growth within the Company's business segments; (iii) future results, including but not limited to, revenue and margin expectations, expectations with respect to the impact of price increases, and expectations with respect to backlog and product mix; (iv) the Company's ability to increase production with capital investments and other activities, (v) future agricultural sales and plans to enter into building contracts; (vi) cash flows and plans to fund strategic initiatives and pay down debt; and (vii) the benefits of the Company's business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company's products; credit-worthiness of the Company's customers; the Company's ability to operate at lower expense levels; the Company's ability to complete projects in a timely and efficient manner in accordance with customer specifications; the Company's ability to renew or obtain financing on reasonable terms; the Company's ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and its effect on the Company's supply chain and demand for its products, domestic and international economic conditions; the Company's ability to attract and maintain an adequate workforce in a competitive labor market; any future COVID-19 setbacks; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by any of the Company's operating segments; obstacles related to liquidation of product lines and segments; and other factors detailed from time to time in the Company's Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. Readers are cautioned not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

SOURCE: Art's-Way Manufacturing Co., Inc.

View the original press release on accesswire.com