VANCOUVER, BC / ACCESSWIRE / March 2, 2023 / Amarc Resources Ltd. ("Amarc" or the "Company") (TSXV:AHR)(OTCQB:AXREF) is pleased to announce the results of 2022 drilling at the PINE Deposit, and from scout drilling at prioritized porphyry copper-gold ("Cu-Au") deposit targets clustered across its 482 km2, 100%-owned JOY District (or "JOY"), in north-central British Columbia ("BC"). During the 2022 season Amarc completed 37 core holes (15,427 m) that considerably expanded the PINE Deposit to over a 1,700 m strike length, discovered new porphyry Cu-Au mineralization at the 5 km2 Canyon deposit target, and further defined additional deposit-scale porphyry systems requiring exploration drilling.

Over the past two years, Freeport-McMoRan Mineral Properties Canada Inc. ("Freeport"), which is earning-in at JOY, has invested approximately $20 million advancing exploration programs (see Amarc release October 11, 2022). Amarc is operator of the project.

Highlights from 2022 PINE Deposit Drilling Include:

- 204 m of 0.42% CuEQ* (0.18% Cu, 0.41 g/t Au and 2.3 g/t Ag)

- 105 m of 0.40% CuEQ (0.13% Cu, 0.47 g/t Au and 2.3 g/t Ag)

- 107 m of 0.31% CuEQ (0.09% Cu, 0.37 g/t Au and 1.2 g/t Ag)

- 179 m of 0.32% CuEQ (0.11% Cu, 0.36 g/t Au and 1.2 g/t Ag)

Highlights from New Porphyry Cu-Au Discovery at Canyon Deposit Target Include:

- 96 m of 0.51% CuEQ (0.39% Cu, 0.18 g/t Au and 2.6 g/t Ag), within

- 296 m of 0.39% CuEQ (0.30% Cu, 0.14 g/t Au and 1.7 g/t Ag)

*Copper equivalent (CuEQ) calculations use metal prices of: Cu US$4.00/lb, Au US$1,800.00/oz, Ag US$24.00/oz and conceptual recoveries of: Cu 85%, Au 72% and 67% Ag.

"The strong results delivered by our 2022 drilling continue to reveal the exceptional potential of the JOY District,"said Dr. Diane Nicolson, Amarc President and CEO. "Delineation drilling at the PINE Deposit substantially expanded mineralization and it is still wide open. In addition, scout drilling of expansive deposit scale targets is confirming the potential for clustered porphyry mineralized deposits around the PINE: the discovery of new copper-gold mineralization at the largely covered Canyon target is especially exciting. Also, as previously reported surface surveys are preparing new and compelling porphyry copper-gold deposit targets across JOY for drilling."

Nicolson said that having recently received and verified all drill results, Amarc is currently in the process of fully integrating all drill core assay details with extensive surface surveys, to complete 2023 program planning with Freeport.

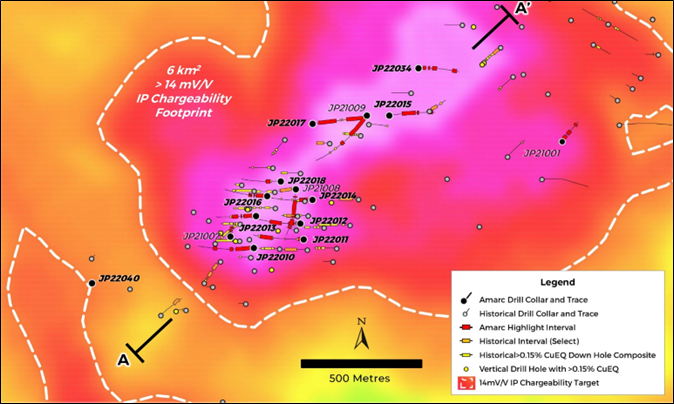

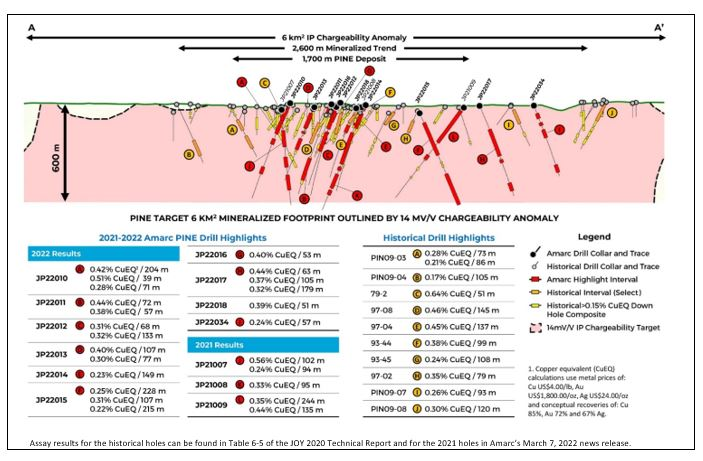

Expansion of the PINE Porphyry Cu-Au Deposit Over 1,700 m of Strike Length

Prior to 2022, drilling the PINE Deposit was, from Amarc's and historical drilling, known to extend over approximately 600 m by 900 m; importantly, it was also recognized to be open to expansion internally and laterally as well as to depth (see Amarc release March 7, 2022). In 2022, the 11 core holes (up to 781 m in length) completed at PINE successfully intercepted significant mineralization that extended the footprint of the deposit over a strike length of 1,700 m (Tables 1 and 2, Figures 1 and 2). Furthermore, outboard, wider spaced and mainly historical drilling indicates the potential to expand this footprint to over 2,600 m. Additionally, drilling is highlighting the favorable geometry of the PINE Deposit, with the majority of known mineralization occurring from surface to 300 m depth, and locally extending to 550 m depth. The PINE Deposit and its expansion potential are hosted within a larger 6 km2 mineralized system, which also remains to be fully explored.

Notably, additional centers of higher Cu-Au grade are beginning to emerge along the 1,700 m PINE Deposit trend. For example, Amarc drilling in the northeastern area of this trend has intersected significant porphyry mineralization over 600 m of strike length, including:

- 63 m of 0.44% CuEQ, within 179 m of 0.32% CuEQ (JP22017)

- 57 m of 0.40% CuEQ, within 107 m of 0.31% CuEQ (JP22015)

- 135 m of 0.44% CuEQ, within 244 m of 0.35% CuEQ (JP21009 completed in 2021)

Figure 1: PINE Deposit - IP Chargeability Surveys Have Confirmed a 6 km2 Mineral System

Figure 2: PINE Deposit - Multiple Higher Grade Centers Emerging Within PINE Mineral System

Table 1: JOY 2022 DRILL PROGRAM ASSAY Results

Target |

Drill Hole5 |

Azim (°) |

Dip |

EOH |

Incl. |

From |

To |

Int.123 |

CuEQ4 (%) |

Cu |

Au (g/t) |

Ag |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PINE | JP22010 | 265 | -60 | 681.00 | 18.96 | 223.03 | 204.07 | 0.42 | 0.18 | 0.41 | 2.3 | |

| Incl. | 18.96 | 49.35 | 30.39 | 0.44 | 0.12 | 0.55 | 2.0 | |||||

| Incl. | 84.83 | 223.03 | 138.20 | 0.48 | 0.22 | 0.43 | 2.8 | |||||

| and | 84.83 | 128.95 | 44.12 | 0.58 | 0.26 | 0.53 | 3.3 | |||||

| and | 141.82 | 223.03 | 81.21 | 0.51 | 0.24 | 0.45 | 2.9 | |||||

| 258.00 | 296.70 | 38.70 | 0.51 | 0.25 | 0.44 | 2.7 | ||||||

| Incl. | 258.00 | 285.81 | 27.81 | 0.62 | 0.29 | 0.54 | 3.3 | |||||

| 455.51 | 505.79 | 50.28 | 0.34 | 0.15 | 0.32 | 1.7 | ||||||

| PINE | JP22011 | 265 | -60 | 637.78 | 35.00 | 65.00 | 30.00 | 0.22 | 0.06 | 0.27 | 1.5 | |

| 386.00 | 542.00 | 156.00 | 0.36 | 0.20 | 0.25 | 2.5 | ||||||

| Incl. | 386.00 | 458.00 | 72.00 | 0.44 | 0.23 | 0.35 | 2.9 | |||||

| Incl. | 494.00 | 539.00 | 45.00 | 0.41 | 0.24 | 0.25 | 2.8 | |||||

| PINE | JP22012 | 265 | -60 | 597.00 | 41.50 | 54.52 | 13.02 | 0.26 | 0.12 | 0.22 | 2.0 | |

| 73.00 | 141.00 | 68.00 | 0.31 | 0.13 | 0.29 | 2.0 | ||||||

| Incl. | 126.00 | 141.00 | 15.00 | 0.49 | 0.20 | 0.49 | 2.7 | |||||

| 221.40 | 354.00 | 132.60 | 0.32 | 0.15 | 0.26 | 2.4 | ||||||

| Incl. | 221.40 | 301.48 | 80.08 | 0.35 | 0.17 | 0.30 | 2.7 | |||||

| PINE | JP22013 | 265 | -60 | 516.00 | 48.00 | 153.00 | 105.00 | 0.40 | 0.13 | 0.47 | 1.8 | |

| Incl. | 59.20 | 96.00 | 36.80 | 0.44 | 0.16 | 0.48 | 2.3 | |||||

| JP22013 | Incl. | 114.00 | 153.00 | 39.00 | 0.46 | 0.12 | 0.59 | 1.4 | ||||

| 177.00 | 189.51 | 12.51 | 0.42 | 0.12 | 0.52 | 1.3 | ||||||

| 226.14 | 303.00 | 76.86 | 0.30 | 0.14 | 0.27 | 1.4 | ||||||

| Incl. | 226.14 | 245.41 | 19.27 | 0.45 | 0.14 | 0.54 | 1.4 | |||||

| PINE | JP22014 | 270 | -60 | 594.00 | 27.00 | 42.00 | 15.00 | 0.28 | 0.10 | 0.31 | 1.3 | |

| 62.05 | 167.00 | 104.95 | 0.25 | 0.10 | 0.26 | 1.3 | ||||||

| Incl. | 66.00 | 84.00 | 18.00 | 0.34 | 0.11 | 0.40 | 1.2 | |||||

| Incl. | 111.00 | 141.00 | 30.00 | 0.33 | 0.12 | 0.37 | 1.7 | |||||

| PINE | JP22015 | 90 | -60 | 647.00 | 72.00 | 300.00 | 228.00 | 0.25 | 0.08 | 0.28 | 1.0 | |

| Incl. | 72.00 | 178.78 | 106.78 | 0.31 | 0.09 | 0.37 | 1.2 | |||||

| and | 72.00 | 129.00 | 57.00 | 0.40 | 0.10 | 0.53 | 1.3 | |||||

| and | 72.00 | 84.00 | 12.00 | 0.81 | 0.16 | 1.15 | 2.0 | |||||

| Incl. | 189.00 | 300.00 | 111.00 | 0.21 | 0.08 | 0.22 | 0.8 | |||||

| 431.97 | 647.00 | 215.03 | 0.22 | 0.10 | 0.21 | 0.8 | ||||||

| Incl. | 522.00 | 534.00 | 12.00 | 0.47 | 0.10 | 0.64 | 1.6 | |||||

| and | 561.00 | 644.55 | 83.55 | 0.24 | 0.12 | 0.20 | 0.9 | |||||

| PINE | JP22016 | 265 | -65 | 609.00 | 13.23 | 155.56 | 142.33 | 0.26 | 0.08 | 0.30 | 1.1 | |

| Incl. | 18.00 | 66.00 | 48.00 | 0.41 | 0.12 | 0.50 | 1.4 | |||||

| 175.51 | 186.33 | 10.82 | 0.30 | 0.12 | 0.31 | 1.4 | ||||||

| 213.36 | 232.07 | 18.71 | 0.22 | 0.12 | 0.17 | 1.4 | ||||||

| 241.78 | 258.00 | 16.22 | 0.29 | 0.10 | 0.32 | 1.2 | ||||||

| PINE | JP22017 | 90 | -60 | 624.00 | 174.00 | 352.80 | 178.80 | 0.32 | 0.11 | 0.36 | 1.2 | |

| Incl. | 248.03 | 352.80 | 104.77 | 0.37 | 0.13 | 0.43 | 1.1 | |||||

| and | 272.72 | 336.00 | 63.28 | 0.44 | 0.14 | 0.52 | 1.2 | |||||

| and | 272.72 | 291.00 | 18.28 | 0.56 | 0.12 | 0.76 | 1.5 | |||||

| Incl. | 310.00 | 336.00 | 26.00 | 0.45 | 0.17 | 0.49 | 1.2 | |||||

| 378.00 | 390.00 | 12.00 | 0.30 | 0.12 | 0.30 | 1.3 | ||||||

| PINE | JP22018 | 265 | -60 | 490.50 | 126.00 | 177.00 | 51.00 | 0.38 | 0.13 | 0.4 | 1.8 | |

| PINE | JP22034 | 90 | -60 | 504.00 | 59.67 | 95.08 | 35.41 | 0.14 | 0.05 | 0.14 | 0.3 | |

| 124.71 | 145.17 | 20.46 | 0.24 | 0.13 | 0.20 | 0.8 | ||||||

| 174.13 | 231.00 | 56.87 | 0.24 | 0.14 | 0.17 | 1.6 | ||||||

| 423.32 | 477.33 | 54.01 | 0.13 | 0.07 | 0.10 | 0.9 | ||||||

| PINE | JP22040 | 270 | -90 | 405.00 | No significant intercepts | |||||||

| Canyon | JP22029 | 40 | -60 | 234.00 | No significant intercepts | |||||||

| Canyon | JP22030 | 55 | -60 | 753.00 | 342.00 | 638.25 | 296.25 | 0.39 | 0.30 | 0.14 | 1.7 | |

| Incl. | 345.21 | 456.00 | 110.79 | 0.48 | 0.38 | 0.16 | 2.5 | |||||

| Incl. | 351.00 | 447.00 | 96.00 | 0.51 | 0.39 | 0.18 | 2.6 | |||||

| and | 360.00 | 399.00 | 39.00 | 0.56 | 0.42 | 0.20 | 2.7 | |||||

| Incl. | 552.00 | 580.00 | 28.00 | 0.51 | 0.40 | 0.19 | 1.4 | |||||

| 708.90 | 719.40 | 10.50 | 0.77 | 0.61 | 0.25 | 2.1 | ||||||

| Canyon | JP22036 | 55 | -60 | 588.00 | 24.47 | 219.00 | 194.53 | 0.20 | 0.14 | 0.09 | 2.3 | |

| Incl. | 69.00 | 76.00 | 7.00 | 0.91 | 0.54 | 0.59 | 6.9 | |||||

| Incl. | 162.30 | 177.00 | 14.70 | 0.33 | 0.22 | 0.18 | 2.1 | |||||

| JP22036 | 210.00 | 219.00 | 9.00 | 0.27 | 0.17 | 0.15 | 1.8 | |||||

| 407.00 | 464.00 | 57.00 | 0.17 | 0.12 | 0.08 | 0.8 | ||||||

| Canyon | JP22038 | 55 | -60 | 576.00 | 384.00 | 570.00 | 186.00 | 0.15 | 0.12 | 0.04 | 0.8 | |

| Canyon | JP22042 | 235 | -70 | 661.30 | 299.40 | 564.00 | 264.60 | 0.15 | 0.11 | 0.06 | 0.8 | |

| Incl. | 318.00 | 347.61 | 29.61 | 0.23 | 0.16 | 0.12 | 1.1 | |||||

| Incl. | 453.00 | 498.00 | 45.00 | 0.20 | 0.15 | 0.07 | 0.9 | |||||

| Canyon | JP22043 | 50 | -60 | 735.00 | 582.00 | 726.00 | 144.00 | 0.16 | 0.13 | 0.03 | 0.8 | |

| Twins | JP22019 | 50 | -60 | 384.00 | 54.00 | 125.58 | 71.58 | 0.21 | 0.10 | 0.19 | 1.0 | |

| Incl. | 99.00 | 125.58 | 26.58 | 0.29 | 0.12 | 0.30 | 1.2 | |||||

| 215.00 | 276.00 | 61.00 | 0.19 | 0.11 | 0.14 | 1.2 | ||||||

| Twins | JP22020 | 235 | -60 | 270.00 | 12.00 | 216.00 | 204.00 | 0.11 | 0.03 | 0.14 | 0.4 | |

| Incl. | 44.22 | 90.00 | 45.78 | 0.17 | 0.05 | 0.22 | 0.6 | |||||

| Twins | JP22021 | 55 | -60 | 216.00 | No significant intercepts | |||||||

| Twins | JP22023 | 235 | -60 | 36.00 | Abandoned in overburden | |||||||

| Twins | JP22025 | 50 | -60 | 219.00 | 12.00 | 48.00 | 36.00 | 0.11 | 0.04 | 0.11 | 0.6 | |

| Twins | JP22026 | 55 | -55 | 282.00 | No significant intercepts | |||||||

| Twins | JP22031 | 55 | -60 | 249.00 | 60.00 | 105.00 | 45.00 | 0.10 | 0.04 | 0.11 | 0.3 | |

| SWT | JP22022 | 265 | -55 | 528.00 | No significant intercepts | |||||||

| SWT | JP22024 | 225 | -60 | 501.00 | 414.30 | 417.00 | 2.70 | 2.12 | 0.005 | 3.73 | 6.2 | |

| SWT | JP22027 | 70 | -60 | 342.00 | 24.00 | 27.00 | 3.00 | 0.25 | 0.09 | 0.28 | 0.4 | |

| SWT | JP22028 | 70 | -60 | 342.00 | 264.00 | 342.00 | 78.00 | 0.08 | 0.02 | 0.11 | 0.4 | |

| Incl. | 328.71 | 342.00 | 13.29 | 0.14 | 0.03 | 0.20 | 0.5 | |||||

| South MEX | JP22041 | 54.16 | 59.82 | 323.00 | 101.00 | 173.00 | 72.00 | 0.10 | 0.02 | 0.10 | 3.4 | |

| Incl. | 127.00 | 149.00 | 22.00 | 0.15 | 0.03 | 0.16 | 4.8 | |||||

| Wrich | JP22044 | 335 | -70 | 393.00 | 59.00 | 167.00 | 108.00 | 0.20 | 0.03 | 0.23 | 6.4 | |

| Incl. | 65.00 | 86.00 | 21.00 | 0.32 | 0.04 | 0.32 | 13.6 | |||||

| Incl. | 119.00 | 137.00 | 18.00 | 0.28 | 0.03 | 0.44 | 1.7 | |||||

| Incl. | 158.00 | 167.00 | 9.00 | 0.34 | 0.02 | 0.46 | 10.2 | |||||

| Finlay North | JP22032 | 30 | -60 | 225.00 | No significant intercepts |

|||||||

| Finlay North | JP22033 | 30 | -60 | 243.00 | 66.00 | 87.00 | 21.00 | 0.07 | 0.004 | 0.11 | 0.4 | |

| Finlay North | JP22035 | 30 | -70 | 219.40 | No significant intercepts |

|||||||

| Finlay South | JP22037 | 55 | -60 | 221.00 | 17.00 | 29.00 | 12.00 | 0.14 | 0.10 | 0.06 | 2.0 | |

| Finlay South | JP22039 | 235 | -50 | 356.00 | No significant intercepts |

|||||||

| CT | JP22045 | 90 | -60 | 204.00 | No significant intercepts |

|||||||

Notes:

- Widths reported are drill widths, such that true thicknesses are unknown.

- All assay intervals represent length-weighted averages.

- Some figures may not sum exactly due to rounding.

- Copper equivalent (CuEQ) calculations use metal prices of: Cu US$4.00/lb., Au US$1800/oz. and Ag US$24/oz. and conceptual recoveries of: Cu 85%, Au 72% and 67% Ag. Conversion of metals to an equivalent copper grade based on these metal prices is relative to the copper price per unit mass factored by conceptual recoveries for those metals normalized to the conceptualized copper recovery. The metal equivalencies for each metal are added to the copper grade. The general formula for this is: CuEQ% = Cu% + ((Au g/t * (Au recovery / Cu recovery) * (Au $ per oz./ 31.1034768 / Cu $ per lb. * 22.04623)) + ((Ag g/t * (Ag recovery / Cu recovery) * (Ag $ per oz. / 31.1034768 / Cu $ per lb. * 22.04623))

- The collar locations in UTM NAD83, Zone 9N coordinates for drill holes are listed in Table 2.

Discovery At Canyon Deposit Target Highlights Potential for Clustered Deposits at JOY

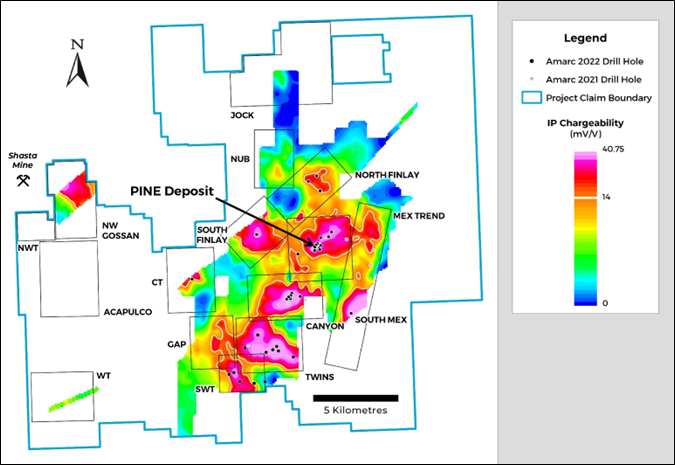

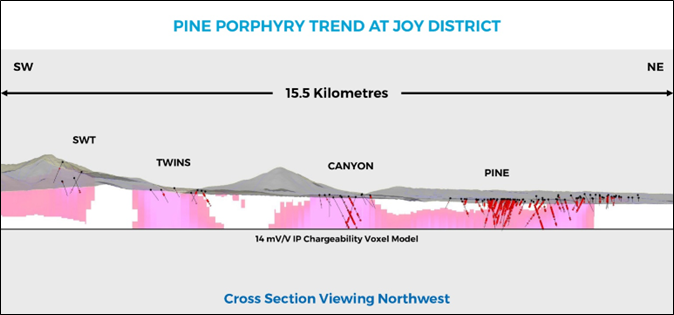

Eight extensive porphyry Cu-Au deposit targets were explored with 26 scout drill holes in 2022, including four targets that had not previously been drill tested. These deposit targets include the Canyon (5 km2), Twins (7 km2) and SWT (3 km2) which along with PINE (6 km2) form the 15.5 km northeast trending PINE Trend, and the South Mex (>1.9 km2) open deposit target at the south end of the 6 km-long MEX Trend (see Amarc's January 23, 2023 news release) (Figures 3 and 4). These trends are similar to the 4 km-long northeast trend of the Nugget, Kemess North, Kemess Underground, Kemess Offset and Kemess East porphyry Cu-Au deposits in the Kemess Mining District held by Centerra Gold Inc., located adjacent to the south of the JOY tenure.

Figure 3: JOY District - IP Surveys Have Outlined Large Clustered Mineral Systems

At Canyon very limited initial scout drilling of this expansive (5 km2) and largely covered sulphide system by Amarc in 2021 (JP21006: 27 m of 0.18% CuEQ with 0.06% Cu, 0.21 g/t Au) (see Amarc news release March 7, 2022) and historical operators (MEX12-013: 49 m of 0.16% CuEQ with 0.05% Cu, 0.20 g/t Au, and PIN09-15: 3 m of 11 g/t Au), intersected promising Cu-Au and Au-only mineralization compatible with the fringes of a potentially important porphyry Cu-Au system. In 2022, further reconnaissance drilling at Canyon discovered a significant new zone of porphyry Cu-Au mineralization with hole JP22030 intersecting:

-

96 m of 0.51% CuEQ (0.39% Cu, 0.18 g/t Au and 2.6 g/t Ag), within

296 m of 0.39% CuEQ (0.30% Cu, 0.14 g/t Au and 1.7 g/t Ag) - 10.5 m of 0.77% CuEQ (0.61% Cu, 0.25 g/t Au, 2.1 g/t Ag)

Four other scout drill holes intersected less robust Cu-Au mineralization disrupted by inter-mineral intrusions. The Canyon discovery remains open to expansion and requires substantial drilling, as does the host 5 km2 IP geophysical anomaly which indicates the presence of a large-scale sulphide system.

Figure 5: Canyon Deposit Target - New Discovery Validates Systematic Exploration Strategy

The highly prospective Twins (7 km2) deposit target is located adjacent and to the southwest along the 15.5 km PINE Trend from Canyon. A single scout drill hole completed by Amarc in 2021 (JP21004), the first ever drilled into the large Twins target, intersected 63 m of 0.18% CuEQ with 0.09% Cu, 0.15 g/t Au, 0.5 g/t Ag, including 39 m of 0.22% CuEQ with 0.11% Cu, 0.19 g/t Au, 0.6 g/t Ag, successfully discovering porphyry-type Cu-Au mineralization (see Amarc release March 7, 2022) within this large mineralized sulphide system. In 2022, very widely-spaced follow-up reconnaissance drill holes, ranging in length from 216 m to 384 m, targeted magnetic high features within the extensive IP chargeability footprint (Figure 3) and encountered widespread indications of porphyry Cu-Au mineralization.

Based on comparisons with the Canyon discovery and the PINE Deposit, intervals of porphyry Cu-Au mineralization including 27 m of 0.29% CuEQ (0.12% Cu, 0.30 g/t Au, 1.2 g/t Ag) in JP22019 and 204 m of 0.11% CuEQ (0.04% Cu, 0.14 g/t Au, 0.4 g/t Ag) in JP22020, may represent the lateral or upper parts of a yet undiscovered porphyry Cu-Au center. The large footprint of this target, its veneer of glacial overburden cover, and Cu-Au intercepts in the widely spaced and relatively shallow drill holes highlight the significant exploration potential for the discovery of another porphyry Cu-Au deposit at Twins.

Systematic Exploration of Emerging Deposit Targets

A similar strategy of initial drill testing with single to widely spaced shorter scout drill holes was employed at other overburden-covered targets, including South MEX, South Finlay, North Finlay and CT, with results indicating continued systematic exploration is warranted. At South MEX, a single scout drill hole, the first in this >1.9 km2 IP chargeability anomaly which remains open to expansion, intersected anomalous Au-Cu-Ag (72 m of 0.10% CuEQ (0.02% Cu, 0.10 g/t Au, 3.4 g/t Ag) in JP22041) in volcanics that straddle the prospective Triassic-Jurassic contact: a geological environment similar to that hosting the Kemess District porphyry Cu-Au deposits (see Amarc release January 23, 2023).

Scout drilling at SWT returned local zones of anomalous Au-Cu compatible with proximity to a porphyry Cu-Au system (e.g. 78 m of 0.09% CuEQ (0.02% Cu, 0.11 g/t Au, 0.04 g/t Ag) in JP22028), as well as local vein-hosted Au-only mineralization (2.7 m of 3.7 g/t Au in JP22024). At the adjacent Wrich occurrence, Au-Ag-Cu mineralization (108 m of 0.20% CuEQ (0.03% Cu, 0.23 g/t Au, 6.4 g/t Ag) in JP22044) is associated with advanced argillic alteration zones and may represent a higher-level signature of a porphyry Cu-Au system.

About the JOY District

Amarc's 100%-owned JOY District is located on the northern extension of the prolific Kemess porphyry Cu-Au District that includes the former Kemess South mine, the permitted and development-stage Kemess North underground deposit, and the advanced-stage Kemess East underground deposit - all currently held by Centerra Gold Inc. Through its association with Hunter Dickinson Inc., Amarc's technical team was first to recognize the Kemess District's true porphyry potential, acquiring Kemess North and Kemess South as early-stage prospects and advancing both to significant porphyry Cu-Au deposits. Kemess South was sold in 1996 on beneficial terms to a predecessor of Northgate Minerals, which brought that deposit into production.

The JOY District is readily accessed via resource roads servicing the southern end of the Toodoggone region, including Centerra's Kemess porphyry Cu-Au deposits and the historical Lawyers, Baker and Shasta epithermal precious metal mines now being redeveloped by Benchmark Metals Inc. and TDG Gold Corp, respectively.

In May 2021, Amarc entered into a Mineral Property Earn-In Agreement (the "EIA") with Freeport-McMoRan Mineral Properties Canada Inc. ("Freeport"), a wholly owned subsidiary of Freeport-McMoRan Inc. (see Amarc release May 12, 2021). Freeport may acquire up to a 70% ownership interest in JOY by making staged investments totally $110 million.

In 2021, Freeport contributed $5.94 million to the Year 1 JOY exploration program and approximately $14 million in 2022 as its Year 2 investment (see Amarc releases November 15 and December 15, 2021).

Further in-depth information on historical and more recent exploration activities completed within the JOY District prior to 2021 can be found in the Company's 'JOY Project 2020 Technical Report', filed under Amarc's profile at www.sedar.com or located on its website at https://amarcresources.com/projects/joy-project/technical-report/.

About Amarc Resources Ltd.

Amarc is a mineral exploration and development company with an experienced and successful management team focused on developing a new generation of long-life, high-value porphyry Cu-Au mines in BC. By combining high-demand projects with dynamic management, Amarc has created a solid platform to create value from its exploration and development-stage assets.

Amarc is advancing its 100%-owned IKE, DUKE and JOY porphyry Cu±Au districts located in different prolific porphyry regions of southern, central and northern BC, respectively. Each district represents significant potential for the development of multiple and important-scale, porphyry Cu±Au deposits. Importantly, each of the three districts is located in proximity to industrial infrastructure - including power, highways and rail.

Amarc is associated with HDI, a diversified, global mining company with a 35-year history of porphyry discovery and development success. Previous and current HDI projects include some of BC's and the world's most important porphyry deposits - such as Pebble, Mount Milligan, Southern Star, Kemess South, Kemess North, Gibraltar, Prosperity, Xietongmen, Newtongmen, Florence, Casino, Sisson, Maggie, IKE, PINE and DUKE. From its head office in Vancouver, Canada, HDI applies its unique strengths and capabilities to acquire, develop, operate and monetize mineral projects.

Amarc works closely with local governments, Indigenous groups and stakeholders in order to advance its mineral projects responsibly, and in a manner that contributes to sustainable community and economic development. We pursue early and meaningful engagement to ensure our mineral exploration and development activities are well coordinated and broadly supported, address local priorities and concerns, and optimize opportunities for collaboration. In particular, we seek to establish mutually beneficial partnerships with Indigenous groups within whose traditional territories our projects are located, through the provision of jobs, training programs, contract opportunities, capacity funding agreements and sponsorship of community events. All Amarc work programs are carefully planned to achieve high levels of environmental and social performance.

Qualified Person as Defined Under National Instrument 43-101

Dr. Roy Greig, P.Geo., a Qualified Person as defined under National Instrument 43-101, has reviewed and approved the technical content in this release.

Quality Control/Quality Assurance Program

Amarc drilled mostly NQ size core in 2022, except in the PINE Deposit area where the holes were drilled HQ core size and then reduced to NQ, typically around 200 m depth, to hole completion. Overall, 12% of the 2022 core drilled was HQ size. All drill core was logged, photographed, and cut in half with a diamond saw. Half core samples from JOY were sent to Activation Laboratories Ltd. (Actlabs), Kamloops, Canada facility for preparation and analysis. During peak periods, samples were also prepared at Actlabs laboratories located in Timmins and Ancaster, Ontario.

At the preparation laboratory, the entire sample was dried, crushed to 80% passing 2 mm size, mechanically split (by riffle) to obtain a representative sample and then pulverized to at least 95% minus 105 microns (μm) (method RX1). The pulverized fraction was analyzed for Au at either the Actlabs, Kamloops, Timmins or Ancaster laboratory by fire assay fusion of a 30 g sub-sample with an ICP-OES finish (method 1A2-ICP). All samples were also analyzed with a multi-element ICP finish. In this method, Cu, Ag and 58 additional elements were determined by 4-acid digestion of a 0.25 sub-sample followed by an ICP-OES and ICP-MS finish (method UT6). Samples >10,000 ppm Cu by UT6 were also analyzed by assay grade 4-acid digestion ICP-OES. All multi-element and Cu ICP analysis was done at the Ancaster facility.

The three Actlabs facilities are ISO/IEC 17025 accredited. As part of a comprehensive Quality Assurance/Quality Control ("QAQC") program, Amarc control samples were inserted in each analytical batch at the following rates: standards one in 20 regular samples, coarse reject duplicate splits one in 20 samples and blanks one in 80 regular samples, or once per drill hole. The control sample results were then checked to ensure proper QAQC.

For further details on Amarc Resources Ltd., please visit the Company's website at www.amarcresources.com or contact Dr. Diane Nicolson, President and CEO, at (604) 684-6365 or within North America at 1-800-667-2114, or Kin Communications, at (604) 684-6730, Email: AHR@kincommunications.com.

ON BEHALF OF THE BOARD OF DIRECTORS OF AMARC RESOURCES LTD.

Dr. Diane Nicolson

President and CEO

Neither the TSX Venture Exchange nor any other regulatory authority accepts responsibility for the adequacy or accuracy of this release.

Forward Looking and other Cautionary Information

This news release includes certain statements that may be deemed "forward-looking statements". All such statements, other than statements of historical facts that address exploration plans and plans for enhanced relationships are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Assumptions used by the Company to develop forward-looking statements include the following: Amarc's projects will obtain all required environmental and other permits and all land use and other licenses, studies and exploration of Amarc's projects will continue to be positive, and no geological or technical problems will occur. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, potential environmental issues or liabilities associated with exploration, development and mining activities, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and tenure and delays due to third party opposition, changes in and the effect of government policies regarding mining and natural resource exploration and exploitation, exploration and development of properties located within Aboriginal groups asserted territories may affect or be perceived to affect asserted aboriginal rights and title, which may cause permitting delays or opposition by Aboriginal groups, continued availability of capital and financing, and general economic, market or business conditions, as well as risks relating to the uncertainties with respect to the effects of COVID-19. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on Amarc Resources Ltd., investors should review Amarc's annual Form 20-F filing with the United States Securities and Exchange Commission at www.sec.gov and its home jurisdiction filings that are available at www.sedar.com.

Table 2: 2022 Drill Hole Information

Target |

Drill Hole |

Easting |

Northing |

EOH |

Azimuth (°) |

Dip (°) |

||

| PINE | JP22010 |

638,143 |

6,343,346 |

681.0 |

265 |

-60 |

||

JP22011 |

638,446 |

6,343,397 |

637.8 |

265 |

-60 |

|||

JP22012 |

638,425 |

6,343,494 |

597.0 |

265 |

-60 |

|||

JP22013 |

638,156 |

6,343,540 |

516.0 |

265 |

-60 |

|||

JP22014 |

638,499 |

6,343,638 |

594.0 |

270 |

-60 |

|||

JP22015 |

638,500 |

6,344,100 |

647.0 |

90 |

-60 |

|||

JP22016 |

638,224 |

6,343,661 |

609.0 |

265 |

-65 |

|||

JP22017 |

638,965 |

6,344,150 |

624.0 |

90 |

-60 |

|||

JP22018 |

638,306 |

6,343,750 |

490.5 |

265 |

-60 |

|||

JP22034 |

639,143 |

6,344,438 |

504.0 |

90 |

-60 |

|||

JP22040 |

637,160 |

6,343,132 |

405.0 |

270 |

-90 |

|||

| Canyon | JP22029 |

637,298 |

6,340,650 |

234.0 |

40 |

-60 |

||

JP22030 |

636,622 |

6,340,620 |

753.0 |

55 |

-60 |

|||

JP22036 |

636,744 |

6,340,707 |

588.0 |

55 |

-60 |

|||

JP22038 |

636,726 |

6,340,515 |

576.0 |

55 |

-60 |

|||

JP22042 |

636,806 |

6,340,843 |

661.3 |

235 |

-70 |

|||

JP22043 |

636,507 |

6,340,491 |

735.0 |

50 |

-60 |

|||

| Twins | JP22019 |

634,805 |

6,338,385 |

384.0 |

50 |

-60 |

||

JP22020 |

636,023 |

6,337,445 |

270.0 |

235 |

-60 |

|||

JP22021 |

635,300 |

6,337,367 |

216.0 |

55 |

-60 |

|||

JP22023a |

635,919 |

6,337,711 |

36.0 |

235 |

-60 |

|||

JP22023b |

635,919 |

6,337,711 |

21.0 |

0 |

-90 |

|||

JP22025 |

636,897 |

6,337,094 |

219.0 |

50 |

-60 |

|||

JP22026 |

634,058 |

6,337,632 |

282.0 |

55 |

-55 |

|||

JP22031 |

635,687 |

6,337,521 |

249.0 |

55 |

-60 |

|||

| SWT | JP22022 |

633,752 |

6,335,649 |

528.0 |

265 |

-55 |

||

JP22024 |

634,593 |

6,335,544 |

501.0 |

225 |

-60 |

|||

JP22027 |

633,123 |

6,336,072 |

342.0 |

70 |

-60 |

|||

JP22028 |

633,404 |

6,336,177 |

342.0 |

70 |

-60 |

|||

| South MEX | JP22041 |

640,298 |

6,339,647 |

323.0 |

54 |

-60 |

||

| Wrich | JP22044 |

635,243 |

6,335,632 |

393.0 |

335 |

-70 |

||

| Finlay North | JP22032 |

638,471 |

6,346,850 |

225.0 |

30 |

-60 |

||

JP22033 |

637,780 |

6,347,399 |

243.0 |

30 |

-60 |

|||

JP22035 |

638,263 |

6,347,722 |

219.4 |

30 |

-70 |

|||

| Finlay South | JP22037 |

634,740 |

6,344,289 |

221.0 |

55 |

-60 |

||

JP22039 |

634,740 |

6,344,289 |

356.0 |

235 |

-50 |

|||

| CT | JP22045 |

630,954 |

6,341,657 |

204.0 |

90 |

-60 |

||

Figure 1: PINE Deposit - IP Chargeability Surveys Have Confirmed a 6 km2 Mineral System

Figure 2: PINE Deposit - Multiple Higher Grade Centers Emerging Within PINE Mineral System

Figure 3: JOY District - IP Surveys Have Outlined Large Clustered Mineral Systems

Figure 4: PINE Trend - 15.5 km-long Mineralized PINE Trend Hosts the PINE Deposit, the Canyon Discovery and the Twins and SWT Deposit Targets

Figure 5: Canyon Deposit Target - New Discovery Validates Systematic Exploration Strategy

SOURCE: Amarc Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/741602/Amarc-Joy-District-Drilling-Significantly-Expands-Pine-Cu-Au-Deposit-and-Makes-Important-New-Discovery-at-Canyon