TORONTO, ON / ACCESSWIRE / December 22, 2022 / Magna Terra Minerals Inc. (the "Company" or "Magna Terra") (TSXV:MTT) is pleased to announce that it has amended the option agreement (the "Amendment Agreement") on its 100%-controlled Hawkins Love Gold Project ("Hawkins Love" or "Project"), located in Southern New Brunswick (Exhibit A). The Amendment Agreement allows the Company to lower near-term cash and share issuance obligations while we continue to assess the potential for the Property to host gold mineralization. The Company is also pleased to provide an update on exploration activities from its 2022 prospecting and mapping program that assessed five (5) new gold targets identified through soil geochemistry over an 8-kilometre strike (see news release dated February 17, 2022). Preliminary exploration on the five gold targets has resulted in the discovery of zones of quartz-sulphide veining with anomalous gold (grab samples* up to 38 ppb gold) at the Jake Lee gold target and strong carbonate-sericite alteration at the Love gold target (see further details below).

Project Highlights

- Quartz vein boulders* with visible gold assaying up to 302.5 g/t gold;

- Soil samples assaying up to 10.0 g/t gold including 276 soil samples >10 ppb gold and 21 samples >50 ppb gold;

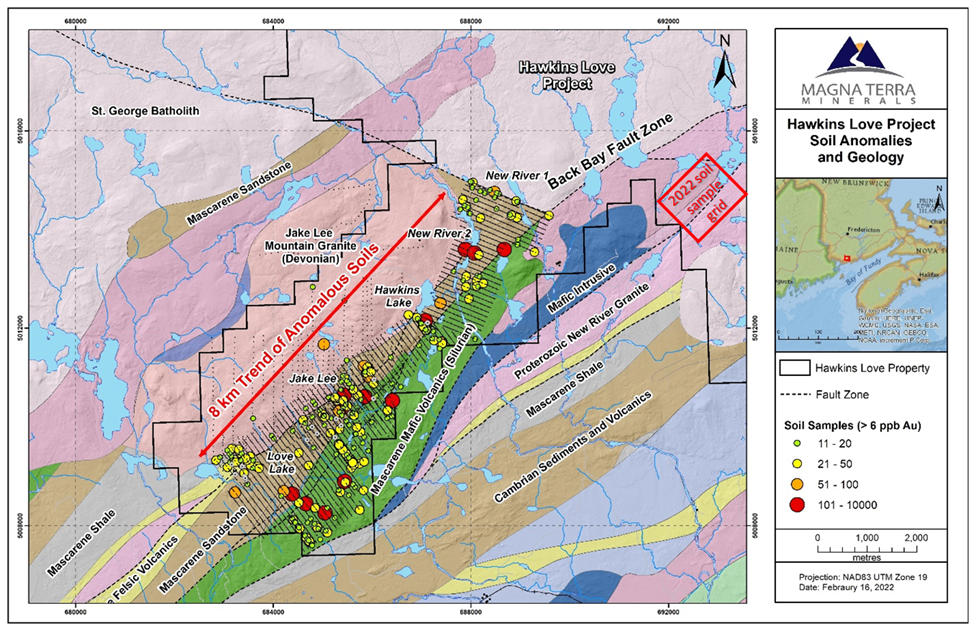

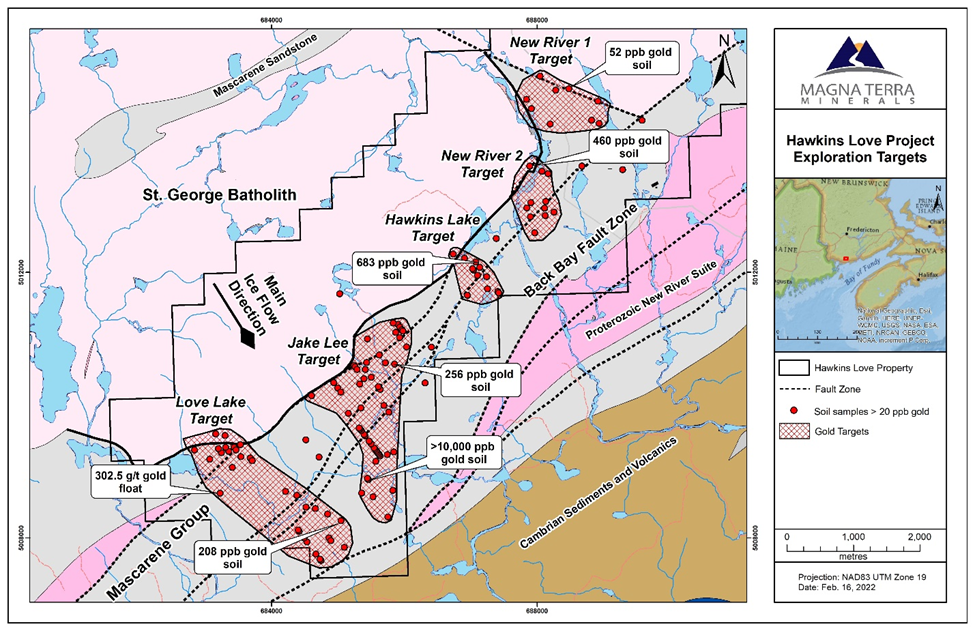

- Five (5) gold targets recently identified on geophysics and gold-in-soil trends discovered along the Back Bay Fault (Exhibits B and C);

- 8-kilometre trend of anomalous gold in soil anomalies and grab samples from five (5) gold targets situated along the Back Bay Fault;

- New gold targets at Hawkins Love share a similar geological environment to the nearby Clarence Stream Deposit - deformed sediments and volcanics adjacent to the St. George granite;

- Quartz-sulphide veins identified at the Jake Lee gold target (Exhibit D); and

- 9,155 hectares of prospective mineral lands along a 10-kilometre extent of a regional-scale gold bearing structure - the Back Bay Fault.

*Note: "grab and float samples" are selected samples and are not necessarily indicative of mineralization that may be hosted on the property.

"We are pleased to have negotiated amended terms to the Hawkins Love agreement that will defer cash and share payments due in 2022 and reduce payments in 2023 and 2024. This restructured agreement will assist the Company in managing its current cash balance and minimize share dilution while we navigate recent unsettled markets for junior gold issuers. Our recently completed exploration program, following-up on the five gold targets identified through work in 2021, has demonstrated that the Project is host to orogenic-style quartz-sulphide veining and alteration that are indicative of potential for the Project to host gold deposits. While we remain focussed on our flagship Great Northern Project in Newfoundland, we continue to believe in the exploration potential of Hawkins Love, as it hosts a similar geological environment to Galway's nearby, multi-million ounce Clarence Stream Project."

~ Lew Lawrick, President and CEO, Magna Terra Minerals Inc.

Exhibit A: Regional Geology and Gold Deposits of Southern New Brunswick with Magna Terra Project Locations.

Exhibit B: Property Geology and Gold Anomalies with location of 2022 soil sample grid; Hawkins Love Project.

Exhibit C: Five Exploration Targets based on gold-in-soil geochemical trends; Hawkins Love Project.

Exhibit D: Quartz-sulphide veins from the Jake Lee gold target; Hawkins Love Project.

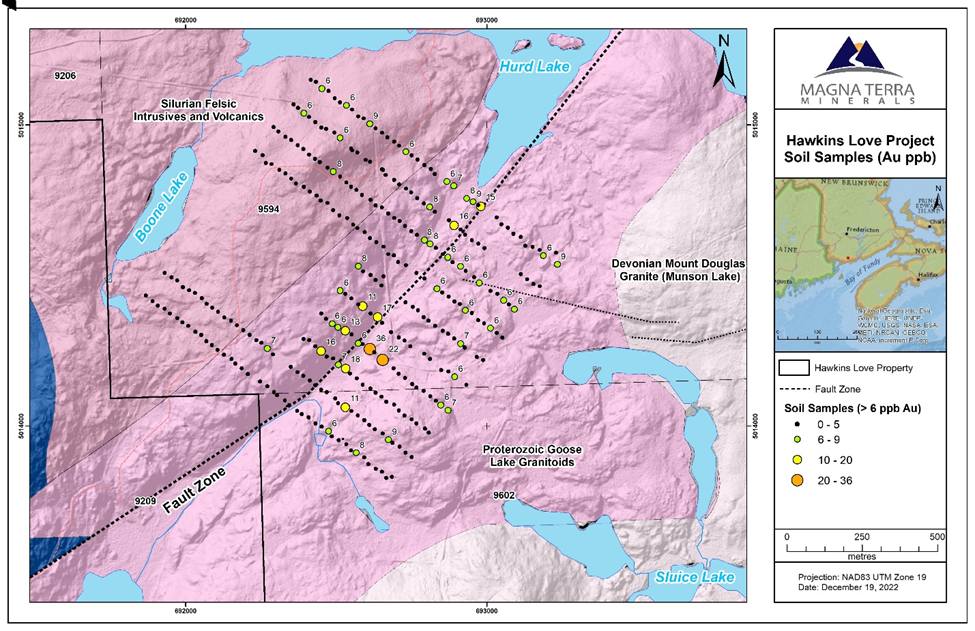

Exhibit E: 2022 Soil sample location map showing trend of anomalous soils along an inferred fault zone; Hawkins Love Project.

Option Agreement Amendment

Under the original terms of the Hawkins Love option agreement dated November 7, 2020 (the "Agreement"), the Company could earn a 100% interest in the Hawkins Love Property by paying the Optionors a total of $400,000 in cash and/or equivalent value MTT shares ("Consideration Shares") and 150,000 Consideration Shares over a four-year period ending November 7, 2024 under the following schedule:

- on the Effective Date - $30,000 in Cash (Paid) and 150,000 Consideration Shares (Issued);

- on or before the first anniversary of the Effective Date - $70,000 in Cash and/or Consideration Shares (Paid/Issued);

- on or before the second anniversary of the Effective Date - $100,000 in Cash and/or Consideration Shares;

- on or before the third anniversary of the Effective Date - $100,000 in Cash and/or Consideration Shares; and

- on or before the fourth anniversary of the Effective Date - $100,000 in Cash and/or Consideration Shares.

On December 12, 2022, the Company entered into the Amendment Agreement whereby it will now earn a 100% property interest by paying the Optionors a total of $400,000 in cash and/or consideration shares and 300,000 consideration shares, over a five-year period ending November 7, 2025.

- on the Effective Date - $30,000 in Cash (Paid) and 150,000 Consideration Shares (Issued);

- on or before the first anniversary of the Effective Date - $70,000 in Cash and/or Consideration Shares (Paid/Issued);

- on or before the third anniversary of the Effective Date - a mandatory payment of 150,000 Consideration Shares;

- on or before the third anniversary of the Effective Date - $35,000 in Cash and/or Consideration Shares;

- on or before the fourth anniversary of the Effective Date - $65,000 in Cash and/or Consideration Shares; and

- on or before the fifth anniversary of the Effective Date - $200,000 in Cash and/or Consideration Shares.

The Company, at its sole election can, pay up to 50% of the value of the annual Cash and/or Consideration Share payment as Consideration Shares.

All other terms of the original Agreement remain unchanged.

Importantly, under the terms of the Amendment Agreement, the Company does not have to make a payment during 2022 assisting the current cash balance and deferring payments into late 2023. Additionally, payments for 2023 and 2024 have been reduced in exchange for a higher payment in the final year of the Amendment Agreement. This structure allows the Company to lower near-term cash and share issuance obligations while it continues to explore the Property. To date, the Company has paid a total of $77,775 in cash and issued 344,444 Consideration Shares under the Agreement.

The maximum number of shares issuable by the Company with respect to the future potential share consideration payment is 3,150,000 shares. All share issuances will be based on the greater of $0.05 per share or the 20-day volume weighted average price on the date a payment is due, and the Company elects to make such payment in common shares. Furthermore, the common shares which may be issued under the agreement will be subject to a regulatory four month and one day hold period from their date of issuance. The Amendment Agreement is subject to approval by the TSX Venture Exchange.

Exploration Update

During June and July 2022, the Company completed a prospecting and geological mapping program focused on follow-up of the five key exploration targets at Hawkins Love. A total of 119 rock grab and float samples and 317 B-horizon soil samples were collected from the Property. Preliminary follow-up exploration on the five gold targets has resulted in the discovery of zones of quartz-sulphide veining with anomalous gold (grab samples* up to 38 ppb gold; Exhibit D) at the Jake Lee gold target and strong iron carbonate-sericite-pyrite-quartz alteration at the Love Gold Target.

The zone of quartz veining at the Jake Lee gold target comprises an exposed zone hosted within sulphide-bearing black shale and felsic volcanic rocks that contains appreciable (up to 5%) fine grained pyrite mineralization. The zone of veining has an estimated width of 5 metres and an unknown strike extent, although the zone of veining and host black shale is associated with an historic VLF conductor and IP chargeability high/resistivity low over strike lengths of 1.6 and 2.1 kilometres, respectively. The vein zone also sits central to a 500 metre-long soil geochemical trend that assays up to 110 ppb gold.

Prospecting at the Love gold target around soil samples assaying up to 165 ppb gold discovered a zone of strong, pervasive iron carbonate, sericite and pyrite altered and quartz veined felsic volcanics that sit proximal to a contact with black shales and mafic volcanics. Although grab samples from the outcrop did not yield assays greater than 5 ppb gold, the presence of orogenic gold-style alteration in this area is considered positive for further exploration potential.

The soil sampling program was designed to test the faulted contact between Silurian intrusive and felsic volcanic rocks of the Mascarene Group and intermediate intrusive rocks of the Goose Lake Granitoids suite and also provide a first-pass on an area that has seen little historic exploration at the east side of the Property (Exhibits C and E). 10 of the 317 soil samples collected contained anomalous gold and assayed between 11 and 36 ppb gold. Each of these anomalous samples were collected within 100 metres of, and are centred along, a 700-metre strike extent of the inferred fault. Follow-up exploration is required to explain this anomalous geochemical trend in the area.

All rock and soil samples were shipped to ALS Global in Moncton, New Brunswick or Sudbury, Ontario for sample preparation and then sent on to ALS Global in North Vancouver, British Columbia for gold and multiple elements via methods Au-AA23 (standard fire assay with Atomic Adsorption finish) and ME-ICP41 (4-acid digestion).

The Company would like to thank the New Brunswick Government for partial funding of the Hawkins Love exploration program under the New Brunswick Junior Mining Assistance Program.

Exploration Target Summary

The recently identified gold targets at the Hawkins Love Project, are hosted in the same geological environment as the Clarence Stream deposit 40 kilometres away, owned by Galway Metals. The Clarence Stream Gold Deposit currently has an NI43-101 combined open-pit and underground Indicated Mineral Resources of 922,000 ounces of gold (12,396,000 tonnes at 2.31 g/t gold) and Inferred Mineral Resources of 1,334,000 ounces of gold (15,963,000 tonnes at 2.60 g/t gold).

The Hawkins Love gold targets are nested along a 10-kilometre long prominent structure known as the Back Bay Fault system that is 3.0 kilometres wide and locally coincident with the southern contact between the Saint George Batholith and the Mascarene Group volcanic and sedimentary rocks. (See Exhibits A and B).

The exploration work to date completed by the team at Magna Terra, has outlined five (5) significant geochemical and structural target areas at the Hawkins Love Project; the Jake Lee, Hawkins, Love, New River 1 and New River 2 gold targets.

The Jake Lee gold target is a zone of anomalous soils and has been outlined over an extent of 1.7 by 2.7 kilometres, with 54 soil samples assaying greater than 20 ppb gold and up to 256 ppb gold and >10,000 ppb gold, over a strike length of 1.7 kilometres that coincides with high tenor, historic stream silt samples assaying up to 5,280 ppb gold in an area of bedrock base metal (Cu, Pb, Zn) mineralization (Exhibit C). A soil sample assaying >10,000 ppb gold (>10 g/t gold; upper detection level) is located at the southern extent of the Jake Lee target and forms a priority target for follow-up prospecting.

The Love gold target includes 32 high tenor soil samples assaying > 20 ppb gold and up to 208 ppb gold occur over an area of 2.8 by 1.0 kilometres with the highest tenor soils located 500 to 1,000 metres down-ice (southwest) of historic, visible gold-bearing boulders* assaying up to 302.5 g/t gold.

The Hawkins gold target includes 12 anomalous soil samples assaying greater than 20 ppb gold and up to 683 ppb gold coincide with know bedrock base metal (Cu, Pb, Zn) mineralization and form a target over a 1.0 by 0.6 kilometre area.

The New River 1 gold target includes 9 anomalous soil samples assaying greater than 20 ppb gold and up to 52 ppb gold form a target over a 1.4 by 0.7 kilometre area.

The New River 2 gold target includes 10 anomalous soil samples assaying greater than 20 ppb gold and up to 460 ppb gold forms a target over a 1.2 by 0.6 kilometre area.

The Hawkins Love Property is characterized by an area with a complex glacial geological history with areas that have thin glacial till cover and other areas covered by thicker glacial till blankets and glacial-fluvial material. The soil anomalies show a consistent southeast directed glacial dispersion, where transport of gold-bearing soils from a source located up-ice from the northwest extent of the soil trend is likely, typically near the deformed northern margin of the Mascarene group in proximity to granitoids of the St. George Batholith (Exhibit C).

Qualified Person and Technical Reports

This news release has been reviewed and approved by David A. Copeland, P. Geo., Chief Geologist with Signal Gold Inc., a "Qualified Person", under National Instrument 43-101 - Standard for Disclosure for Mineral Projects. All quoted rock and soil samples and grades have been compiled from historic assessment reports obtained from the Government of New Brunswick as well as recently acquired data.

All rock float and grab samples and soil samples referred to in this release were analyzed for gold at ALS Global in North Vancouver, BC ("ALS"), using standard fire assay (30 g) pre-concentration or fire assay fusion with Atomic Absorption finish (method AU-AA23). ALS is a fully accredited firm within the meaning of NI 43-101 for provision of this service.

About Magna Terra

Magna Terra Minerals Inc. is a precious metals focused exploration company, headquartered in Toronto, Canada. Magna Terra owns two district-scale, resource stage gold exploration projects in the top-tier mining jurisdictions of New Brunswick and Newfoundland and Labrador. Further, the Company maintains a significant exploration portfolio in the province of Santa Cruz, Argentina which includes its precious metals discovery on its Luna Roja Project, as well as an extensive portfolio of district scale drill ready projects available for option or joint venture.

Forward Looking Statements

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian legislation. All statements in this news release that are not purely historical are forward-looking statements and include statements regarding beliefs, plans, expectations and orientations regarding the future including, without limitation, the ability of the Company to file a report that complies with Regulation 43-101. Although the Company believes that such statements are reasonable and reflect expectations of future developments and other factors which management believes to be reasonable and relevant, the Company can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: "believes", "expects", "anticipates", "intends", "estimates", "plans", "may", "should", "would", "will", "potential", "scheduled" or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, and the ability of the author of the Technical Reports to finalize same.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include the inability of the Company to execute its proposed business plans, and carry out planned future activities. Other factors may also adversely affect the future results or performance of the Company, including general economic, market or business conditions, future prices of gold, changes in the financial markets and in the demand for precious metals, changes in laws, regulations and policies affecting the mineral exploration industry, and the Company's investment and operation in the mineral exploration sector, as well as the risks and uncertainties which are more fully described in the Company's annual and quarterly management's discussion and analysis and in other filings made by the Company with Canadian securities regulatory authorities under the Company's profile at www.sedar.com. Readers are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly, are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements.

These forward-looking statements are made as of the date of this news release and, unless required by applicable law, the Company assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in these forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Magna Terra Minerals Inc.

Lewis Lawrick

President and CEO, Director

647-478-5307

Email: info@magnaterraminerals.com

Website: www.magnaterraminerals.com

SOURCE: Magna Terra Minerals Inc.

View source version on accesswire.com:

https://www.accesswire.com/732987/Magna-Terra-Announces-Hawkins-Love-Option-Agreement-Amendment-and-Provides-Project-Update