VANCOUVER, BC / ACCESSWIRE / October 22, 2024 / Mako Mining Corp. (TSXV:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide third quarter 2024 ("Q3 2024") production results for the Company's San Albino gold mine ("San Albino") in northern Nicaragua as well as an update on its Eagle Mountain gold project in Guyana, South America. Certain amounts shown in this news release may not total to exact amounts due to rounding differences.

Q3 2024 Operational Highlights

-

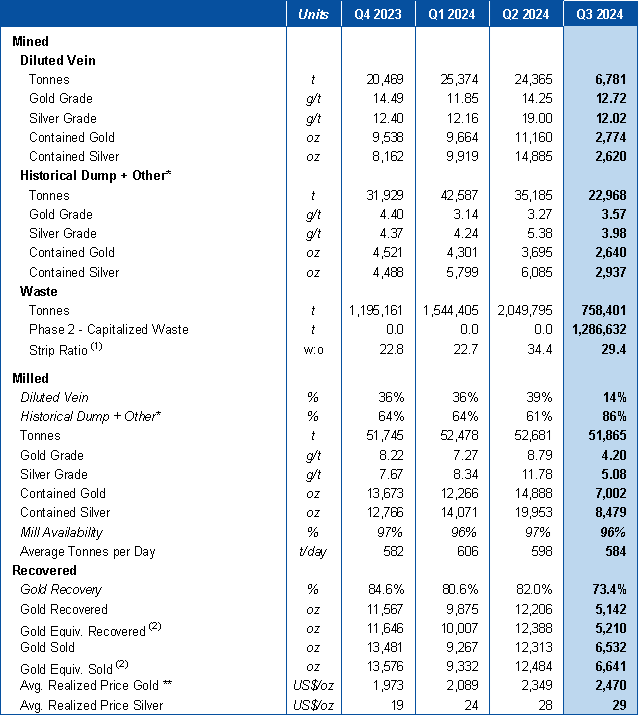

29,749 tonnes mined containing 5,414 ounces ("oz") of gold ("Au") at an average grade of 5.66 grams per tonne ("g/t") Au and 5,557 oz of silver ("Ag") at 5.81 g/t Ag

6,781 tonnes mined containing 2,774 oz Au at 12.72 g/t Au and 2,620 oz Ag at 12.02 g/t Ag from diluted vein material

22,968 tonnes mined containing 2,640 oz Au at 3.57 g/t Au and 2,937 oz Ag at 3.98 g/t Ag from historical dump and other mineralized material above cutoff grade ("historical dump + other")

29.4:1 strip ratio (1)

-

51,865 tonnes milled containing 7,002 oz Au at an average grade of 4.20 g/t Au and 8,479 oz Ag at 5.08 g/t Ag

14% and 86% from diluted vein and historical dump and other, respectively

584tonnes per day ("tpd") milled at 96% availability

Mill recovery of 73.4% for gold

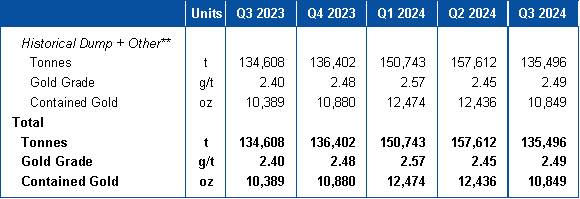

At quarter end, the stockpile was estimated at 135,496 tonnes at an average grade of 2.49 g/t Au for contained Au of 10,849 oz

5,142 oz Au recovered and 6,532 oz Au sold during the quarter

Delivered 40,500 oz of silver as part of the Sailfish Silver Loan for a total of US$ 1.2 million in Q3 2024

Akiba Leisman, Chief Executive Officer of Mako states that, "after the receipt of the Las Conchitas EIA in early July, the Company needed to accelerate a substantial amount of waste pre-stripping activities during Q3 in order to access consistent amounts of higher-grade diluted vein material from the mine. This stemmed from a decision the Company made at the end of 2022 to bifurcate the permits at Las Conchitas into 1) an initial bulk sample permit over six small mining zones; and 2) a final full-scale EIA permit over the entirety of the Las Conchitas area. This bifurcation allowed the Company to defer millions of dollars of surface acquisitions that have since been completed with cash flow generated from the mine. Because of the delay in the EIA permit, production for the quarter was relatively low, with 5,142 oz Au recovered and 6,532 oz Au sold during Q3 2024. Beginning in September, consistent access to diluted vein material was achieved. Production in Q4 2024 back to normal rates, with over 2,100 ounces of gold recovered in the first 19 days of the quarter."

Table 1 - Operating Results

* Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

**For the purpose of calculating revenue, payments to Sailfish are deducted from the Average Realized Price.

(1) Strip Ratio calculation does not include the Phase II - Waste Capitalization

(2) Equiv. Gold ounces are calculated by: Silver Rec. or Silver Sold (oz) / Avg. Realized Price of Gold (US$/oz) / Avg. Realized Price of Silver (US$/oz)

Table 2 - Quarter End Stockpile Statistics

** Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

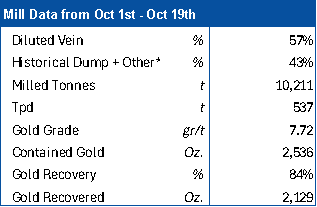

Table 3 - Mill Performance October 2024

Mining

The mine produced an average of 323 tonnes per day of diluted vein and historical dump + other material in Q3 2024. After the receipt of the Environmental Impact Assessment ("EIA") for the Las Conchitas area in early July, six months behind the original forecast, the Company was able to commence waste stripping outside the smaller area that was permitted for the initial bulk sample. In Q3 2024, 1,286,632 tonnes of waste material were mined outside the bulk sample area. This pre-stripping of the broader Las Conchitas area was originally scheduled to be completed between January and June of this year. Due to the delay, total diluted vein production in Q3 was approximately one fourth of average rates. The Company began to access more consistent volumes of diluted vein material in the middle of September, and production was fully back to normal in the beginning of Q4 (see Table 3).

The total production of diluted vein material in the quarter came from four different zones within the San Albino and Las Conchitas areas: 59% of the total ounces were mined from Limon Vein (Las Conchitas South), 34% from Mango Vein (Las Conchitas South), 6% from Southwest Pit (San Albino Deposit), and 1% from Phase 1 in Cruz Grande Vein (Las Conchitas Intermediate). The average grade of the diluted vein was 12.72 g/t Au containing 2,774 oz Au.

At quarter end, the stockpile was estimated at 135,496 tonnes containing 10,849 oz Au at 2.49 g/t Au.

Milling

All components of the 500 tpd gravity and carbon-in-leach processing plant have been fully operational since the beginning of May 2021. During Q3 2024, the plant throughput rate averaged 584 tpd, above the nameplate capacity of 500 tpd. The mill head grade averaged 4.20 g/t comprised of 14% diluted vein material and 86% historical dump + other material. This was below the normal 2:3 ratio due to the EIA permit delay mentioned above. The mill recovery averaged 73.4% for gold, resulting in 5,142 ounces of gold recovered in Q3. Since the beginning of October, consistent with the increased proportion of higher-grade diluted vein material, mill head grades and recoveries have reverted to normal, averaging 7.72 g/t Au and 84%, respectively. Gold production has also increased, with 2,129 gold ounces recovered during the first 19 days of Q4.

Mill availability remained high at 96% for the second consecutive quarter. The YTD plant availability of 97% compares favorably with plant availability rates achieved throughout the industry.

Eagle Mountain Gold Project

On September 30th, 2024, the Guyana Geology and Mines Commission ("GGMC"), approved the renewal of the Eagle Mountain Prospecting License ("PL"). Pursuant to the Guyana Mining Act, the term of prospecting licenses is three years with two rights of extension of one year each, for a total of five years. Stronghold Guyana, Mako's subsidiary in Guyana, was granted two other renewals in 2013 and 2019. The PL provides the Company with the exclusive right to explore the PL area for gold, valuable minerals, and base metals. The PL also provides Mako the exclusive right to apply for a mining license application over the PL area. This timeline assumes that further environmental, social, and technical studies and filings advance according to plan.

Through 2024, the Company's activities at Eagle Mountain have focused on engineering and environmental work, including tailings and waste dump siting studies, geotechnical drilling, hydrogeology and hydrology, and environmental geochemistry. These activities are predominantly geared to put the Company in a position to apply for an environmental permit and a mining license application in the second half of 2025, consistent with Mako's plan to accelerate the development plan for Eagle Mountain.

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. The Company also owns 100% of the gold project Eagle Mountain in Guyana, South America.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedarplus.ca.

Forward-Looking Information: Statements contained herein, other than historical fact, may be considered "forward-looking information" within the meaning of applicable securities laws. The forward-looking information contained herein is based on the Company's plans and certain expectations and assumptions, including that Q3, 2024 detailed operating costs and financial results will be available in November;and that the Company canoperate San Albino profitably in order to fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation; that the Company is not successful in operating San Albino profitably and/or funding its exploration of prospectus targets on its district-scale land package; political risks and uncertainties involving the Company's exploration properties; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company's expectations regarding the Company's Q3 2024 production results at San Albino gold project, and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on accesswire.com