If anyone read about Recharge Resources Ltd. (OTC: RECHF)(CSE: RR)(Frankfurt: SL5) without knowing its share price, they would likely conclude that it's a large-cap exploration and development company. They would have reasons to believe that. Foremost, they control precedent-rich assets in some of the world's most mining-friendly jurisdictions, are shifting toward advanced-stage exploration at projects, and have the capital to conclude 2023 exploration initiatives. Additionally, they have assays, surveys, and geological evidence indicating that they could be sitting on millions, even billions, of dollars worth of assets at its Pocitos, Georgia Lake, and West Lithium projects.

So, for those guessing that RECHF shares trade closer to those of the sector giants, they were off by a long measure. RECHF shares trade at, despite the list just provided, roughly $0.25 a share. That's not necessarily discouraging to many. Those owning shares since the start of May have an over 56% return to date. And that's against a horrible backdrop for small, micro, and nanocap stocks that have been beaten lower in 2023. The broader averages mask the underbelly of the market. Other than a few large-cap names, most company stocks have struggled to stay green.

Of course, RECHF is performing well because they are completing the groundwork needed to monetize some of their prize mining-project assets. The goal is to provide significant lithium supplies and other potentially unearthed metals to power the global shift toward electrification. But investors aren't rewarding RECHF shares for sitting idle. Instead, RECHF shares are in rally mode because of the advances made at its mining-friendly project locations.

Reasons To Be Bullish On RECHF Stock

Many reasons justify the interest in RECHF. Most recently, the company announced its Ekosolve™ Lithium Solvent Exchange Extraction process has been able to extract 94.9% of the lithium from the brines provided from its 2022 DDH3 drill program at the Pocitos 1 lithium brine project located in Salta, Argentina. The update is fueling optimism that this project can be massive.

Highlights from the report indicate that the EkosolveTM DLE Extraction technology pilot plant tested at the University of Melbourne achieved 94.9% extraction efficiency with brines at an average lithium concentration of 86 ppm LI. Lithium recovered from 85.08 ppm Li in brine was 80.76 ppm, representing slightly better than previous brines tested and, notably, the second-highest recovery recorded in RECHF's history. Moving forward, Lithium chloride salt production is the next stage of processing, as potential offtake partners of Richlink have indicated their preference for Lithium Chloride. That initiative begins, which includes a new drill/production well program when the permits are issued by Salta Mines Department.

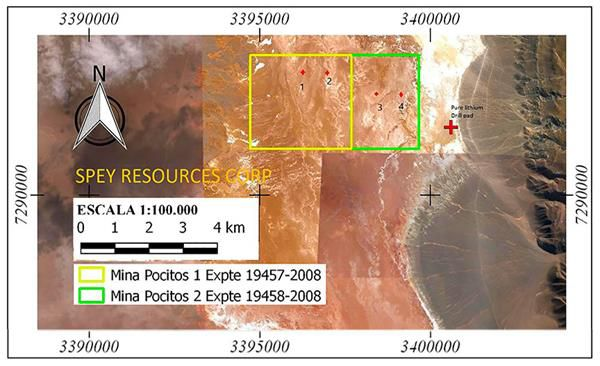

Those measures add to other reports indicating that the company is on the right path to turning exploration ambition into revenues. News in June revealed that surveys completed show potentially better-than-expected reserves at its flagship mining locations, expediting the resolve of RECHF to exploit the value from its assets, whether alone or through partnerships, as early as this year. That intent is being facilitated by accelerating the development of its Pocitos Lithium Brine Project by moving forward with an inaugural NI 43-101, a completed MT geophysics survey, a pending drill program, and a planned upcoming NI 43-101 resource estimate. Notably, the completed MT survey showed precisely where the conductive brines containing lithium have been concentrating, increasing optimism that the property can potentially generate enormous returns for itself and its stakeholders.

The MT results did more to move the exploration ball forward. They also serve as a pre-engineering step to bring RECHF closer to monetizing its Ekosolve™ Extraction project, with the encouraging results bullish for performance and testing recovery rates for lithium brine, an essential measure needed ahead of a planned full-sized plant scale-up to process up to a 20,000 tonne per year. The Ekosolve™ Lithium Brine Extraction plant implementation will be located at RECHF's Pocitos project; data aggregation is underway, with recovery rates expected and published in July.

Mining-Friendly Assets In A Great Neighborhood

The MT report facilitates a forward-looking agenda. But there's plenty to justify and support the case for a higher share price today. Current value drivers include its Pocitos projects, with substantial progress made to dig into the value expected at the Pocitos 1 project in Argentina. The completed groundwork at that location positions RECHF better than ever to tap into valuable mineral deposits that can serve surging lithium and other battery metals demand. Expediting that intent, RECHF announced earning approval from Argentina's Department of Mines to drill a production diameter well at its Salar Lithium Brine Project. That approval shifts RECHF into a higher gear toward maximizing asset values.

There's more to appreciate from this microcap exploration company. In June, RECHF announced that all assays had been received on its fully-funded spring drill program at its 100% owned Brussels Creek Gold-Copper-Palladium Project in Kamloops, BC, Canada. There, a new near-surface discovery has been made of a gold zone from 25.75m to 29.25m (3.5m), assaying 5.08 g/tonne gold. The intent of the 900-meter NQ drill program was to test the potential for copper-gold mineralization similar to that present at the adjacent New Afton mine owned by New Gold Inc.(NYSE: NGD).

Neighboring that location supports the belief RECHF can exploit value just the same, noting that the New Afton Mine occupies the site of the historic Afton Open Pit mine, which operated from 1977 to 1997. The present mine and concentrator facility commenced production in July 2012, and since, the mine produced 52,542 oz. of gold (AU) and 1,700,000 lbs of copper (Cu). There's more to like.

A recent update indicates how valuable a stake RECHF may hold regarding its option purchase agreement with Spey Resources. In fact, AIS Resources Limited (TSX.V: AIS, OTCQB: AISSF), a billion-dollar market cap miner, congratulated Recharge Resources on signing that agreement with Spey Resources Corp., which could lead to RECHF acquiring up to a 100% undivided interest in the Pocitos 2 Project.

AIS retains a 7.5% royalty of the FOB price of lithium carbonate or other lithium compounds sold on Pocitos 1 & 2 pursuant to AIS' underlying Option Agreement with Spey Resources. That means that if the Pocitos 1 and 2 options are exercised, AIS will receive $1,000,000 and $732,000, respectively, on or before June 30, 2023. Both Pocitos 1 and 2 have been optioned by Recharge Resources from Spey. That's a significant deal and option, noting that RECHF exercising its acquisition rights can significantly increase the size of its potential resource holdings.

Notably, proven reserves, in other words, those assets still underground, can be accretive to the RECHF balance sheet. And with RECHF moving toward advanced exploration stages in several projects, the more they prove, the greater the value added.

Explosive Potential From Proven Lithium-Rich Territory

The most attractive part of RECHF at the $0.25 level is that unlike most of its peers, they are a company in motion, advancing projects where if survey data posts as expected from its in-process exploration, RECHF will be a significant step closer to building an up-to-20,000-tonne lithium extraction Ekosolve plant at the Pocitos 1 project. The more excellent news on that front is that once completed, RECHF has supply agreements in place, committing to sell up to 20,000 tonnes of lithium chloride/carbonate per year to Richlink Capital Pty. Ltd. The battery materials supply agreement was announced after executing a joint letter of intent.

That deal can be a windfall. S&P Global expects spot prices for lithium carbonate to average at least $40,000 per tonne in the coming years as demand outstrips supply. Assuming RECHF delivers the entire 20,000 tonnes as contracted, revenues could eclipse $800 million at expected exchange rates. Capitalizing on that opportunity could happen faster than many expect, considering that RECHF now has three existing drill holes in place in addition to its newest drilling and a CSAMT audio-telluric geophysical survey to contribute to an NI 43-101 mineral resource estimate.

From a theoretical perspective, the work completed mitigates downside risk to RECHF stock. Part of that presumption results from RECHF benefiting from an Argentinian geological team empowering the company to expedite progress toward establishing a NI 43-101 compliant mineral resource. They are also helping to facilitate, even expediting, a scoping study of the project in collaboration with its Chinese offtake partners and investors for lithium chloride products at the Pocitos1 Project. Combining the intrinsics with the inherent potential, RECHF is positioning and preparing to feed the substantial global demand for lithium. Remember, a partner could expedite the process 10X. That could very well be in the cards.

Lithium Worth More Than Gold In Many Respects

Elon Musk recently told his investors that his company is moving forward to build a lithium refinery on the Texas Gulf Coast to gain more control over the supply chain for EV batteries. And Tesla (NASDAQ: TSLA) isn't the only company working proactively to secure the assets needed to maintain production; Ford (NYSE: F), General Motors (NYSE: GM), and several other EV manufacturers are trying to secure as much lithium as possible. Some are trying to buy total production outputs from suppliers or even considering purchasing entire projects to support EV initiatives. Of course, they represent just one industry needing what RECHF intends to supply.

Others need it, too, including consumer goods, defense companies like Lockheed Martin (NYSE: LMT), and industrials. They all need what RECHF intends to sell. It's often said that value is at its best when on the ground floor, which makes sense, given that risk is still attached to the company. But, taken as a whole and accounting for the infrastructure already turning the gears of progress, there are still tremendous values to be had in under-the-radar exploration companies on the cusp of transformation.

RECHF makes that list, supported by plenty of asset firepower.

Georgia Lake And West Lithium Projects In-Play

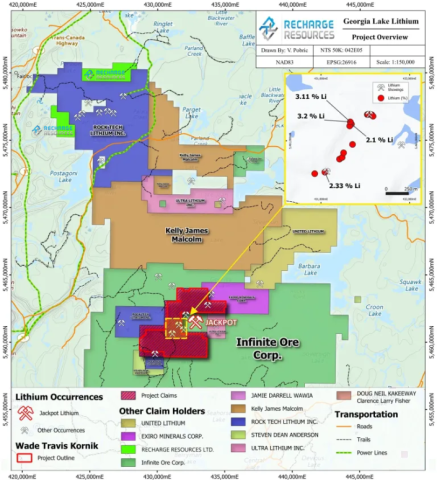

While the above is plenty to appraise, Recharge Resources is also advancing promising Georgia Lake and West lithium projects, located approximately 160 km northeast of Thunder Bay, Ontario, within the Thunder Bay Mining Division. Parts of these properties border Rock Tech projects, which recently announced its expectation to finalize a more than $670 million high-quality lithium supply deal with Mercedes-Benz AG.

That deal leads RECHF to remain optimistic its locations can offer the same production promises. Known is the fact that the Rock Tech Lithium, Georgia Lake project hosts several spodumene-bearing pegmatites, with Lithium mineralization discovered in 1955 and subsequently explored by several historic owners exposing the properties as an NI 43-101 Mineral Resource. That was reported in Rock Tech's Preliminary Economic Assessment filed in March 2021.

While past performance isn't the most accurate indicator in many industries, it is within the mining and exploration sector. Remember, mineral deposits are not stingy where they settle, meaning that bordering a property indicated to have potentially massive reserves is indeed bullish to neighboring prospects. Thus, the attention to RECHF stock is not surprising.

Frankly, more attention is expected. Rock Tech intends to deliver up to 10,000 tonnes of high-quality lithium hydroxide per year to Mercedes-Benz AG starting in 2026. That's indeed excellent news for Rock Tech. Moreover, it also gives good reason for RECHF to trade higher in sympathy, noting that Rock Tech anticipates that the planned delivery of that product won't deplete its capable inventory, indicating a substantial amount of lithium is expected to be mined.

More directly, bordering a company preparing to supply billions of dollars worth of lithium to a global business giant puts Recharge Resources in the right place at the right time. In fact, few argue against the statement that in the mining business, location is everything. And based on Rock Tech's deal, RECHF is sitting on a potential lithium windfall.

Cobalt Adds To The RECHF Value Proposition

There's another potentially massive value driver that shouldn't be ignored. Recharge Resources has announced capitalizing on other market opportunities by adding a third asset to its business pipeline potential: cobalt. Cobalt is also a critical metal needed for EV battery production. However, more valuable to RECHF's opportunity to attract client interest is that virtually no cobalt production is happening in North America. It is debatable whether that's due to its fractional use compared to other necessary battery metals. What isn't, however, is that cobalt's need is no less critical than other battery metals.

That inherent demand adds another appreciable revenue-generating shot on goal to the business plan. Moreover, as one of only a handful of North American suppliers, RECHF could earn a sizable market share, whether alone or through partnerships, especially after reporting that it's already in the early stages of proving its cobalt resources. If those reserve estimates are verified, it's feasible for RECHF to become one of the first North American cobalt resources brought into commercial production.

As it is, by combining assets, management, survey results, and working in the most mining-friendly jurisdictions, RECHF is on the precipice of a transformative 2023. Remember, RECHF is exploring promising properties in a sector where the large-cap miners can't fill the global demand. That makes the junior miners and exploration companies like RECHF vital to the supply chain.

Thus, while the investment proposition in RECHF is speculative, to be fair, so is the entire mining sector. Still, even with that backdrop, plenty of companies sport multi-billion dollar market caps. To say that RECHF can't join that billion-dollar club would be presumptuous. They can and have the properties to do so. It won't happen in 2023, but investors can bet that RECHF will be a giant step closer to exploiting value from its assets by the end of this year. Usually the case, valuations move higher with progress. That makes RECHF at these prices more than an attractive proposition; it's a compelling one.

Disclaimers: Shore Thing Media, LLC. (STM, Llc.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to four-thousand-dollars cash via wire transfer by a third party to produce and syndicate content for Recharge Resources, Inc. for a period of two weeks ending on 7/08/23. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: Send Email

Country: United States

Website: https://primetimeprofiles.com/