Strongest quarter of FY 2021, with revenue expected to more than double in Fiscal 2022 to approximately $27 million

TORONTO, ON / ACCESSWIRE / December 20, 2021 / Electrovaya Inc. ("Electrovaya" or the "Company") (TSX:EFL)(OTCQB:EFLVF), a lithium-ion battery manufacturer with differentiated intellectual property that allows heightened safety and improved longevity enabling industry-leading performance, today reported its financial results for the fourth quarter and fiscal year ended September 30, 2021 ("Q4 FY2021" & "FY 2021", respectively). All dollar amounts are in U.S. dollars unless otherwise noted.

Financial Highlights:

- Revenue for Q4 FY2021 was $4.2 million (C$5.4 million), compared to $6.9 million (C$8.8 million) in the fiscal fourth quarter ended September 30, 2020 ("Q4 FY2020"). Revenue for Q4 FY2021 decreased by 40% compared to Q4 FY2020 but increased significantly on a sequential basis compared to $1.9 million (C$3.2 million) in the fiscal third quarter ended June 30, 2021 ("Q3 FY2021"). Management believes that the year-over-year revenue decline in Q4 FY2021 was primarily due to a reduced-order volume resulting from a transition to the OEM Strategic Supply Agreement, which was signed in December 2020. This agreement brought a new corporate sales team focused on large corporations, and management believes the sales cycle is relatively long for these customers. Continued disruptions to the supply chain caused by the COVID-19-pandemic, as well as component shortages, also impacted the Company. Management is encouraged by the strong quarterly sequential revenue growth in Q4 FY2021 and believes the situation has improved, as the Company has received indications of significant new orders for delivery in the 2022 calendar year.

- Revenue for FY 2021 was $11.6 million (C$14.8 million), compared to revenue of $14.5 million (C$18.5 million) in the fiscal year ended September 30, 2020 ("FY 2020"). The gross margin was 34% in FY 2021, which was consistent with FY 2020.

- The balance sheet was strengthened during FY 2021. On September 30, 2021, current assets were $12.0 million, current liabilities were $13.5 million, and the equity deficiency was $1.7 million. This represents an increase of $4.0 million in current assets, a reduction of $3.0 million in current liabilities, and a reduction in the equity deficiency of $7.0 million compared to the balances as of September 30, 2020.

- On September 27, 2021, the Company completed a brokered private placement of Common Shares and warrants to purchase Common Shares with an institutional investor in the United States for gross proceeds of approximately C$3.8 million. The Company issued 2,919,230 Common Shares and warrants to purchase up to 1,459,615 Common Shares at a price of C$1.30 per Common Share and associated warrant. Each warrant entitles the holder thereof to purchase one Common Share at an exercise price of C$1.60 per Common Share at any time prior to September 29, 2024.

- On December 7, 2021, the Company filed a final base shelf prospectus with the securities regulatory authorities in each of the provinces of Canada. The base shelf prospectus is valid for a 25-month period, during which time the Company may offer and issue, from time to time, common shares, warrants, units, subscription receipts, and debt securities, or any combination thereof, having an aggregate offering price of up to $100 million. The ability to draw on the shelf prospectus was conditional upon extending the working capital and promissory note facilities. This condition is now fulfilled.

- On December 17, 2021, the Company amended its C$7 million working capital facility to extend the maturity from December 31, 2021 to December 31, 2022.

- On December 17, 2021, the promissory note which was due to mature on December 31, 2021 was amended to extend the maturity to July 1, 2022.

Business Highlights:

- On September 22, 2021, the Company launched EVISION, an internally developed and proprietary remote monitoring system. This new system is cloud-based and is able to track battery operational usage in Electrovaya-powered applications such as lift trucks or electric buses in real-time. The system monitors battery health, utilization, and charging to provide customers with optimized fleet and charging management. The EVISION system is now live and generating revenue.

- On September 23, 2021, the Company announced that its research division, Electrovaya Labs, produced promising initial test results using a proprietary approach for a solid-state (NMC cathode/lithium metal anode) battery. The initial results have demonstrated minimal capacity fade, and multiple tests have demonstrated the repeatability of the performance with coin cells at room temperature.

- On October 5, 2021, the Company announced that all of its battery models will be receiving a capacity increase of approximately 7%. This change has also been reflected in the UL files for Electrovaya batteries, in which new model numbers are used to reflect the capacity increases. Furthermore, additional models have been added to the UL file, expanding the number of Electrovaya UL-listed offerings.

- On October 13, 2021, the Company signed a Strategic Supply Agreement with Vicinity Motor Corp, a leading supplier of electric, compressed natural gas, and clean diesel vehicles. The Vicinity Strategic Supply Agreement is for the supply of battery systems for Vicinity's line of Vicinity Lightning™ EV buses and fully electric VMC 1200 Class 3 trucks.

- On December 1, 2021, the Company announced that Steven Berkenfeld has been engaged as a Special Advisor to the CEO and Board. Mr. Berkenfeld will provide capital markets, strategic, and commercial guidance to support the company's growth across multiple market segments.

Positive Financial Outlook:

The Company anticipates revenue of approximately $27 million for the fiscal year ending September 30, 2022 ("FY 2022"), more than double the revenue total of $11.6 million in FY 2021. The revenue is anticipated to be generated from two primary sources: direct sales and sales through the Company's OEM partner dealer network.

The revenue forecast takes into consideration the OEM Strategic Supply Agreement, which includes an exclusivity provision, pursuant to which the OEM must make annual purchases in the minimum amount of $15 million in order to maintain exclusivity. This annual period commences on January 1, 2022. While there is no assurance that the OEM will make more than $15 million of purchases in 2022, given the sales initiatives underway with the OEM, management anticipates achieving or even possibly exceeding this minimum purchase level and has accordingly included it in the revenue forecast of $27 million for FY 2022.

Impact of COVID-19 Pandemic:

Electrovaya is an essential business and has operated without major interruption during the COVID-19 pandemic to date. The Company's customers include large global firms in industries such as grocery, logistics, and e-commerce that are continuing to provide critical services during this difficult period. The crisis has highlighted Electrovaya's important role in helping its customers execute mission-critical applications under highly challenging conditions. COVID-19 did disturb the Company's supply chain from many of its global vendors, with resultant delays in delivery of the Company's products to its customers and associated cost increases.

Electrovaya considers the health and safety of its employees and other stakeholders to be of the highest priority. To mitigate any potential spread of COVID-19, the Company has implemented a number of common-sense initiatives at its headquarters, including increased sanitization of frequently touched surfaces, use of masks, air purifiers, and social distancing guidelines, all of which somewhat reduce operational efficiency.

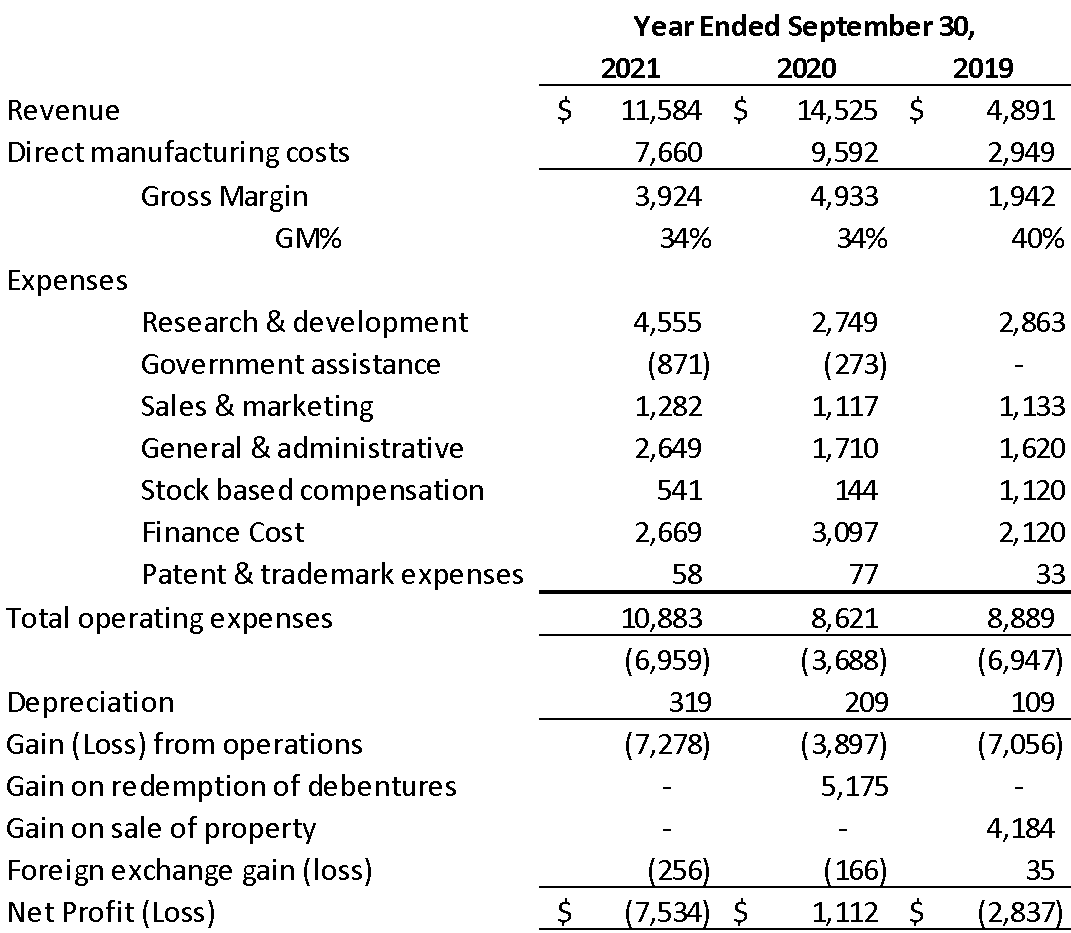

Selected Annual Financial Information for the Years ended September 30, 2021, 2020 and 2019

Results of Operations

(Expressed in thousands of U.S. dollars)

Summary Financial Position

(Expressed in thousands of U.S. dollars)

Quarterly Results of Operations

(Expressed in thousands of U.S. dollars)

The Company's complete Financial Statements, Management Discussion and Analysis and Annual Information Form for the fourth quarter and fiscal year ended September 30, 2021 are available at www.sedar.com or on the Company's website at www.electrovaya.com.

Conference Call Details:

The Company will hold a conference call on Tuesday, December 21, 2021 at 8:00 a.m. Eastern Time (ET) to discuss the September 30, 2021 year-end financial results and to provide a business update.

US and Canada toll free: (877) 407-8291

International: + 1(201) 689-8345

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to

the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks

beginning on December 21, 2021 through January 4, 2022. To access the replay, the U.S. dial-in number is (877) 660-6853 and the non-U.S. dial-in number is +1 (201) 612-7415. The replay conference ID is 13725757.

For more information, please contact:

Investor Contact:

Jason Roy

Electrovaya Inc.

Telephone: 905-855-4618

Email: jroy@electrovaya.com

About Electrovaya Inc.

Electrovaya Inc. (TSX:EFL)(OTCQB:EFLVF) designs, develops and manufactures proprietary Lithium Ion batteries, battery systems, and battery-related products for energy storage, clean electric transportation and other specialized applications. Electrovaya is a technology focused company with extensive IP. Headquartered in Ontario, Canada, Electrovaya has production facilities in Canada with customers around the globe.

To learn more about how Electrovaya is powering mobility and energy storage, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements that relate to, among other things, revenue forecasts and in particular the revenue forecasts for the fiscal year ending September 30, 2022, expected improvements in sales and revenues in fiscal year 2022, the Company's ability to satisfy its ongoing debt obligations, the ability to draw under the Company's shelf prospectus, anticipated increased collaboration with OEMs and OEM channels constituting a source of sales growth for the Company, in particular, the Company's OEM partner making purchases under the OEM Strategic Supply Agreement in the minimum amount necessary to maintain exclusivity, anticipated sales under the Vicinity Strategic Supply Agreement, anticipated continued increases in sales momentum in fiscal 2022 in the Company's direct sales channel, the future direction of the Company's business and products, the effect of the ongoing global COVID-19 public health emergency on the Company's operations, employees and other stakeholders, including on customer demand, supply chain, and delivery schedule, the Company's ability to source supply to satisfy demand for its products and satisfy current order volume, technology development progress, plans for product development, and the Company's markets, objectives, goals, strategies, intentions, beliefs, expectations and estimates generally, and can generally be identified by the use of words such as "may", "will", "could", "should", "would", "likely", "possible", "expect", "intend", "estimate", "anticipate", "believe", "plan", "objective" and "continue" (or the negative thereof) and words and expressions of similar import. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from expectations include but are not limited to: that current customers will continue to make and increase orders for the Company's products, and in accordance with communicated intentions and expectations, that the Company's alternate supply chain will be adequate to replace material supply and manufacturing, that the Company's settlement of the Litarion insolvency proceedings will proceed as outlined in the settlement agreement and without a significant negative effect on the Company or its assets, general business and economic conditions (including but not limited to currency rates and creditworthiness of customers), Company liquidity and capital resources, including the availability of additional capital resources to fund its activities, competition in the battery production and energy storage industry, changes in laws and regulations, legal and regulatory proceedings, the ability to adapt products and services to the changing market, the ability to attract and retain key executives, the granting of additional intellectual property protection, and the ability to execute strategic plans. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the Company's Annual Information Form for the year ended September 30, 2021 under "Risk Factors", and in the Company's most recent annual Management's Discussion and Analysis under "Qualitative And Quantitative Disclosures about Risk and Uncertainties" as well as in other public disclosure documents filed with Canadian securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

Revenue forecasts herein constitute future‐oriented financial information and financial outlooks (collectively, "FOFI"), and generally, are, without limitation, based on the assumptions and subject to the risks set out above under "Forward‐Looking Statements". Although management believes such assumption to be reasonable, a number of such assumptions are beyond the Company's control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management's current expectations and plans relating to the Company's future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company's financial condition in accordance with IFRS, and it is expected that there may be differences between actual and forecasted results, and the differences may be material. The inclusion of the FOFI in this news release disclosure should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

SOURCE: Electrovaya, Inc.

View source version on accesswire.com:

https://www.accesswire.com/678796/Electrovaya-Reports-Q4-FY2021-and-Fiscal-2021-Results