NEW YORK, NY / ACCESSWIRE / December 10, 2024 / As we close out 2024, a year of tremendous growth and transformation for Avanza Capital Holdings, we take this moment to reflect on our achievements and share a glimpse of what lies ahead. This year, our strategic foresight, operational excellence, and commitment to transparency led to outstanding results, marked by consistent inflows, robust market positioning and unparalleled performance metrics.

2024: A Year of Breakthroughs

The numbers speak volumes. In 2024, we generated $34,709,091.00 in total inflows, reaffirming the trust of our lending partners while demonstrating resilience in a challenging market. These achievements represent more than figures-they embody the trust, opportunity, and execution that define Avanza Capital.

2024 Key Highlights

Total Inflows: $34,709,09.00, showcasing steady growth and strong lender confidence.

Portfolio Diversification: A risk-adjusted strategy allowed us to thrive despite market volatility.

Operational Efficiency: Enhanced underwriting and cutting-edge technology streamlined deal execution.

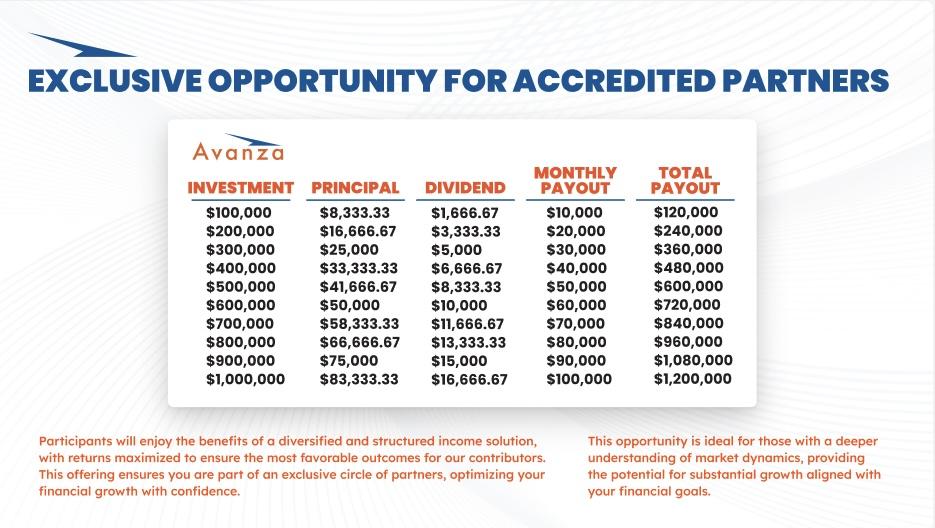

lender Returns: Delivered 20% annualized returns with monthly distributions of principal and interest, underscoring our focus on consistent and superior performance.

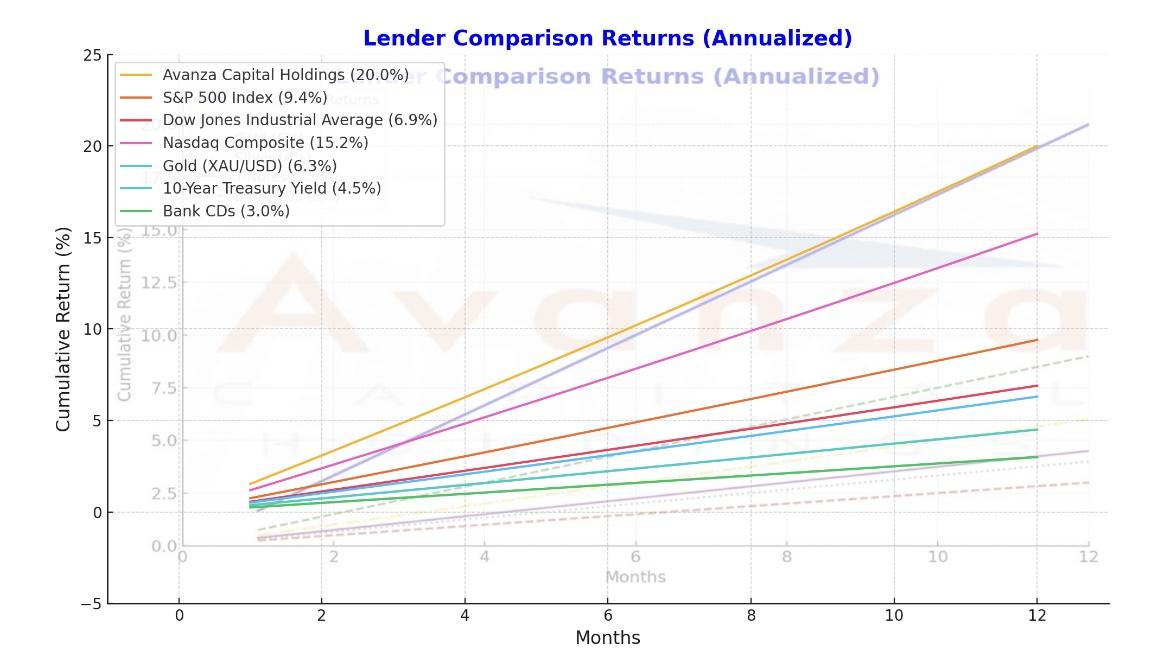

Avanza Capital Outperforms Major Indices Over the Last 12 Months

As we reflect on the past 12 months, we're thrilled to share how Avanza Capital Holdings has consistently delivered exceptional results for our lending partners. While navigating a complex and ever-evolving financial landscape, we've achieved 20% annualized returns, significantly outperforming major market indices.

Let's take a look at how we compare:

Avanza Capital Holdings: +20% annualized return

S&P 500 Index: +9.4%

Dow Jones Industrial Average: +6.9%

Nasdaq Composite: +15.2%

Gold (XAU/USD): +6.3%

10-Year Treasury Yield: +4.5%

Bank CDs: +3.0%

What Sets Us Apart?

This level of performance didn't happen by accident-it's the result of disciplined execution, strategic foresight, and a relentless focus on creating value for our partners. Here's what drives our outperformance:

StrategicDiversification

Our ability to identify and underwrite high-quality lending opportunities has positioned us as a leader in the private credit space. By leveraging non-traditional banking solutions like merchant cash advances and the purchase of future receivables, we've built a diversified portfolio designed to deliver steady, risk-adjusted returns.

Agile Capital Deployment

With our proven underwriting processes and the expertise of our legal team, we ensure that every dollar of capital is deployed strategically, providing both stability and growth potential for our lenders.

Consistent Monthly Returns

While traditional capital allocations often come with volatility, we offer predictable monthly payouts of both principal and interest. This reliability has become one of the hallmarks of our platform, helping our partners enjoy steady income streams, regardless of broader market conditions.

Thriving Amid Rising Rates

As interest rates rise and traditional banks tighten their lending criteria, Avanza's flexible, non-bank model allows us to meet the growing demand for alternative capital. This adaptability has been a key factor in driving our success.

Why Choose Avanza?

While traditional indices like the S&P 500 and Nasdaq have performed well, they can't match the stability and risk adversity offered by Avanza Capital Holdings. Our 20% annualized returns provide more than just financial growth-they represent the confidence our partners have in our ability to execute on a winning strategy.

Unlike equities or commodities, Avanza's model offers:

Non-correlated performance to traditional markets

Monthly distributions that prioritize liquidity

Risk-mitigated strategies guided by a team of experts

Managing Systematic and Unsystematic Risk at Avanza Capital Holdings

At Avanza Capital Holdings, risk management isn't a buzzword - it's a core pillar of our strategy. We understand that all lending decisions are subject to two critical categories of risk: systematic risk and unsystematic risk. While systematic risk impacts the broader financial system, unsystematic risk is specific to individual borrowers, sectors, or deals. Here's how we manage both to ensure stability and protect our lending partners.

Systematic Risk: Navigating Market-Wide Volatility

Systematic risk refers to macroeconomic and financial market factors that impact all businesses and capital allocations. Examples include interest rate hikes, inflation, regulatory changes, and economic slowdowns. While systematic risk is unavoidable, it can be mitigated. Here's how Avanza Capital takes control.

Our Approach to Managing Systematic Risk:

Portfolio Diversification Across Borrowers, Sectors, and States

Our exposure isn't limited to one sector or one type of borrower. By funding businesses in 48 states and diversifying across multiple industries, Avanza ensures that broader economic shocks don't affect every part of our portfolio at once. When one sector experiences a downturn, others may remain stable or thrive.

Interest Rate Protection

Unlike most lenders that are directly affected by rising rates, our returns are structured at a fixed 20% annual rate. This ensures consistent returns for our lending partners, regardless of how interest rates move. The broader market can experience higher costs of borrowing, but at Avanza, our partners see no disruption in their returns.

Regulatory Readiness

As regulations evolve, such as with Basel III Endgame, we take a proactive approach. Our external legal counsel - one of America's Top 50 securities attorneys - ensures that our operations remain compliant and forward-thinking. Instead of reacting to change, we position ourselves to take advantage of it.

Risk-Adjusted Yield Management

While market rates may change, our capital allocations remain steady. With the ability to provide liquidity through monthly payouts, Avanza has the flexibility to make strategic shifts when necessary, all while protecting our partners' returns.

Liquidity for Lenders

Unlike other alternative capital initiatives that impose multi-year lockups, Avanza offers monthly liquidity. Lenders have the flexibility to compound in certain scenarios, redeploy returns, while receiving monthly distributions of principal and interest, which adds an additional layer of protection during market downturns.

Bottom Line:

We cannot eliminate systematic risk, but we can mitigate its impact. By diversifying sectors, controlling exposure, and leveraging fixed-rate returns, Avanza provides lending partners with a sense of security - no matter what's happening in the global economy.

Unsystematic Risk: Controlling the Controllable

Unsystematic risk refers to deal-specific risk - the unique risks tied to a borrower, a specific loan, or an individual sector. While systematic risk impacts the broader market, unsystematic risk can be managed more directly. Our proactive measures include the following:

Our Approach to Managing Unsystematic Risk:

Rigorous Underwriting Process

Every loan that we deploy capital into undergoes one of the most stringent underwriting processes in the industry. Our proprietary system ensures that every deal is scrutinized and backed by:

Collateral: Tangible, real assets secure every loan.

Promissory Notes: Borrowers are contractually obligated to repay.

Comprehensive Loan Agreements: These agreements, reviewed by top-tier legal counsel, ensure we have the legal framework to protect lender capital.

The Role of Lender Portal Pro

Launched under the leadership of Managing Partner Anthony DeBenedictis, Lender Portal Pro provides our accredited lenders with a real-time window into every aspect of their capital allocations. Partners can track loan performance, borrower repayments, contributions, distributions dates, amounts, compounded interest, waterfall structures, and other key metrics, offering complete transparency. This visibility is a powerful tool for reducing risk perception and enhancing decision-making.

Strategic Loan Sizing

No single borrower, sector, or loan controls a disproportionate share of our total loan book. This method ensures that if one loan faces challenges, it has no material impact on the entire portfolio. By keeping loans diversified and manageable, we never put all our eggs in one basket.

Legal Oversight On EveryTransaction

Our award-winning legal team ensures every deal is airtight. From loan agreements to collateral arrangements, our legal team provides rigorous oversight, ensuring we're legally protected at every turn. Nothing moves forward without legal approval.

Active Monitoring & Early Risk Detection

Risk isn't something you wait for - it's something you anticipate and act on. We employ machine learning algorithms to identify anomalies in borrower behavior. For example, missed payments, revenue declines, or other performance issues trigger early intervention to protect lender capital at the grass roots. Real-time insights ensure that no risk goes unnoticed.

Bottom Line:

Unsystematic risk is far more manageable than systematic risk. By applying rigorous underwriting, legal oversight, and early intervention, Avanza transforms unpredictable risk into calculated, strategic lending decisions.

The Avanza Capital Octopus Mentality: Mastering Risk from All Angles

At Avanza, we believe risk management is both an art and a science. Our strategy draws inspiration from the most sophisticated financial models and is symbolized by the octopus - a creature renowned for its adaptability, intelligence, and ability to operate with multiple "arms" working in unison. We've redefined the old adage: Bulls make money, bears make money, greedy pigs get slaughtered, and the octopus adapts - mastering every current, outmaneuvering every predator, and seizing every opportunity with precision, patience, and purpose. This isn't just a metaphor - it's our strategy in action.

8 Tentacles of Strategy

Just as the octopus controls eight arms simultaneously, we control eight key risk levers at once - spanning underwriting, collateral, legal, diversification, risk management, deal structure, partner transparency, and liquidity.

Decentralized Decision-Making

Each "arm" of our strategy operates independently. If one aspect of a deal falters (like a borrower missing a payment), the other risk controls (like collateral or promissory notes) step in to ensure lender protection.

Rapid Adaptation

Just as an octopus can change color or squeeze through small spaces, Avanza can adapt to sudden regulatory shifts, market changes, and borrower issues. We anticipate risks in real-time, ensuring our lending partners are never caught off guard.

Regeneration

The octopus can regenerate lost limbs. Avanza's diversified portfolio approach means that, even if one deal underperforms, it doesn't harm the larger portfolio. Our approach ensures that performance is never reliant on a single borrower, sector, or deal.

The Avanza Octopus Strategy in Practice:

When market conditions tighten, Avanza moves quickly, adjusting our underwriting process, reducing exposure to higher-risk borrowers, and repositioning capital into safer opportunities. Our octopus-inspired model has enabled us to thrive for 8 consecutive years.

How It All Comes Together

Systematic Risk: Impacts the entire economy and financial markets.

Unsystematic Risk: Deal-specific risks tied to borrowers, sectors, or deals.

How Avanza Combats Both:

Systematic Risk is mitigated through diversification, regulatory foresight, and fixed-rate returns.

Unsystematic Risk is controlled through underwriting, legal safeguards, and risk-adjusted returns.

By tackling both types of risk, Avanza delivers the kind of predictable, stable, and secure cash flow that accredited lending partners rely on. This dual approach enables us to provide 20% annualized returns, month after month, with the stability and transparency that sets Avanza apart in the alternative credit space.

Digging deeper:

Structuring the Deal: The Foundation of Avanza Capital Holdings Succes

Purchase Agreement: The Avanza Capital model is structured as an advanced purchase of future receivables, not a loan, creating a unique financing model.

Factor Rate: The cost of funding is based on a factor rate, ensuring clear repayment expectations.

Transparent Agreements: Contracts outline the percentage of receivables purchased and repayment terms in detail.

Adapting to Revenue Fluctuations: The Flexibility Advantage

Revenue-Driven Payments: Payments adjust dynamically to match the merchant's revenue fluctuations, reducing the burden during slow periods.

Daily or Weekly Deductions: Automatic ACH withdrawals simplify payment collection while ensuring consistency.

Simplified Qualification: Lowering Barriers to Entry

Cash Flow Focus: Avanza Capital approvals prioritize cash flow, revenue patterns, and receivables over traditional credit scores providing our borrowers with "Action Capital" to thrive and scale.

Key Metrics for Eligibility: Evaluating average daily sales and monthly revenue ensures accessible funding for small businesses.

Speed and Accessibility: Fast Capital Deployment

Quick Turnaround: Businesses receive funding within days, making Avanza Capital a go-to solution for "Action Capital" urgent cash flow needs.

No Collateral Required: The unsecured nature of Avanza Capital reduces complexity for merchants seeking fast solutions.

Managing Risk:Building a Resilient Portfolio

Unsystematic Risk Mitigation: Funding is diversified across industries and businesses to minimize risk.

Dynamic Repayment Structures: Percentage-based repayments reduce default risks during low-revenue periods, ensuring sustainable returns.

Legal and Regulatory Safeguards: Ensuring Compliance

Top-Tier Legal Oversight: Legal counsel ensures contracts meet all federal and state guidelines, protecting both funders and merchants.

Transparent Terms: Clear, upfront agreements protect businesses from unexpected terms and costs.

Compliance as a Priority: Structured agreements define Avanza Capital as calculated transactions of receivables, not loans, ensuring alignment with usury laws.

Strategic Utilization: Making the Most of Avanza Capital Holdings

Versatile Use of Capital: Avanza Capital may be used for inventory purchases, payroll, marketing, scaling, and covering unexpected expenses. Critical for businesses in recovery that may have been compromised and fragmented by the supply chain tailwinds.

Tailored Solutions: Providing "Action Capital" aligns with the merchant's specific business goals and operational needs.

Aligning Sourcing with Strategy: Precision in Capital Deployment

Targeting Growth Industries: Focused sourcing ensures capital is directed to businesses with predictable cash flows.

Proactive Deal Identification: Data-driven algorithms and underwriting insights guide sourcing decisions, minimizing risk.

Supporting Merchant Growth: A Symbiotic Partnership

Flexible Repayment Structures: Avanza Capital empowers businesses to grow without the constraints of fixed-term loans.

Educational Support: Avanza Capital helps merchants navigate the complexities of MCA financing, ensuring sustainable success, and clearly demonstrating the differentiation between our model and other lenders with best - in - class correction and oversight.

Maximizing Returns: The Cycle of Risk, Reward, Repeat

Smart Lending Strategies: Balancing risk and reward creates a replicable model for consistent, sustainable returns.

Yield Spread Optimization: Avanza provides focus on opportunities that maximize returns while preserving capital first and foremost as the number one priority.

Each strategy contributes to a robust and dynamic non-traditional banking platform ecosystem, enabling Avanza Capital to thrive while empowering small businesses to reach their goals.

Want to see how our systematic and unsystematic risk strategy works in action?

schedule an appointment to visit our data room:

Check out our latest articles on risk management and lending strategy:

🔗Navigating Regulatory Transformation: Avanza's Strategic Advantage

🔗Redefining Private Credit Markets with 10 Core Pillars of Excellence

🔗Avanza Capital Holdings Marks Eight Years of Empowering Small Businesses

If you'd like to discuss our risk management philosophy further, please reach out to Frank Scarso, CEO, or Anthony DeBenedictis, Managing Partner as well as our team of partners ready to assist. We're always ready to discuss how Avanza protects your capital and builds trust every step of the way.

With systematic and unsystematic risk under control, Avanza Capital Holdings is redefining what it means to offer stable, reliable, and high-yield lending opportunities in the world of alternative credit.

Mastering the Art of Sourcing Premium Lending Deals

One of the most critical elements of our success lies in our deal-sourcing capabilities. At Avanza Capital, we don't just find opportunities; we craft them. As I often share with our partners, sourcing premium lending deals isn't simply an art-it's a science, perfected over time.

Our 8-year approach combines the expertise of top-tier legal counsel, advanced machine learning algorithms, and strategic foresight to identify and secure high-yield, low-risk opportunities. Our mantra is simple: Risk, Reward, Repeat. This process enables us to manage risk effectively, maximize rewards, and create a repeatable model of sustainable growth for our lending partners.

Through Lender Portal Pro, we've streamlined communications, transparency, and access for our lending partners, setting a new standard for how Avanza Capital interacts with our partners.

Looking Ahead to 2025: Opportunities in the Private Credit Market

As we anticipate 2025, the private credit market is poised for exponential growth. Key drivers include:

Market Demand for Flexible Capital:

Small and medium-sized businesses continue to seek timely, non-traditional funding solutions.

volatile Interest Rates:

Our fixed-income fund structure provides a competitive edge, offering 20% annual returns despite capital costs.

Private Credit as a Preferred Asset Class:

With predictable cash flows and lower volatility, private credit remains an attractive option for institutional and accredited lenders.

Technology-Driven Expansion:

Enhanced underwriting technology and data-driven decision-making will drive portfolio growth and resilience.

Avanza in the Spotlight

We've been honored to make waves in the financial industry, with recent press mentions highlighting our leadership and innovation:

Avanza Capital Holdings: Redefining Private Credit Markets with 10 Core Pillars of Excellence

Avanza Capital Holdings: Best Outside Legal Team for Oversight of 2024

Business in Action: Beyond Adversity Celebrates 8 Years of Resilience

Insights & Research

Direct Lending is Surging: Direct lending opportunities could exceed 8.5% annual returns over the next decade, according to J.P. Morgan Asset Management.

The $30 Trillion Opportunity Ahead-yes, that's $30 with a "T":

https://avanza.nyc/the-next-era-of-private-credit/

Just to put it into perspective:

As of December 10, 2024, the global cryptocurrency market capitalization is approximately $3.66 trillion. Bitcoin remains the dominant cryptocurrency, accounting for about 55% of the total market cap, equating to roughly $2 trillion. Avanza Capital Holdings believes we are in one of the fastest growing sectors with institutional support and multiple expansion. The private credit market, encompassing non-bank lending to small and medium-sized enterprises (SMEs), has experienced significant growth, reaching approximately $2 trillion in assets under management by the end of 2023.

Private credit plays a crucial role in the U.S. economy, particularly in supporting SMEs, which account for about 99.9% of all U.S. businesses and contribute to approximately half of the GDP. In 2022, private credit supported an estimated 1.6 million jobs, generating $137 billion in wages and benefits, and contributing $224 billion to the GDP.

While private credit significantly impacts employment and economic activity, its direct contribution to the overall U.S. GDP is relatively modest. However, by providing essential financing to SMEs, private credit fosters business growth and innovation, indirectly bolstering economic development and competitiveness.

It's important to note that the private credit market's influence on the U.S. economy is multifaceted, affecting various metrics such as employment rates, business expansion, and overall economic resilience. As the market continues to evolve, its role in shaping economic outcomes is expected to grow correspondingly.

With private credit projected to grow to $2.8 trillion by 2028, Avanza is strategically positioned to capitalize on the expanding market.

Navigating Regulatory Transformation: As traditional banks face stricter regulations, alternative lending platforms like ours are poised to fill the gaps.

https://avanza.nyc/navigating-regulatory-transformation-avanzas-strategic-advantage/

Testimonials from Our Partners

"Avanza Capital redefines the private credit space. The 20% annual returns have been steady and reliable, exceeding all expectations." Doyle Lending Partner

"With Avanza, I know my capital allocations are not only growing but also supporting small businesses across America." Raymond Lending Partner

"The Lender Portal Pro is a game-changer-transparent, intuitive, and lender-focused." Robert Lending Partner

"Avanza's team of experts truly stands out in managing risk and maximizing returns. I trust them completely." Rita Lending Partner

"Their attention to legal detail and rigorous underwriting gives me peace of mind as a lending partner." Jay Lending Partner

"I've looked back at this over the last years and can honestly say, this is one of the best business decisions I've ever made." Shawn

Business in Action Spotlight

In Issue 18 of Business in Action, we're proud to be featured in the article "Beyond Adversity: How Avanza Redefines Success", highlighting our journey over the last eight years and the principles that continue to drive our success.

To read the full feature, visit: Business in Action: Beyond Adversity

Looking Ahead

As we move into 2025, we're excited to continue building on this success. Our team remains committed to delivering results that exceed expectations while empowering small businesses and supporting our valued lending partners.

Avanza Capital Holdings: A Legacy of Legal Excellence and Unwavering Compliance Derived From A Leveraged Relationship Dating Back Over 3 Decades That Turned Into One Of The Most Profitable Relationships Ever

As 2024 comes to a close, we're proud to highlight one of the most critical pillars of Avanza Capital Holdings' success: our unwavering commitment to legal oversight and compliance. From day one, we've recognized that in the world of private credit, securing lender confidence requires more than returns - it requires trust, transparency, and absolute adherence to the law.

This year, our dedication to legal excellence has been publicly recognized, and we've taken intentional steps to ensure every aspect of our lending process remains fortified with the industry's highest standards of oversight. In this issue, we spotlight how our strategic reliance on top-tier legal counsel has become a defining advantage for Avanza, securing our place as a market leader in alternative banking and private credit.

Legal Oversight: The Bedrock of Our Lending Model

In an industry that continues to evolve with regulatory shifts like Basel III Endgame, the importance of a proactive legal strategy cannot be overstated. Unlike traditional alternative platforms and other alternative lenders, Avanza Capital Holdings' legal framework is not an afterthought - it is the cornerstone of our operations. From deal sourcing to contract structuring, our legal team ensures that every aspect of our lending model is built on rock-solid legal principles, positioning Avanza Capital as the "Poster Boys" of compliance - ahead of even the most sophisticated financial models.

Here's how our external legal counsel differentiates us from the pack:

• Rigorous Risk Mitigation: Every deal is subject to extensive legal review, ensuring airtight protection for our lending partners.

• Deal Structuring & Loan Security: Legal oversight ensures that all loans are backed by collateral, promissory notes, and binding agreements to protect lender capital.

• Regulatory Compliance: With the Basel III Endgame reshaping the financial industry, Avanza's legal team stays ahead of changes, safeguarding our business from unnecessary risks.

This focus on compliance isn't just theoretical. It's a well-documented part of our story.

Award-Winning Legal Strategy

This year, our legal approach was publicly recognized when Avanza Capital Holdings was named "Best Outside Legal Team for Oversight of 2024" by the Best of Best Review. This prestigious accolade reflects the standard of excellence we uphold in every transaction, giving lenders the confidence that their capital is secure.

🔗 Read the full article here: Avanza Capital Holdings: Best Outside Legal Team for Oversight of 2024

https://www.americastop50lawyers.com/product-page/anthony-c-varbero-america-s-top-50-lawyer-securities-law-florida-new-york

The award recognizes our collaboration with one of America's Top 50 securities attorneys, who plays an active role in every major decision impacting lender protection, compliance, and legal soundness. Our legal counsel ensures every financial move we make is legally fortified, providing unmatched peace of mind to our accredited lenders.

How Legal Oversight Directly Impacts Lenders

Legal protection isn't just about contracts and regulations - it's about how we secure our lenders' returns. Here's how it works in practice:

Proactive Deal Sourcing & Screening:

Our legal team works hand-in-hand with our underwriters to vet every potential borrower. No deal is greenlit without legal clearance, ensuring compliance with both internal risk thresholds and external regulatory guidelines.

Transparent Terms & Conditions:

Every agreement is clearly structured to protect lender capital. Our collateralized loans come with full transparency on terms, timelines, and repayment schedules - with oversight from top-tier legal professionals.

Fortification Against Market Volatility:

In a year where market volatility was a recurring theme, our legal counsel was pivotal in protecting returns. The Basel III Endgame, which introduced new regulatory capital rules, created potential risks for lenders in traditional banking. Avanza's proactive legal strategy allowed us to remain flexible, secure, and compliant, giving our lending partners a distinct advantage.

Legal Innovation in Practice

At Avanza, "innovation meets compliance" isn't just a slogan. It's a lived philosophy. This commitment was highlighted in the following key articles and press mentions:

🔗Redefining Private Credit Markets with 10 Core Pillars of Excellence

Our 10 Core Pillars include Legal Transparency & Oversight as a critical driver of lender protection. It's a clear signal that compliance and transparency aren't reactive elements - they're baked into our operational DNA.

🔗Avanza Capital Quietly Building Momentum in the Private Credit Revolution

🔗Navigating Regulatory Transformation: Avanza's Strategic Advantage

With the Basel III Endgame poised to reshape banking regulations, Avanza's legal strategy was showcased in this insightful feature. Thanks to our external legal counsel, we have proactively positioned our platform to mitigate risk and capitalize on opportunities.

🔗Anthony DeBenedictis Joins Forces with Frank Scarso to Propel Avanza Forward

The addition of Managing Partner Anthony DeBenedictis marked a new chapter in Avanza's story. As a leader in operational transparency, DeBenedictis worked directly with our legal team to drive the successful launch of our Lender Portal Pro. The result? Our lenders now have access to real-time updates and key legal disclosures on every deal.

A Commitment to Lender Protection and Oversight

Our guiding principle is clear: Protect lender capital at all costs. Legal oversight plays an indispensable role in fulfilling that promise. Every loan, agreement, and strategic move is backed by the most respected legal advisors in the financial industry, and that commitment is reflected in every success story we've shared with our lenders.

Our unwavering dedication to risk mitigation, legal integrity, and transparency ensures that accredited lenders know exactly where their capital is, how it's protected, and where it's growing.

In Case You Missed It catch it here:

https://avanza.nyc/in-the-news/

https://avanza.nyc/avanza-capital-quietly-building-momentum-in-the-private-credit-revolution/

https://avanza.nyc/navigating-regulatory-transformation-avanzas-strategic-advantage/

https://avanza.nyc/beyond-adversity/

https://avanza.nyc/anthony-debenedictis-joins-forces-with-frank-scarso/

https://avanza.nyc/avanza-capital-holdings-selects-investor-portal-pro-to-elevate-lending-partner-relations-and-enhance-transparency/ (Creating Lender Portal Pro)

This collection of articles showcases how legal oversight, transparency, and lender protection have become inseparable from Avanza Capital Holdings' identity.

If you have questions about our outside legal framework or how we continue to protect lender capital, reach out to our team today. We're here to keep you informed, protected, and ahead of the curve.

Thank you for your trust, your partnership, and your belief in our vision. Together, we're redefining private credit markets and creating a new standard for what's possible.

Looking Ahead

As we enter 2025, our Longstanding legal strategy will remain a core pillar of our operational success. From navigating new regulatory changes to ensuring our lenders have unparalleled peace of mind, we remain committed to staying ahead of the curve. By partnering with America's leading legal minds, we continue to set the bar for operational integrity in private credit.

Whether it's through the expertise of our Top 50 securities attorney or the foresight of our executive team, our message is simple: If it's not legally sound, it doesn't happen.

We look forward to continuing this journey with you. Thank you for trusting us with your capital, your goals, and your future.

A Word of Gratitude

None of this would have been possible without your trust and partnership. As we prepare for 2025, our mission remains clear: to deliver sustainable growth, innovative strategies, and unwavering dedication to your success.

Thank you for being an integral part of our journey. Together, we're shaping the future of private credit markets.

As we reflect on the achievements of the past year, we are deeply grateful for the trust and collaboration of our valued partners. Your unwavering support has been instrumental in our shared success.

On behalf of the entire team at Avanza Capital Holdings, we extend our warmest wishes to you and your families for a healthy, joyful holiday season and a prosperous New Year. May this season bring peace, happiness, and continued success to us all.

We look forward to building on our partnership and achieving even greater milestones together in the year ahead.

Wishing you all a joyful, healthy, and abundantly prosperous holiday season and New Year!

With gratitude and best regards,

Frank Scarso

frank@avanza.nyc

CEO, Avanza Capital Holdings

Anthony DeBenedictis

anthony@avanza.nyc

Managing Partner

Newsletter Disclaimer - Avanza Capital Holdings

The information provided in this newsletter is for informational purposes only and should not be considered financial, legal, or financial advice. Avanza Capital Holdings operates as a private merchant cash advance alternative non-traditional banking platform, not a hedge fund. Our approach focuses on delivering alternative financing solutions and unique private credit opportunities, which may not be suitable for all individuals.

All financial activities involve risk, and past performance is not indicative of future results. While Avanza Capital Holdings employs rigorous underwriting standards and risk management strategies, there is no guarantee of future returns or the preservation of capital. Readers are encouraged to conduct their own due diligence and seek guidance from licensed financial, tax, or legal professionals before making any financial decisions.

Avanza Capital Holdings does not provide tax advice. Any references to specific financial outcomes are for illustrative purposes only and should not be relied upon as a predictor of future success. For more information or to discuss potential opportunities, please contact us directly.

SOURCE: Avanza Capital HoldingsView the original press release on accesswire.com