BUENOS AIRES, ARGENTINA / ACCESSWIRE / March 6, 2024 / Pampa Energía S.A. (NYSE:PAM)(Buenos Aires Stock Exchange:PAMP), an independent company with active participation in the Argentine electricity and gas value chain, announces the results for the fiscal year and quarter ended on December 31, 2023.

Pampa's financial information adopts US$ as functional currency, converted into AR$ at transactional nominal exchange rate (‘FX'). However, our affiliates Transener and TGS's figures are adjusted for inflation as of December 31, 2023, and translated into US$ at the period's closing FX. The reported figures in US$ from previous periods remain unchanged.

The impact of the local currency depreciation

The steep US$ quote increase from AR$350 to AR$808 on December 13, 2023, mainly affected the tax valuation as it reports under local currency. Despite being adjusted for inflation, it was diluted by the AR$ depreciation, temporarily diverging from the accounting valuation of PPE and accruing a non-cash deferred income tax. Regarding Transener and TGS, the 21% average inflation adjustment on the fourth quarter 2023 (‘Q4 23') flows failed to offset the AR$ devaluation.

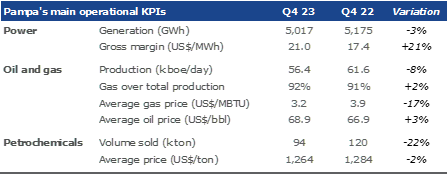

Q4 23 main results[1]

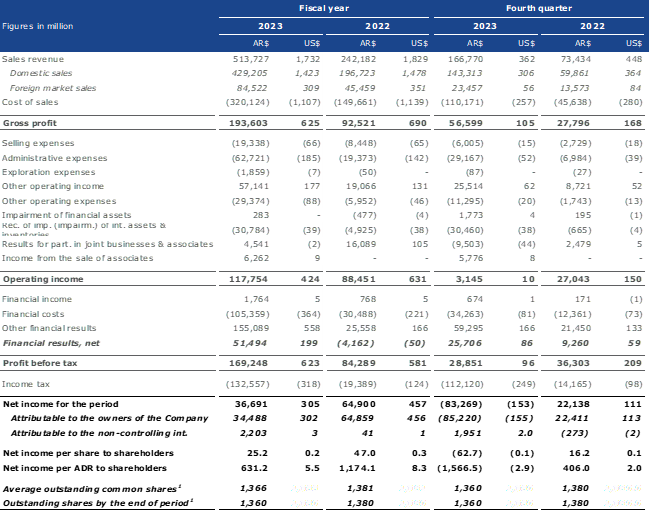

19% year-on-year sales decrease, recording US$362 million[2] in Q4 23, explained by lower gas sales, thermal and petrochemicals dispatch.

Operating performance highlighted by Ensenada Barragán Thermal Power Plant (‘CTEB')'s Combined Cycle (‘CCGT') and hydros:

Adjusted EBITDA[3] reached US$129 million, 30% lower than Q4 22, explained by reductions of US$46 million in holding and others, as the sharp AR$ devaluation significantly diluted the adjusted by inflation results of TGS and Transener, and a 30% drop in oil and gas. These decreases were partially offset by improvements of 10% in power generation and 33% in petrochemicals.

The income attributable to the Company's shareholders recorded a US$155 million loss, briefly explained before by lower sales and affiliates' equity income, in addition to US$151 million of higher non-cash deferred income tax charges due to the temporary lag between the accounting and tax valuation of PPE. It is worth noting that the accounting valuation is based on the US$ as functional currency, while the tax reporting is in AR$, which inflation adjustment was diluted by the sharp devaluation impact towards the end of Q4 23. Gains from holding financial securities partially offset these losses.

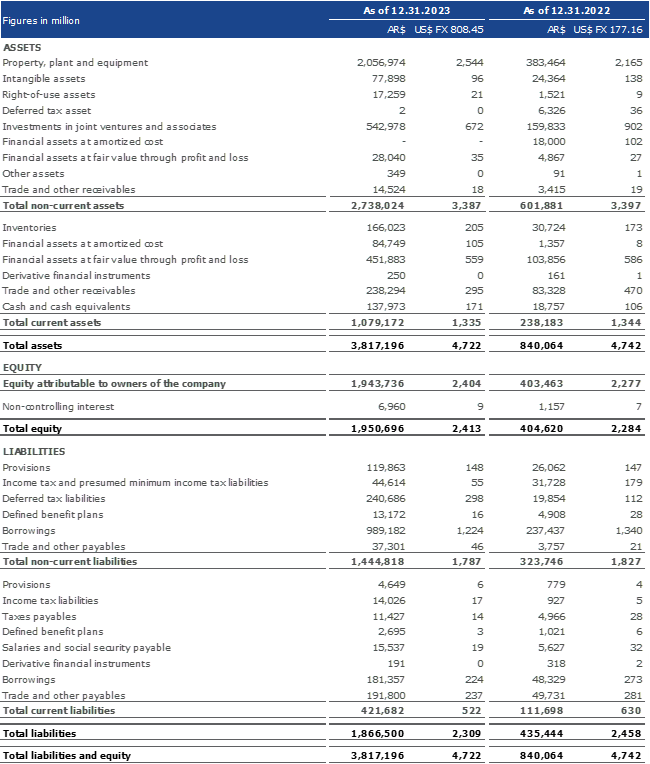

Net debt decreased to US$613 million, reaching the lowest in the last 5 years. This substantial decrease was mainly explained by an interannual reduction of US$165 million in gross debt, due to principal cancellations and dilution of the AR$ debt. Moreover, a US$135 million increase in cash and cash equivalents was recorded, resulting in a net leverage ratio of 0.9x and accomplishing a solid balance sheet.

Consolidated balance sheet

(As of December 31, 2023 and 2022, in millions)

Consolidated income statement

(For the fiscal year and quarters ended on December 31, 2023 and 2022, in millions)

Note: 1: It considers the Employee stock-based compensation plan shares, which amounted to 3.9 million common shares as of December 31, 2022 and 2023.

For the full version of the Earnings Report, please visit Pampa's Investor Relations website: ri.pampaenergia.com/en.

Information about the videoconference

There will be a videoconference to discuss Pampa's Q4 23 results on Thursday, March 7, 2024, at 10:00 a.m. Eastern Standard Time/12:00 p.m. Buenos Aires Time. The hosts will be Gustavo Mariani, CEO, Nicolás Mindlin, CFO, Horacio Turri, executive director of E&P and Lida Wang, investor relations and sustainability officer at Pampa.

For those interested in participating, please register at bit.ly/Pampa4Q2023VC.

For further information about Pampa:

investor@pampaenergia.com

ri.pampaenergia.com/en

www.argentina.gob.ar/cnv

www.sec.gov

[1] The information is based on financial statements (‘FS') prepared according to International Financial Reporting Standards (‘IFRS') in force in Argentina.

[2] It does not include sales from the affiliates CTBSA, Transener and TGS, shown as ‘Results for participation in joint businesses and associates'.

[3] Consolidated adjusted EBITDA represents the results before financial items, income tax, depreciations and amortizations, extraordinary and non-cash income and expense, equity income and other adjustments, and includes affiliates' EBITDA at our ownership. Further information on section 3.1.

SOURCE: 1/3 Pampa Energía S.A.

View the original press release on accesswire.com