MINNEAPOLIS, MN / ACCESSWIRE / May 9, 2023 / Insignia Systems, Inc. (Nasdaq:ISIG) ("Insignia") today reported financial results for the first quarter ended March 31, 2023 ("Q1").

Overview

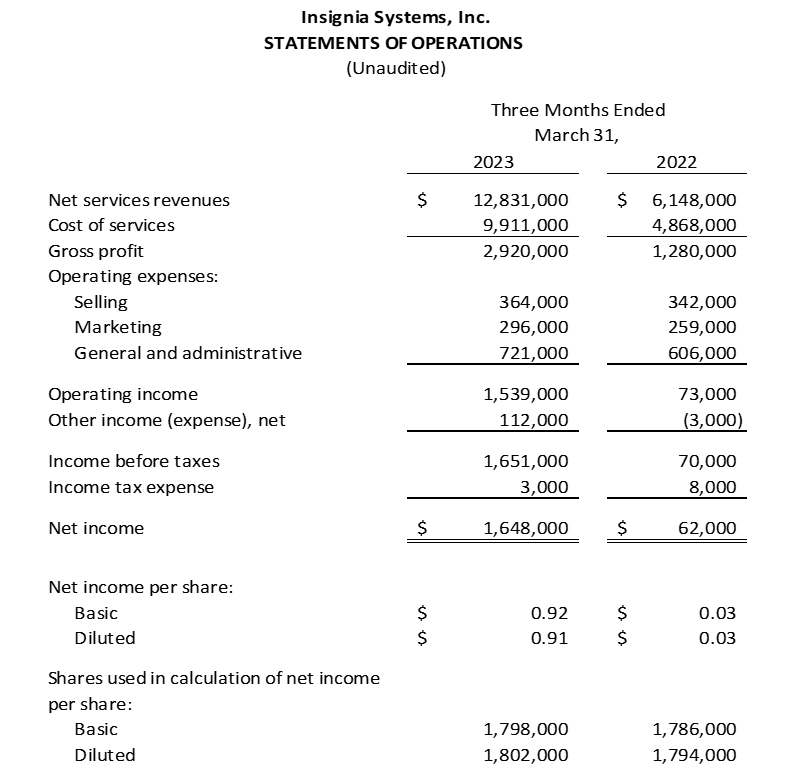

- Q1 2023 net sales increased 108.7% to $12.8 million from $6.1 million in Q1 2022.

- Q1 2023 operating income was $1.5 million compared to $73,000 in Q1 2022.

- Q1 2023 net income was $1.6 million, or $0.92 per basic share and $0.91 per diluted share, compared to $62,000, or $0.03 per basic and diluted share in Q1 2022.

Insignia's President and CEO, Kristine Glancy, commented, "Q1 2023 was the company's best revenue quarter ever, primarily driven by both new clients and retail expansion on our display solutions. We secured and supported several new brands launching in retail for their first time, while also retaining a significant number of clients executing additional projects with us. Our on-pack solutions also grew significantly, reaching our highest revenue quarter thus far, driven primarily by several larger new clients. I am extremely pleased with the strong start to 2023. Our clients appreciate our tailored approach to retail and have become some of our best advocates as we continue to expand our client portfolio with referrals."

Kristine Glancy continued, "Our team reached capacity with the high volume of projects, so we will be thoughtfully growing our team with the addition of several critical positions. We are also planning on optimizing our internal processes to help improve efficiency, so the team has even more time to spend with clients and growing our business. As announced at the end of 2022, we are winding down our POPS program, with the last programs executing in the second quarter. This has allowed us to redeploy resources to both on-pack and display, where we are continuing to see strong growth. Our display revenue is expected to fluctuate over the year, driven by the timing of retail category transitions and overall in-store support, with the first quarter typically providing the highest number of opportunities and revenue. As in past years for display and on-pack revenues, we expect the first quarter to be our best quarter, and we are anticipating losses in the remaining quarters of the year and a loss for the full year."

As previously announced, Insignia continues to explore strategic options to maximize shareholder value. Potential strategic alternatives that may be evaluated include, but are not limited to, an acquisition, merger, business combination, in-licensing, start-up of other new businesses, or other strategic initiatives. There can be no assurance that this process will result in any transaction or other initiatives, and the company has no updates at this stage. Chardan has been engaged to act as Insignia Systems' strategic financial advisor to assist the company in this review process. Insignia recently announced the launch of its newly created non-bank lending platform, led by Randy Uglem who has over twenty years of experience in the industry. Randy will help guide the company in this new platform as we look to use our strong cash position to explore opportunities.

Q1 2023 Results

Net sales increased 108.7% to $12,831,000 in Q1 2023, from $6,148,000 in Q1 2022, primarily due to a 121% increase in the combination of display and on-pack revenue, partially offset by a 43% decrease in signage revenue. Display revenue has increased due to both sales to new CPGs and an increase in sales to existing CPGs, and an increase in average contract size. Due to the sales cycles within the retailers that our display and on-pack solutions execute, we anticipate seasonality in sales, with those sales significantly stronger in the first quarter of the year, than in the remaining quarters of the calendar year.

Gross profit in Q1 2023 increased to $2,920,000, or 22.8% of net sales, from $1,280,000, or 20.8% of net sales, in Q1 2022. The increase in gross profit was primarily due to increased sales.

Selling expenses in Q1 2023 were $364,000, or 2.8% of net sales, compared to $342,000, or 5.6% of net sales, in Q1 2022. Increased selling expenses were primarily due to increased staff related expenses.

Marketing expenses in Q1 2023 were $296,000, or 2.3% of net sales, compared to $259,000, or 4.2% of net sales, in Q1 2022. Increased marketing expenses were primarily the result of increased staff and staff-related expenses.

General and administrative expenses in Q1 2023 were $721,000, or 5.7% of net sales, compared to $606,000, or 9.8% of net sales, in Q1 2022. Increased general and administrative expenses were primarily due to the comparison to reduced expenses in the first quarter of 2022 from the Director Deferred Compensation Plan due to a reduction in our share price for the three months ended March 31, 2022.

Other income for Q1 2023 was $112,000, compared to other expense of $3,000 for Q1 2022. The increase related primarily to interest income from short-term investments in Q1 2023.

Income tax expense for Q1 2023 was 0.2% of pretax income, or an expense of $3,000, compared to income tax expense of 11.4% of pretax income, or $8,000, in Q1 2022.

As a result of the items above, the net income for Q1 2023 was $1,648,000, or $0.92 per basic share and $0.91 per diluted share, compared to $62,000, or $0.03 per basic and diluted share, in Q1 2022. As discussed above, we anticipate seasonality in sales, with those sales and related gross profit expected to be relatively stronger in the first quarter of the year, resulting in expected losses in the remaining quarters of 2023, and a loss for the full year.

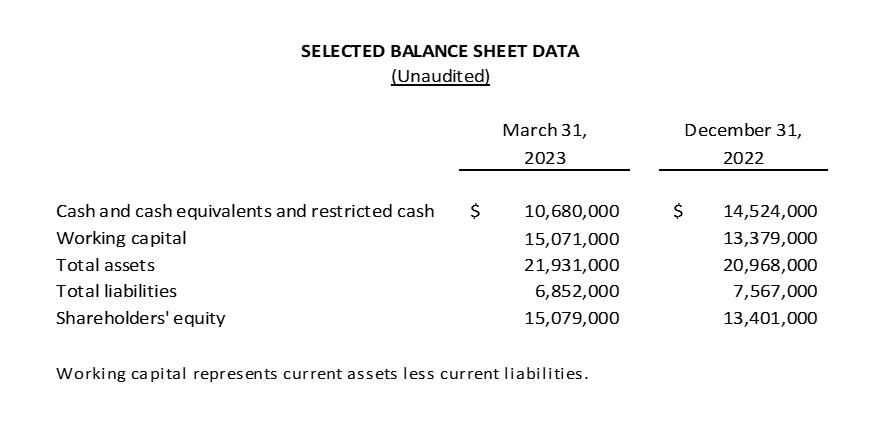

As of March 31, 2023, cash and cash equivalents and restricted cash totaled $10.7 million, compared to $14.5 million as of December 31, 2022. Working capital was $15.1 million at March 31, 2023 compared to $13.4 million at December 31, 2022.

About Insignia Systems, Inc.

Insignia Systems, Inc. is a leading provider of in-store solutions to consumer-packaged goods ("CPG") manufacturers, retailers, shopper marketing agencies and brokerages. The Company's primary solutions are display solutions, on-pack solutions and signage.

For additional information, contact (800) 874-4648, or visit the Insignia website at www.insigniasystems.com

Investor inquiries can be submitted to investorrelations@insigniasystems.com.

Cautionary Statement for the Purpose of Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995

Statements in this press release that are not statements of historical or current facts are considered forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. The words "anticipate," "continue," "expect," "plan," "remain," "will" and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these or any forward-looking statements, which speak only as of the date of this press release. Statements made in this press release regarding, for instance, the ongoing exploration of strategic alternatives, anticipated future profitability, future revenues, innovation and transformation of Insignia's business, allocations of resources, and the benefits of new relationships, are forward-looking statements. These forward-looking statements are based on current information, which we have assessed and which by its nature is dynamic and subject to rapid and even abrupt changes. As such, actual results may differ materially from the results or performance expressed or implied by such forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, including those set forth in our Annual Report on Form 10-K for the year ended December 31, 2022 and additional risks, if any, identified in our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K filed with the SEC. Such forward-looking statements should be read in conjunction with Insignia's filings with the SEC. Insignia assumes no responsibility to update the forward-looking statements contained in this press release or the reasons why actual results would differ from those anticipated in any such forward-looking statement, other than as required by law.

SOURCE: Insignia Systems, Inc.

View source version on accesswire.com:

https://www.accesswire.com/753491/Insignia-Systems-Inc-Announces-First-Quarter-2023-Financial-Results